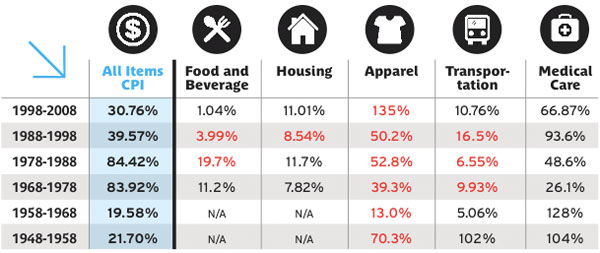

Prices go up, sometimes steadily, sometimes in leaps and bounds, and although they may occasionally slide in the other direction, higher prices are the rule. Over the past ten years, prices nationwide have gone up an average of about 2.5 percent per year, a healthy rate of inflation, says Northwestern University economics professor Giorgio Primiceri. The upward march, however, is not uniform across all the goods and services tracked by the consumer price index (CPI). In the last decade, the CPI category indexes of food, housing, transportation, medical care, and education have gone up nationwide compared with the overall inflation rate, while those of recreation, communication, and apparel have gone down.

Health care costs, in particular, have been jetting upward, rising almost twice as fast as inflation overall from February 1998 to February 2008. Hospital services are up 183 percent over inflation; prescription drug prices, more than 60 percent. Explanations for the increase are complex and controversial, but one factor may be advances in technology—something usually tied to lower prices. Paul Pieper, an economics professor at the University of Illinois at Chicago, explains the medical paradox: “Medical advances have led to costly procedures and equipment that were not possible previously. We spend more on medicine because medicine can do more.”

While medical care has been taking a heavy toll, lovers of communication technology and new threads can take heart. The CPIs for apparel and communications (including telephone and Internet services, computers, etc.) have actually gone down, even in raw dollars, since 1998. Pieper says globalization and cheap overseas labor are behind falling apparel prices, meaning some don’t see the low prices as all good.

Finally, while the cost of public transportation since the early 1980s has gone up 21 percent above inflation, new cars are 119 percent below inflation. So the message is clear: Dodge inflation by staying healthy (even though the cost of an apple a day is up 77 percent over inflation since 1998) and hitting the mall, preferably in a new car, cell phone in hand, of course.

By the Numbers

Source: U.S. Bureau of Labor Statistics, Consumer Price Index

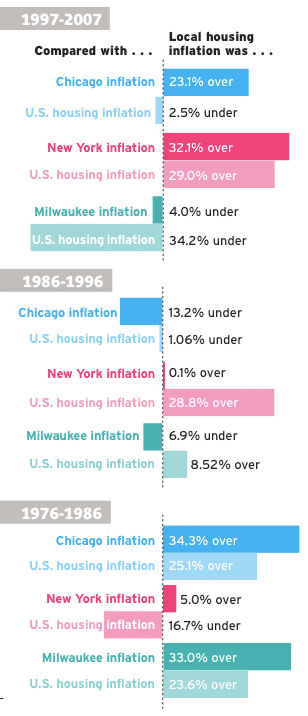

Home, Grown

Looking at housing prices on a regional level shows that, surprisingly, the sharpest inflation-adjusted price increase wasn’t in the real estate–crazed past ten years, but two decades ago. The spike was a return to equilibrium after a period when prices sagged because of the urban crises of the late 1960s and recession of the early 1970s, says UIC economics professor John McDonald.