In this month's Chicago, my colleague Carol Felsenthal tries to pin down the Chicagoland man of mystery who could be our next governor: Bruce Rauner. If you're wondering who he is and what he wants to do, don't feel like you're out of touch with the news. As Felsenthal relates, no less than Jim Edgar responded when Rauner asked for his support: "I don't know you."

Rauner has been candid, at least, about his economic vision: lower income taxes, a freeze on property tax increases, and a modestly expanded set of service taxes. He's clear (and probably right) that pension changes to existing plans will be ruled unconstitutional, and admits that his plan for future benefits—a 401k-type plan—won't offer substantial savings in the short term.

Which leaves a big gap between future income tax revenues, Rauner's dedication to funding education and infrastructure, and his explicit plans for new revenues, and political writers are starting to get restless about it.

Veteran political writer Rich Miller, for instance, who is not prone to hyperbole: "I don’t say this lightly, but it’s a boldfaced lie, cheerily spoon-fed to an angry, disgusted populace desperate for even a hint of good news. He needs to be called out for this."

And Crain's Greg Hinz, ditto: "Even if Mr. Rauner somehow persuades Springfield Democrats to enact tort and workers' compensation reform, switch out a tax on service for the income tax hike and take other controversial steps, will that provide enough revenue to make the schools happy and retire $100 billion in debt?

"I doubt it."

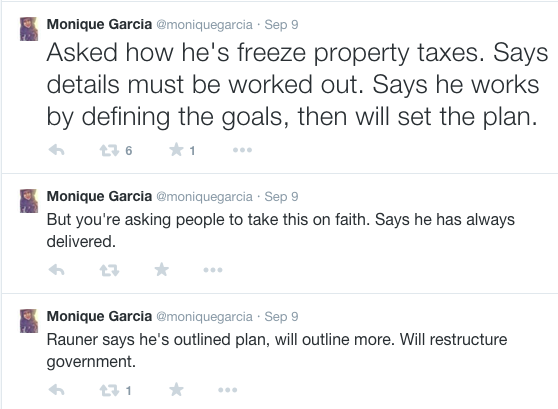

When Rauner and Quinn appeared before the Tribune editorial board, he was pressed hard on it. The Trib's Monique Garcia captured the back-and-forth:

Taking pols on faith is not how political analysts work; in the context of an election season, it may sound like a ludicrous request. But in the context of Rauner's career, it makes a bit more sense. Here's how Carol Felsenthal describes his career:

Through the years, Rauner has invested largely according to Golder’s winning formula: Find a business that’s difficult to make profitable locally but that could be profitable regionally or nationally. Select a star CEO. Give him a couple hundred million dollars to buy companies in the same fragmented industries that are ripe for consolidation and economies of scale. Take the business public. Repeat.

The second step is to find management. Rauner is as much a corporate headhunter as a private-equity investor. Here's how he described it in Chicago in 2011:

Most private equity firms buy mature companies and unwanted divisions of large corporations, managements intact. But you seem to go out and find management and then, together with them, go buy the companies.

We’re in two businesses: industry research and executive recruiting. We study industries, and we network like crazy to find the superstars. Today, we’re partners with two dozen CEOs. Some we’re backing for the second, third time. It can take from six months to nine years from the time we meet someone until we actually become partners with each other.

Or as described in Private Equity International:

GTCR is known today for having one of the most intense, relentless and successful focuses on CEO recruitment in the private equity industry, and its modus operandi is always the same: seek out an ideal CEO for a given platform, doggedly pursue him or her until the offer is accepted, then help the CEO build a company. In many cases, the CEO is hired before a single acquisition is identified.

Or Carl Thoma, Rauner's former colleague and the "T" in GTCR. As he says in The Masters of Private Equity and Venture Capital, they stumbled on the pager industry basically by accident, and realized it fit their typical business model—high growth, fragmented, and one that could benefit from consolidation. So:

Finding the chief executive was, of course, our first key task. We did not yet have a company to operate, but we needed to put the right CEO in place…. We were brand new to the industry—remember, we had first come across paging as a possible investment only a few months earlier—so we did not have the connections with or the top talent that we sometimes do in industries where we have more background knowledge."

After finding a CEO and upper management, they took a step back:

While we are investors with an ownership mindset, we still do not want to be in the position of managing the companies we own. As a board member of PageNet, for example, I worked with George Perrin, but I never wanted to take charge of the company or crowd Perrin out in areas where he could manage capably on his own. With the company now in our portfolio, our firm got involved in enhancing the management tactics of the executives, but we expected and wanted them to implement and refine to fit the needs of their specific company.

What kind of "management tactics"? Rauner explained to The Wall Street Interview:

We'll take one or two seats on a company's board of directors, and then help out in areas where we can be useful, focusing on issues like recruiting additional executives; identifying acquisitions for the company; helping structure, price, and negotiate acquisitions, if they ask us to do that; arranging other types of capital in addition to our own arranging debt or mezzanine financing, arranging joint ventures or leasing terms, etc.; helping the company go public selecting the underwriters and the analysts, and getting it public at the right time at the right price. We try to be supportive partners and advisors, without getting in the way.

It's banking and management, but not necessarily the operations of the business itself.

And that might go some way towards explaining Rauner and his goal-first, plan-later approach. He's accustomed to targeting acquisitions or industries in which to create a business, setting goals for that business—and then assembling management to carry out those goals.

Rauner has been emphatic about his plan to put together a can-do bureaucracy from experts; indeed, that's much of his expertise, a hands-on recruiter of talent, as Felsenthal details. But much of Rauner's "management" will be selected by the fractious, divided state he wants to govern in the form of the legislature. Will it work? He wants you to trust him—and for the state to pick him on the basis of his business success, as he's done his whole life.