April set a new post-recession milestone in Chicago metro-area homes sales with 10,404 closings taking place—the highest number of April sales since 2006, a new analysis from RE/MAX shows. This uptick in sales comes as inventory across the seven-county region (including Cook, DuPage, Kane, Kendall, Lake, McHenry, and Will counties) continues to shrink, the report also highlights.

Why do April sales matter? Typically, it’s one of the busiest months for closings and also a litmus for how strong or weak the market may be in the following months, says Paul Wells of RE/MAX of Barrington. Despite low inventory, Wells suspects that there are a number of variables for the big sales month in April, particularly high demand and rising mortgage interest rates.

“People are trying to get their rates locked in as soon as they can. In many markets, especially if you’re in the mid to lower end, you don’t have time to wait—it’s a competitive market,” Wells says.

In terms of suburban areas that are seeing the most action, Wells says that communities within close proximity to the city and those with great transit access to the city—think Arlington Heights, Mount Prospect, and Park Ridge to name a few—are in high demand. Competition is even more fierce for entry to mid-priced homes in these areas, Wells adds.

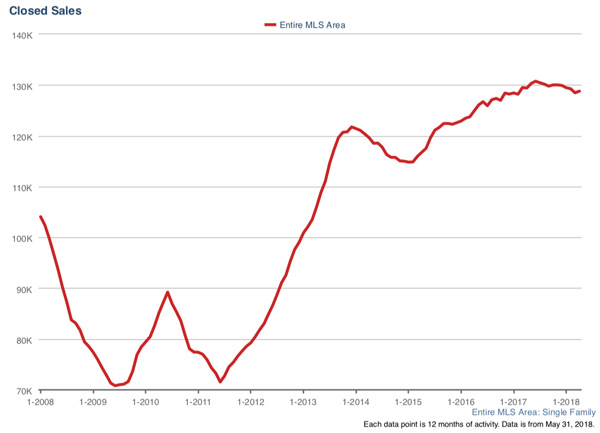

While inventory remains low around the metro region, the median sale price for detached homes is inching back to pre-recession levels. According to Wells, there are currently 41,000 properties listed on the MLS throughout the metro area. During the same period last year, the area had about 46,000 properties on the market, and in 2016, there were 49,000 properties for sale. The current median sale price for detached single family homes is around $240,000, Wells indicates, up from the $163,000 median sale price during the bottom of the market in March 2012. The number is still off from the $248,000 median sale price in 2008.

While metro sales figures appear to indicate that the Chicago area is still falling behind, the story is much different in hot downtown and North Side communities, says Center Coast Realty founding broker Mike McElroy.

“Some say that Chicago lags the rest of the county in appreciation and sale prices, and that may be true for the metro area as a whole, but that’s not true for downtown Chicago and much of the North Side,” McElroy says. “These areas are actually more in line with the rest of the country than the greater Chicagoland area and the city of Chicago as a whole.”

McElroy suspects that North Side homeowners who bought at the bottom of the market are ready to sell, trying to time their sale at the height of the market.

“You can’t exactly time the top or bottom of the market, but we’re seeing more listings this year than in previous years. I think a lot of sellers are finally realizing that we’re probably at or near the top,” McElroy addds.

Neighborhoods seeing strong demand and rising sale prices include Lakeview, the Gold Coast, and particularly Logan Square, McElroy says.

However, McElroy suggests that homeowners who are considering selling should do some homework.

“The truth is, if you want to know what your property might be worth, you should look at properties similar to yours and see what they’re selling for and how long they’re on the market.”