You know how if you’ve been driving really fast on a highway for a while and you take your foot off the gas pedal, the car doesn’t screech to a halt but glides along, slowing down almost imperceptibly? But you’re still going fast?

That’s the real estate market in the past month or so. After a wild spring and early summer marked by bidding wars, homes getting snatched up in a few days, and other craziness, real estate agents, sellers, and others have recently been wondering where the party went.

The answer: it got a lot quieter, but it’s still going.

A round of statistics released by Midwest Real Estate Data Tuesday shows that both the number of homes sold in the Chicago area and the average sale price dropped in September from August. They do that almost every year when summer turns to fall.

The difference is that this year, Chicago was on a roll from early spring well into summer—seeming to gain some ground on price recovery that we had lagged behind other cities on—so that a seasonal slowdown felt more like a stumble. “You looked around and wondered, is it just my office, our location,” said Matt Farrell, the president of the Chicago Association of Realtors and managing partner of the firm Urban Real Estate.

Not to worry, Matt: So far, the autumn dropoff hasn’t been as steep as it was the past few years.

While the average price for a conventionally sold home (a home that wasn’t a foreclosure or a short sale) was $307,493, which is 4.4 percent below the average for August and 9.2 percent below the peak month—June—both of those figures are smaller than their counterparts in 2012. Then, September was 8.5 percent below August and 12 percent below the year’s peak month, also June.

September prices on conventionally sold homes were were 5.4 percent higher than September 2012’s, according to MRED’s data; for all homes, including both conventional and distressed sales, prices were up 12.8 percent.

The number of conventionally sold homes dropped in September too: 22 percent. But again, last September was worse, dropping 23.6 percent. No surprise: a big chunk of the population times its homebuying to get into a new address before the start of a new school year. Here’s the silver lining to September’s drop in sales volume: With 6,577 homes sold, September 2013 did better than any month in 2012, even the high-season early summer months. The same thing is true when foreclosures and short sales are added in: The number of sales, 9,621, seems slim compared to the four prior months, which each had more than 11,000 sales, but it’s way above every month in 2012.

My point here is yes, if you thought things had slowed down, they have. However, they haven’t stopped. Real estate agents I’ve spoken to in the past few weeks express a little befuddlement—the slowdown seemed to go on longer than the usual lull that happens around the end-of-summer vacation weeks. But from the data, it appears that that’s only relative.

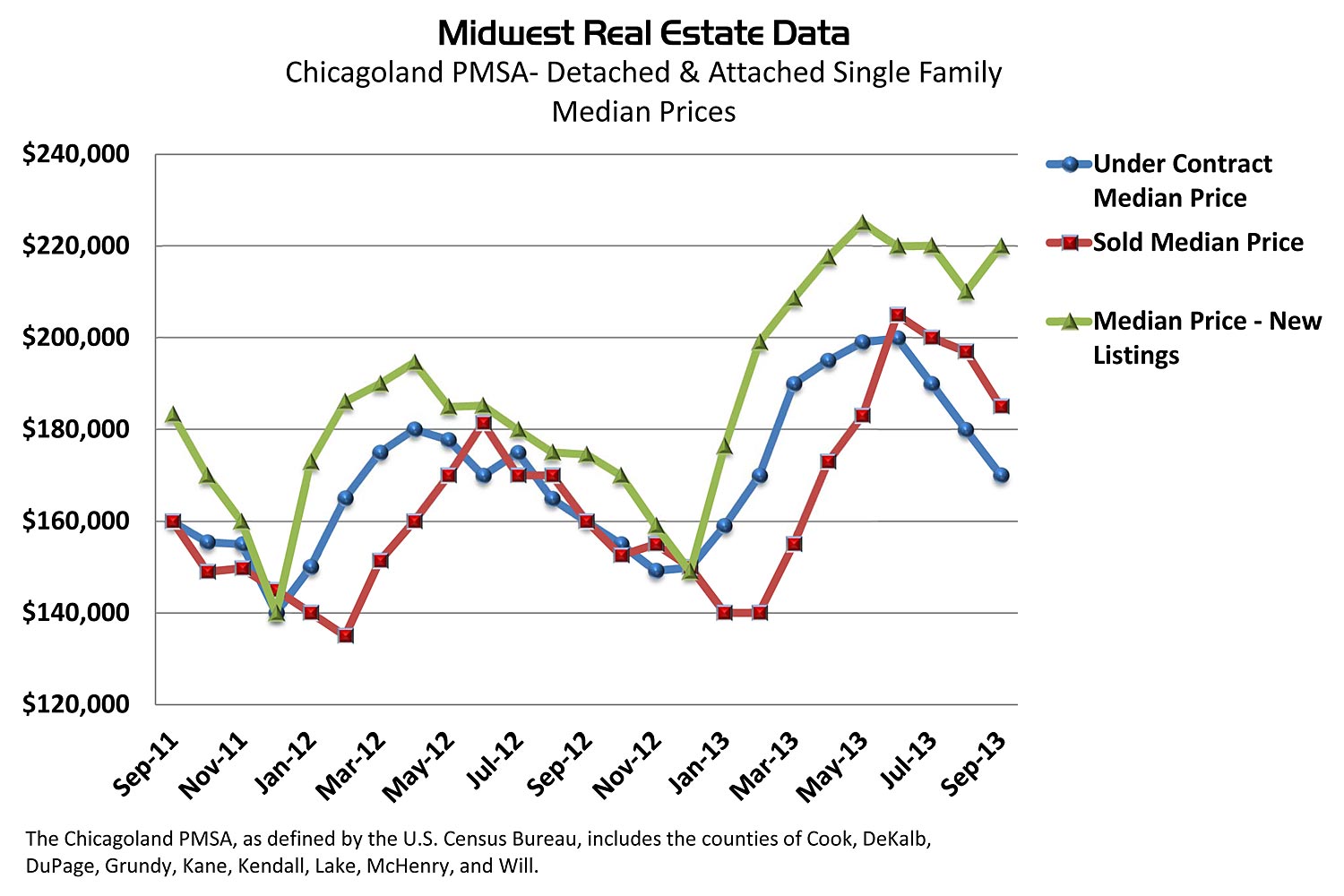

A look at the chart above and you can tell that sellers and their agents were taken by surprise by the slowdown: While the asking prices on new listings (the green line) had been tracking downward along with sold prices (the red line) for a few months, in September, asking prices switched directions and went up. Let’s watch what happens to the green line next month.

So will we keep gliding in coming months, or slow down more abruptly? Gary Lucido of Lucid Realty enjoys chewing on real estate data as much as I do. Last week he blogged about the same widespread perception of a slowdown. He noted that new contracts written in September, to close in October or later, seemed to be down by about one percent from the year before. If true, he wrote, that would be the first decline in new contracts in 29 months. (Not all new contacts actually close.) Nevertheless, he told me this week, “I’m still on the fence about whether it will slow down more.”

There are reasons other than the coming freeze season to wonder whether the slowdown will get steeper. Among the biggest might be our entire nation’s nervousness about the whole fiscal wreck in Washington DC. It’s hard to be confident about the near future with all that going on, and on top of that, a Market Watch article on Tuesday forecast that if the US defaults on its debt this week, the interest rate on mortgages could jump by as much as two percentage points within 24 hours.

And then we’d see how it feels to stomp on the brakes.