The day this winter that McDonald’s summoned the wrecking ball to its hulking rock-’n’-roll-themed restaurant in River North, the 63-year-old company gave itself permission to stop living in the past. In the flagship’s place will rise a solar-powered modernist structure designed by Carol Ross Barney that looks more like a peace garden than a burger joint. Instead of music memorabilia, you’ll find living plant walls. Replacing its iconic yellow arches will be banks of birch trees.

It is, in short, the physical manifestation of the vision set forth by Steve Easterbrook when he became CEO in March 2015: Transform McDonald’s into a “modern, progressive burger company” where innovation is not only encouraged but is an existential requirement. At its center is a strategy in which the chain is trying to appeal to upwardly mobile millennials without alienating the core patrons who rely on it for cheap eats. “Affordability is key for a wide swath of McDonald’s customer base,” says restaurant analyst Mark Kalinowski. “So you have to make sure you’re not turning them off when you’re making other changes aimed at a different customer.”

Change has come furiously in the last three years. Today, customers at thousands of McDonald’s locations can order at digital kiosks rather than employee-staffed cash registers. By midyear, Quarter Pounders will be made with fresh beef instead of frozen. And the fancy sandwiches in the Signature Crafted line are topped with pico de gallo and guacamole. On top of that, Easterbrook is uprooting the company’s headquarters from a nature-preserve-like campus in Oak Brook and dropping it into the West Loop, one of the nation’s hottest restaurant neighborhoods.

“With all of the moves we make, whether with our new headquarters or with the Rock ’n’ Roll McDonald’s, we’re making a statement about our company and our brand and the culture we’re trying to create,” says Chris Kempczinski, president of McDonald’s U.S. operations. The old flagship’s Americana theme looked back to celebrate McDonald’s heritage, he says: “The statement we’re making with the new restaurant is much more forward-looking.”

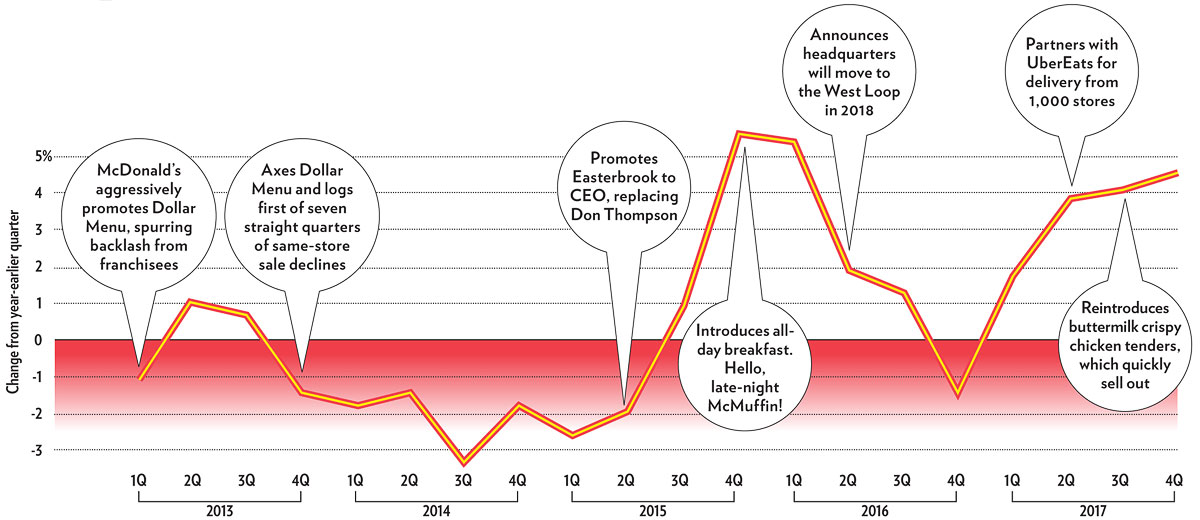

Kempczinski’s boss came to power amid a seven-quarter streak of same-store sale losses in the United States abetted by a customer revolt and franchisees who rebelled against the Dollar Menu. But when McDonald’s axed $1 McDoubles in 2013, competitors such as Burger King undercut it on price and whisked away the base, which just wanted an inexpensive meal. At the same time, quality-focused fast-casual spots like Chipotle, Panera, and Five Guys took a bite out of McDonald’s lunch, too. In a presentation last year, executives acknowledged they had lost 500 million transactions between 2011 and 2016.

McDonald’s finally stopped the bleeding in 2017. Same-store sales in the United States have now increased in nine of the last 11 quarters, through the end of last year. This turnaround, says Tim Calkins, a marketing professor at Northwestern University’s Kellogg School of Management, has been nothing short of remarkable: “You look at it, and it’s very hard to point at one thing in particular Easterbrook has done. He has made a whole series of changes, and all of those are working together to drag McDonald’s into the modern era.”

Analysts and McDonald’s executives agree that acing its value menu is the linchpin of the company’s larger objectives. McDonald’s was finally able to get franchisees to fall in line behind a program that builds off its original Dollar Menu: The $1, $2, $3 Dollar Menu, which Kalinowski calls one of the most important things the chain is doing this year. (The rollout of fresh beef Quarter Pounders is up there, too, he says.)

McDonald’s hopes those revamped value deals will drive traffic while allowing franchisees enough profit to pay for required renovations. Elements of the new River North flagship, such as a more modern decor and more efficient modular prep-line infrastructure, eventually will be rolled out across the country. As will technology and equipment upgrades, including updated appliances, smarter self-service kiosks, and digital menu boards in drive-through lanes.

At the same time, the company will continue to look for improvements to the product itself. “There are certainly a lot of McDonald’s customers watching their budgets who also want access to better items on their menu,” Kalinowski says. One example: cage-free eggs, which McDonald’s has begun phasing in. According to a survey by World Animal Protection, 83 percent of millennials consider the welfare of critters when making food decisions—a number just too high to ignore.

“This is the reality of the world we live in. Customers are not waiting around for McDonald’s to catch up with what their needs are,” says Kempczinski, who was plucked from the packaged foods giant Kraft Heinz in 2015. “We need to make it so McDonald’s flexes to their needs instead of asking the customer to flex to ours.”

For one thing, he envisions a more personalized McDonald’s experience that connects smartphones with restaurants: “Imagine when a kiosk puts up a menu customized to you, where offers are tailored to you.” That idea, still in the incubation stage, offers a window into how the chain hopes customers will start to see it: “Whatever you want it to be. It can be value or a delicious premium burger experience.”

To steal another fast-food titan’s mothballed slogan of years past: The McDonald’s of the future wants you to have it your way.

Arching Up

McDonald’s same-store U.S. sales performance as the Easterbrook era unfolded