Yesterday the Tribune published the results of a poll on a proposed "millionaire's tax," or at least a non-binding referendum voters will have before them. The idea is simple: an increase of three percentage points on incomes over a million dollars, with the money going to education. Making the state's income tax system progressive has been debated for awhile, especially as rising inequality has reduced the growth in state tax revenues in comparison with progressive-tax states.

It would be difficult, though, as the state's constitution mandates a flat income tax; the non-binding referendum is just a toe-dip, a way of gauging support (and getting Democrats out to the polls). And, according to the Tribune's poll, it's a popular one, except in heavily Republican downstate Illinois.

And then there's this: "While a majority of voters of all income ranges expressed support for the extra tax on millionaires, the question received its greatest support among people with household incomes of more than $100,000 — 61 percent in favor and 33 percent opposed."

I was surprised, but perhaps I shouldn't have been. In 2012, California enacted—by referendum—its own version of the millionaire's tax, a one-percent increase on singles making $250k or more, married couples making $500k or more, and heads of households making $340k or more. Plus a 0.25 increase in the sales tax. So Proposition 30 effected more people—everyone, to some degree—on top of California's already-progressive, already quite high income taxes on well-off households, which went up to 12.3 percent at the very highest bracket. It didn't pass by much, but it passed.

And now California, which for so long was neck-and-neck with Illinois for the most fiscally screwed state in America, is in the black, and people are happy with the results of Proposition 30:

But today, few Californians are arguing that Proposition 30, which to the surprise of many political observers sailed to an easy victory in last year's Nov. 6 election, hasn't been a good thing for the state.

It stabilized school funding in California for the first time since the Great Recession began, allowing school districts to avert thousands of teacher layoffs. It helped the Legislature balance its budget for the first time in years without slashing social programs. And it helped a state whose fiscal mismanagement used to be fodder for late-night comedians suddenly become a poster child of sound budgeting that some say Washington, D.C., politicians should model.

Was Prop 30 classical class warfare, with the poor taking a pound of flesh from the rich? Not exactly. The strongest correlation for Prop 30 support outside of Democratic affiliation, and not far from it, was educational level. In a late Field poll, only poll respondents with a high-school degree or less came out against Proposition 30, 46 percent to 40 percent. The percentage in favor rose with educational level; those with post-graduate experience were 61-27 in favor.

After Prop 30 passed, three political scientists—Cary Wolbers, Caroline Tolbert, and Christopher Witko—did a post-mortem on the reasons for its success. Support declined as election day approached and pundits were surprised that it passed with 54 percent in favor. What happened?

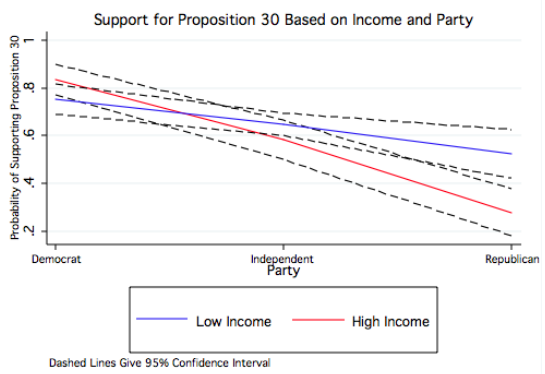

In short, Prop 30 supporters were able to assemble a coalition of Democrats—particularly high-income Democrats—and low-income Republicans to squeak by. (Online voter registration, leading to higher-than-expected turnout among college students and other young voters, also helped, as well as triggers that would have cut education if the initiative failed.) Here's how it broke down:

High-income Democrats were more likely to support Prop 30 than low-income Democrats; low-income Republicans were far more likely to support it than high-income Republicans. The divide between high-income Democrats and Republicans was quite steep, much less so for low-income voters.

The authors suggest that the form of direct democracy provided by California's ballot referendum system allowed Prop 30 to circumvent the effects of partisanship, at least enough to get it passed.

It's sort of a What's the Matter With Kansas? test—given the opportunity to weigh in on a single issue, low-income Republicans who would stand to benefit from higher taxes on people with more money voted in self-interest, producing results that are closer to nationwide opinion on the issue than actual enacted legislation.