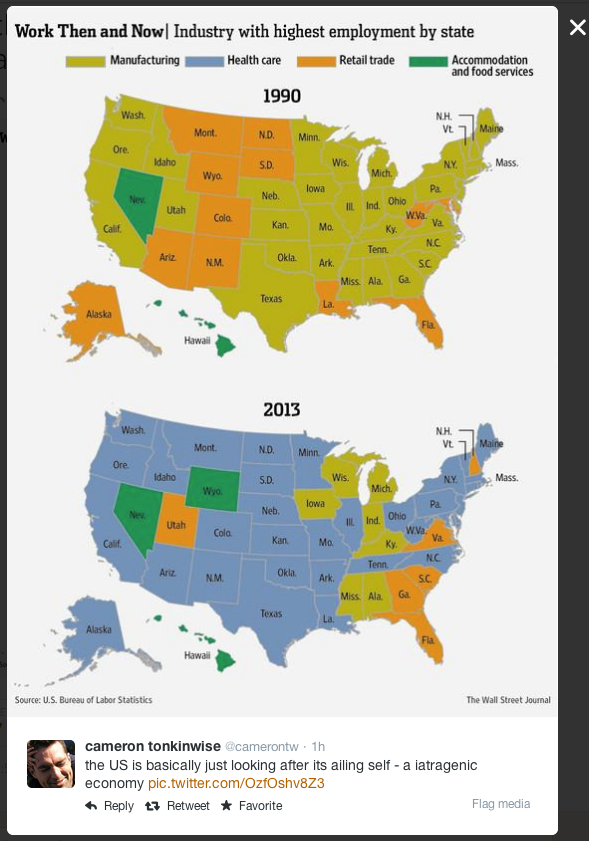

This tweet, from Cameron Tonkinwise, director of design studies at Carnegie Mellon, passed through my feed and made me a bit depressed.

(Iatrogenic: "brought forth by the healer.")

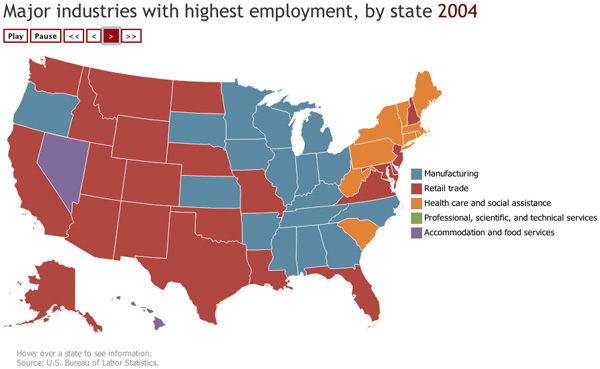

And it's a pretty recent development that skipping over 20 years elides. Ten years ago, retail trade was the biggest industry in many states (via):

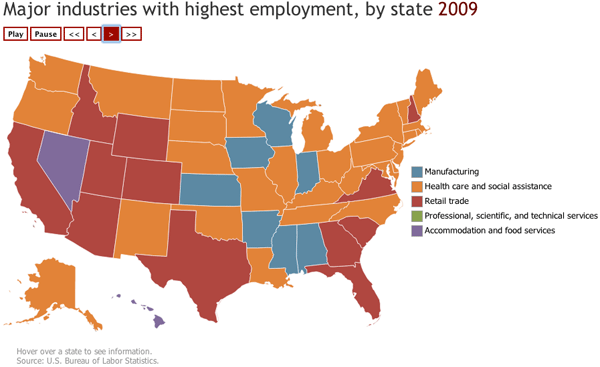

Five years after that:

Since then the changes have been minor: manufacturing returned as Michigan's biggest employment sector; it ceased to be the biggest manufacturer in Kansas. The big Midwestern manufacturing states are actually part of a manufacturing belt that runs north from the Gulf, up the Mississippi, and north through the upper Midwest.

Except Illinois. (Missouri flipped from manufacturing in 2003.)

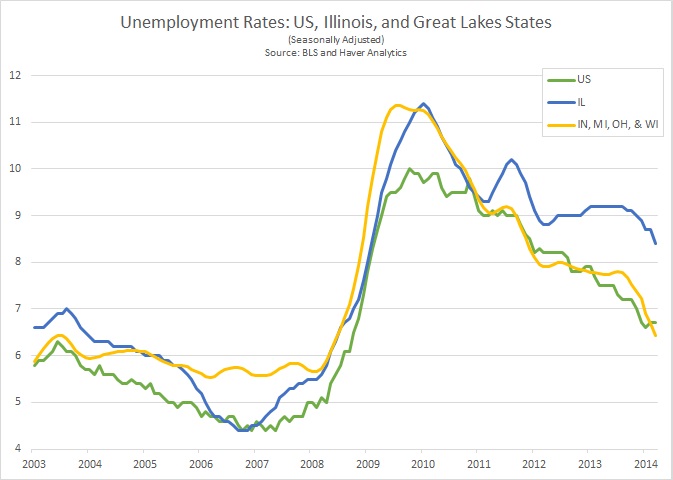

Looking for details on why Illinois recently became a regional outlier, I came across a fascinating post by the Chicago Fed's Bill Testa from May: "Is Something Ailing the Illinois Economy?" In it, Testa tries to figure out why state unemployment has lagged in comparison to its Great Lakes neighbors, Indiana, Michigan, Ohio, and Wisconsin.

And it's lagging, which is a recent phenomenon:

Testa explores the state's fiscal problems and tax hike as a factor, and while he doesn't dismiss it, he's not satisfied with such a monocausual explanation. So he delves down into the state's employment mix, which is more diverse than that of its neighbors:

"Concentration" refers to how the state's wages overall in a certain sector compare to the country as a whole: "For example, the first row indicates that Illinois payroll wages in the Agriculture, Construction, and Mining Machinery sector lies at 2.88 times the national average while, in the four remaining Great Lakes states, the sector’s payroll lies at less than the national average—80 percent."

So Illinois has a high concentration of wages in agriculture, construction, and mining manufacturing; the other Great Lakes states are below the national average. If you go down to "motor vehicle, body & trailer, and parts manufacturing," the other Great Lakes states are at five times the national average, and Illinois is below average.

And that's where Testa finds a big difference in payroll employment growth:

In looking for alternative or contributing explanations, the state’s particular mix of industries is likely contributing to underperformance. For example, the state’s high concentration in construction and mining machinery stands out, as does its lower concentration in automotive as compared to Great Lakes states located to the east. The downstate Illinois economy is highly concentrated in manufacturing, and downstate areas have seen slower payroll employment growth than the Chicago area. And so, Illinois’s performance may yet converge with its neighbors as the automotive boom settles down, and as global economic recovery revives exports of machinery and equipment.

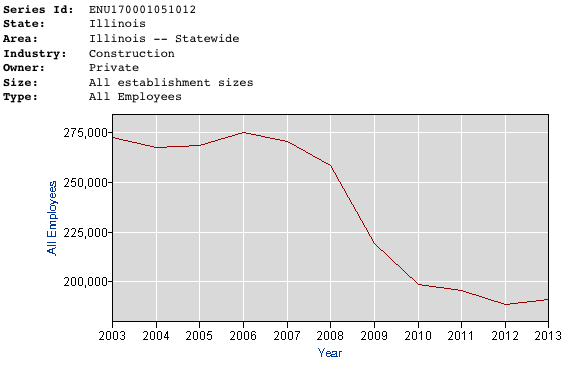

In considering other structural causes, the Chicago area experienced super-normal growth prior to the recession due to excessive home-building and related activities. Accordingly, part of Chicago’s recent performance may derive from a slow healing of residential real estate and related activity following the boom period.

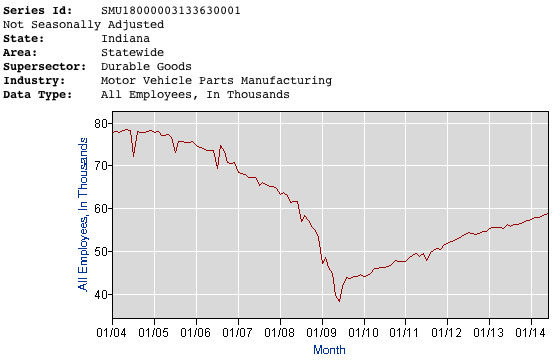

The automotive industry is still employing fewer people than it did early in the 2000s, but it's been adding significant numbers of jobs, particularly in Indiana and Michigan. In Indiana motor vehicle parts manufacturing lost 40,000 jobs, but has added about 20,000 from the bottom (more auto employment data here):

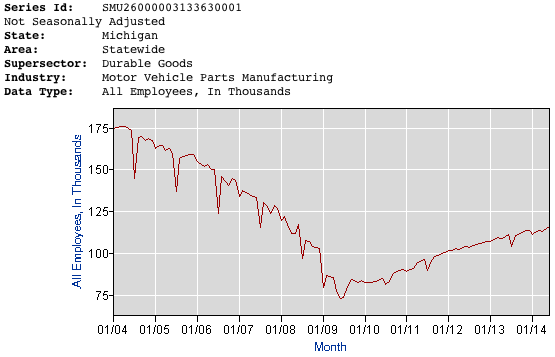

Michigan lost about 100,000 but recovered about 35,000:

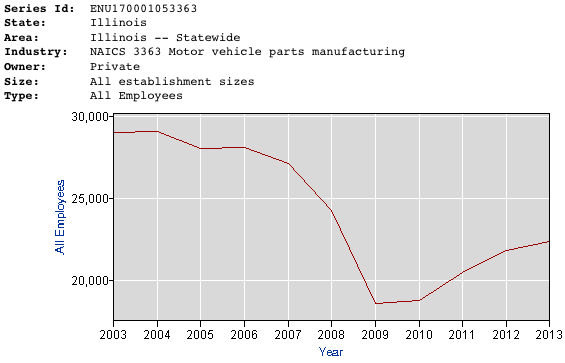

Illinois has seen similar trends, but it just doesn't employ that many people in the auto industry.

Meanwhile, in construction, Illinois hasn't recovered, at all, after losing almost 100,000 jobs (from a high of 275,000 in 2006 to a low of 189,000 in 2012):

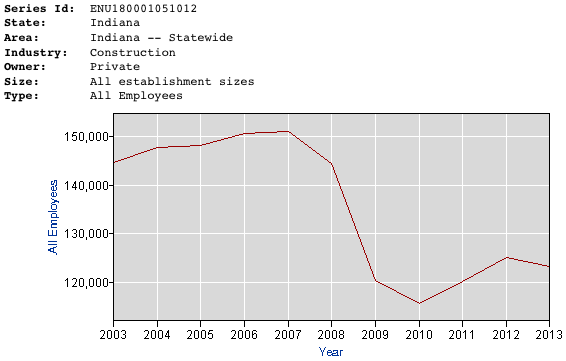

Indiana has fewer jobs in construction, losing about 35,000 but then adding about 10,000 from the bottom:

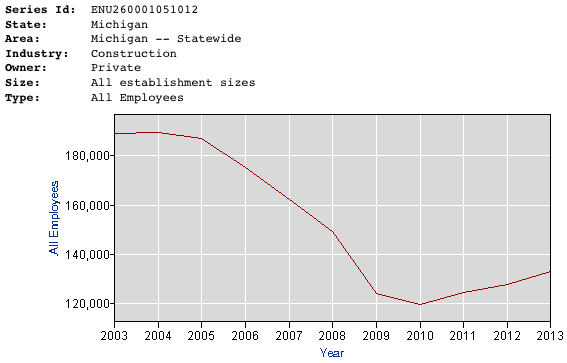

Michigan lost 70,000, and added about 10,000:

The federal government threw itself into saving the auto industry, and in turn its Great Lakes-centered supply chain, a regional infusion of money benefitting states with a heavy concentration in that industry. Somewhat paradoxically, that concentration in the seemingly fading supersector of American auto manufacturing was a big advantage in a cripplingly large recession. Illinois's different, more broad economic base—much of which is based in the industry that drove the recession—seems to have led to a slower recovery.

It's good news for our neighbors… for now. Atif Mian and Amir Sufi, economists and the authors of the recession autopsy House of Debt, point out that household spending on new cars is surprisingly, perhaps suspiciously, robust. The increase in new-auto spending, from the depth of the recession to now, looks, in degree, like the increase in home goods and home-improvement spending from 2005-2006. And they argue that we're in a subprime auto boom.

Obviously cars are a lot cheaper than houses (or higher education, another expensive, bubblicious industry). A bust, provided it doesn't wind its way into the financial system like housing loans, wouldn't be remotely as painful. But it's a cliff to watch out for as the Great Lakes ascend out of the recession.