Graphic: Courtesy of MREDLLC; Thumbnail photo: Chris Sweda/Chicago Tribune

We may have had ridiculously cold weather in March, but the heat in the real estate market more than made up for that. Prices popped: In Chicago, the median sale price was 8.9 percent above where it had been a year before, and for the nine-county region, it was up 2.2 percent, according to Illinois Association of Realtors data released Monday. And the time it took to get a house sold was a little more than 20 percent faster than it had been in March 2013.

In fact, March was so good in Chicago real estate that for once, our recent tendency to be the opposite of the national norm was to our advantage: On the national scene, the number of homes sold in March was down 0.6 percent from February. Here, March was up 33 percent from February.

“Poor Chicago”? I think not.

After lagging behind much of the nation’s real estate recovery, Chicago’s recovery may finally be taking root. “A lot of places have already gone where we’re going now,” says Russ Bergeron, the CEO of Midwest Real Estate Data.

Data that MRED’s Gayle Ludemann compiled for me late last week gets into detail about what happened in March. A few things stand out:

• The proportion of distressed sales dropped. In March, 43 percent of the homes sold in the Chicago area were foreclosures or short sales. That’s down from 47.2 percent the month before, and down from 45.9 percent in March 2012. (There were more homes of those types sold, but the increase in the sales of non-distressed homes was even bigger, so their share of the market shrank.)

That’s a sign that we’re moving back toward a market where distress isn’t such a dragging-down factor for sellers whose homes aren’t in distress. “Moving,” not “moved.” We’re still at more than two out of five homes selling in distress.

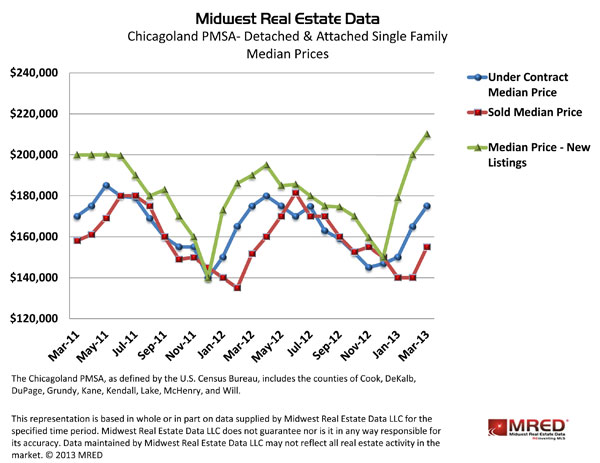

• Asking prices are going up much faster than selling prices. In the chart above, the green line shows asking prices and the red is selling prices. The way the spread between them has grown in the past few months worries me: I’m concerned that sellers may be too happy about the turn in the market, and in their enthusiasm could ask too much, leading to a whole new dip when buyers refuse to reach for it.

While sellers may be better able to sell now because rising home values have lifted more of them up from underwater, many sellers are still holding out for a time when prices are even higher, according to this analysis and others.

But Bergeron sees the leap in asking prices as potentially a good sign: “I think sellers are feeling more confident,” he says. “Hopefully they’ll start getting some of those prices, [because] what we’ve been lacking is seller confidence.” Buyers have been very confident, because of the combination of low prices and low interest rates making this the perfect time to buy. But “a lot of sellers have been sitting back waiting to get their best deal,” he notes.

• Are sellers getting better deals now than they were a year ago? It depends on what they’re looking for. They’re certainly getting their homes sold faster: homes that weren't in distress sold in an average of 140 days in March. That’s 38 percent faster this March than last year.

But on price, ‘better’ is not such a clear term. MRED’s data show that non-distressed sellers are getting a better percentage of their asking price: In March 2012, they were selling at 88.57% of their original list price; a year later, that had gone up a little less than three percentage points, with sellers getting 91.2% of their original asking price. But the average sale price on traditional, non-distressed homes rose a less than one percent in the same period. This suggests that sellers are doing better in part because they’ve cut their expectations.

And that loops us back to the past few months’ growing gap between asking and selling prices. Let’s all keep our eyes on how that gap changes in the next couple of months, okay?