Around 9 p.m. on March 8th of this year, shortly after calling his Democratic opponent to concede the race to fill the term of the retiring Republican congressman and House Speaker J. Dennis Hastert, Republican candidate Jim Oberweis made his way to the podium at the Q Center in far west suburban St. Charles to perform what for him has become almost a ritual. "Coming in first is a lot more fun than coming in second," Oberweis told the crowd of dispirited supporters. "Unfortunately, we're on the other side of that this time. I'm sorry we came up short, but we have another run at it in seven months."

The special election was the fourth failed bid by Oberweis for major elected office. His loss put the 14th Congressional District of Illinois—a wide swath meandering west from the booming exurbs nearly to Iowa—under Democratic control for the first time in 70 years. Hastert had held the seat for more than 20 years and almost always won with more than 60 percent of the vote. Yet Oberweis, a 62-year-old multimillionaire dairy magnate and investment manager who has lived his entire life in the area and had Hastert's backing, couldn't beat the Democrat, Bill Foster, a mild-mannered physicist running in his first campaign. Oberweis has another shot in November—March's special election decided only who would serve the final nine months of Hastert's term—but he has now lost so many times that the prospect of a rematch gives many Republican stalwarts apoplexy.

"Oberweis's ego has embarrassed the party enough," harrumphed the conservative Chicago Tribune columnist Dennis Byrne in a column after Foster's win.

"The cumulative results show that Oberweis plain-and-simple is not liked," wrote the conservative blogger Tom Roeser shortly after the March defeat. "What has to happen before he understands this—someone to drive a political stake through his heart?"

In April, the House Republican leader, John Boehner, reportedly tried to do just that, saying he wanted Oberweis out of the race, according to Rich Miller, citing an anonymous source on his Illinois political blog Capitol Fax. The National Republican Congressional Committee, which spent more than $1 million on the first Oberweis campaign against Foster, nearly a quarter of its funds at the time, has withdrawn financial support for the rematch. And polling shows the outcome could be even more lopsided than the 53-to-47-percent loss in March. "It's too early to say that this race is in the bag for Foster, but it is very rare that a candidate wins a special and then loses next time around," says David Wasserman, the House editor of the nonpartisan elections newsletter The Cook Political Report.

With his sharp analytical mind, deep Aurora roots, and bulging bank account, Jim Oberweis would seem a lock for public office. But despite spending around $7 million of his own money in runs for governor, the Senate (twice), and Congress, he has yet to win a seat. His first marriage collapsed (at least in part because of his political efforts), and a strong reputation built on decades of running several successful businesses has been eclipsed by his political belly flops. He is perhaps best known now as the Milk Dud, a derisive play on the family dairy coined by the late Chicago Sun-Times political writer Steve Neal.

Yet Oberweis is undeterred. He says he is optimistic about the November race, but he won't rule out future runs should he lose. In his 30 years as a stockbroker, Jim Oberweis got rich by picking winners. So why does he continue to invest in himself?

"He just has this confidence that—I don't know where it comes from or how he maintains it—goes beyond confidence, just outright knowledge that he can make a difference," says his daughter Trish Oberweis, an associate professor of criminal justice at Southern Illinois University at Edwardsville.

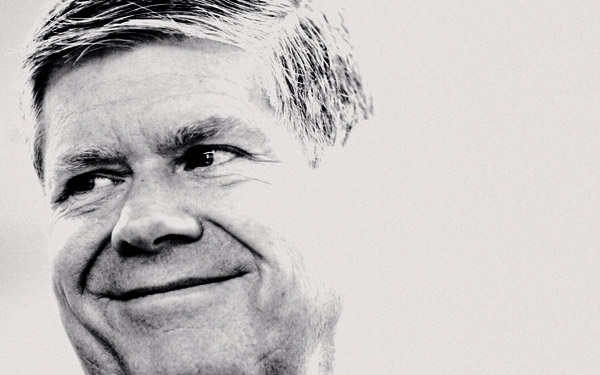

"I don't believe I would be a normal, average individual legislator," says Oberweis, who is tall and lumbering, with a slight paunch and a tendency to rap his hand against the table when making a point. "I have a history of making some things happen where people said it was impossible."

* * *

The Oberweis campaign office is on the second floor of a handsomely restored former windmill factory on the banks of the Fox River in downtown Batavia. When I arrived on a Tuesday morning in May, the front door was locked. It took a phone call to his new campaign manager, David From, to let me in. A former aide to Hastert and moderate Republican representative Mark Kirk, From replaced Bill Pascoe, a veteran GOP operative known for combative campaigns, after the March loss. "Jim has been kind of dehumanized," From acknowledges. "It would be a mistake for us to try to reinvent him, [but] there are some things that are there, that have been in the background of his campaigns and his life, that could be highlighted more effectively." Then the new campaign manager hits on something that is an article of faith among the candidate's family and close supporters. "I think many of the qualities that make Jim not a great campaigner are what would make him a great congressman."

"There's this horribly negative impression about him that I think has arisen from him being fairly succinct," says Joe Oberweis, 28, the youngest of Oberweis's five children and the chairman and CEO of Oberweis Dairy. "He says what he thinks. And he has chosen, on a few occasions, analogies or examples that just sounded bad."

Oberweis concedes that he entered politics naïvely. "My thought about the political process was I'd like to have all the candidates out there and have them clearly communicate their positions and then let me, as a voter, pick," Oberweis says. "I thought that's how it worked. Wrong. That's not how it works at all. It's almost the opposite. In business you want to communicate as clearly as you can. It seems to me in politics, the rewards go to those who don't communicate clearly."

With a few exceptions, Oberweis is clear about his views. The less government, the better. Simplify the tax code and make the Bush tax cuts permanent. Offer incentives to increase individual accountability, such as merit pay for teachers and a health care system based on personal savings accounts. And, most contentiously, in a district where the Hispanic population increased by nearly 40 percent between 2000 and 2006, reform immigration. He believes in ending birthright citizenship, denying amnesty for existing illegal immigrants, and making English America's official language.

"Securing Our Borders," as his campaign Web site puts it, forms the crux of Oberweis's political brand, and it is the issue—with its attendant charges of racism—that is most responsible for the revulsion some feel toward him. But in conversations with Oberweis, it is far less likely to come up than, say, the mushrooming federal debt. His most loyal political supporters seem drawn to his distaste for government spending and economic regulation. His repeated inability to package those beliefs into a winning political message is what most frustrates them. "If elected, it is my belief that Jim would be a terrific congressman," said Robert Bonifas, the CEO of Alarm Detection Systems in Aurora and a longtime Oberweis friend and political donor. "Whether he is capable of providing a mental enema to the electorate to flush out the old Jim and instill the new Jim, I don't know."

* * *

The family's namesake dairy, in North Aurora, was founded in 1927 by Oberweis's paternal grandfather. While Jim was growing up, his father, Joe, ran it; his mother, Lora, was a teacher and principal in the Aurora schools. Oberweis worked at the dairy during summers, delivering milk to homes and dipping ice-cream cones in the dairy store, but he resisted following his older brother, John, into the business. "As a kid I think I baled hay and milked cows once," Oberweis says.

Still, the dairy remained influential in his life. Joe Oberweis was interested in local politics and especially vocal about core rural concerns of the time, such as deficit spending and agricultural policy. When Jim Oberweis entered the University of Illinois at Urbana-Champaign in the fall of 1964, he majored in political science with the intention of becoming a lawyer who would, his father hoped, "defend the industry against the outrageous policies of the federal government," as Oberweis puts it. But he was more interested in stocks than statutes and quickly dropped out of law school at Northwestern University to join an investment firm.

In 1978, he founded his own firm, Oberweis Securities, Inc. "It was exhilarating," Oberweis says of his rise through the investment world. "Some of the best years of my life."

Not long after, he first thought about running for Congress and raised the idea with his wife, Elaine, his college sweetheart, whom he married the summer before his senior year at U. of I. She nixed it on the spot. "She said something to the effect of, 'Jim, we have five children and I want to raise them in Aurora, Illinois, not Washington, D.C.' And quite frankly, that was pretty hard logic to argue with."

Oberweis says he "really, totally forgot about politics" and spent the next two decades focused on raising his kids and building his business. There was plenty to keep his attention. After the October 1987 stock market crash, he bought a small Minneapolis brokerage in an attempt to weather the slump. Instead, that company artificially inflated the value of a series of stocks, forcing Oberweis to reimburse client accounts. "We ended up having to sell [my] business for next to nothing," Oberweis says. "I literally thought my life was over. Twenty years ago my net worth was approximately zero."

There were more troubles. In 1986, Jim had bought Oberweis Dairy from his aunt Marie and his older brother, John, after John suffered a stroke. The dairy was on the verge of bankruptcy in the late 1980s when Elaine Oberweis took charge. By dropping institutional milk sales and emphasizing home delivery, customer service, and quality emblems like glass bottles and hormone-free cows, she rebuilt the dairy as a high-end brand. (Its 2008 revenue, according to Joe Oberweis, will be around $72 million, and it's growing at nearly 5 to 10 percent per year.)

Meanwhile, Oberweis and a remnant of his company, Oberweis Securities, was bought out, and Oberweis eventually repurchased a small mutual fund he had started. "That was really the rebirth for Oberweis Asset Management," Oberweis says. "Today we manage somewhere between 1.5 and 2 billion dollars." It was also the rebirth of Oberweis's political aspirations.

* * *

Early in 2001, Oberweis gathered his immediate family and told them that he planned to run for the U.S. Senate the following year. "He said, If anybody really objects to this, I'm not going to do it," recalls his daughter Jenni Roberts during a phone call from a birthday party at Chuck E. Cheese for one of Oberweis's 14 grandchildren.

"It's been something he's always kicked around, something he always had an interest in," his son Joe says. "I was a little surprised when he actually went forward with it in 2001. At the time it was an exciting thing."

The excitement didn't last long. In an interview with the radio host Steve Dahl in October of that year, Oberweis was asked his position on abortion.

"The honest answer is I've been a lifelong Catholic—still am," he said on the air. "Obviously, I have concerns about that particular issue. However, I think that right now we're getting a very, very strong symbol in the Taliban of what can happen if we try to impose our religious beliefs on others. So I really think that that issue is a choice that government should stay out of and let people make that the way they see fit."

The statement was remarkably temperate for a Republican candidate, and a rival candidate immediately attacked Oberweis for it. He went on to lose the Senate primary by nearly 15 points to a little-known state legislator. "I had virtually been on the moon for 20 years as far as politics was concerned," Oberweis explains now. "My answer was, I thought, the logical conservative response: OK, I'm pro-life, but as a true conservative we shouldn't have the government dictating that for us, and the Taliban are the best example of that when you go too far."

It's a view consistent with the less-is-more approach of one of Oberweis's political idols, Barry Goldwater. (Ronald Reagan, who was born in what is now the 14th District, is the other.) And Oberweis still espouses it, to an extent, such as when he tells me, "I wish that whether you're pro-life or pro-abortion, that was not an attribute of the Republican Party or the Democratic Party." But he says that in the year following the radio interview, he came to believe that if voters understand he is personally pro-life, they are authorizing him to legislate those beliefs. When Oberweis ran for Senate in 2004, he supported passing a constitutional amendment against abortion, according to the Sun-Times.

* * *

Oberweis had thought his political career was over after losing in that earlier 2002 race. "I'm done and now I'm back to business," he recalls of his thinking then. But before he could pick up where he left off, his marriage fell apart. "I was, I thought, happily married for 35 years, and I absolutely can tell you I never strayed in any way during that period of time and never even considered the possibility of not being with my wife for the rest of our lives," Oberweis says. "And then one day she left and moved in with another guy."

Oberweis brings this up, unprompted, at the end of an interview in his campaign office. "I can tell you it was by far the worst thing that I ever went through in my life. I literally lost about 70 pounds in six months."

The man she left him for was a former employee of the dairy (she also left the company). Oberweis says he's still not entirely sure why it happened. "We obviously had some differences over what we thought our lives should be," he says. "She thought I should retire and play golf. She wanted to go bird watching and take life easy, and I'm not finished with my life yet."

Oberweis's former wife, Elaine Pearson (she changed her name after remarrying), says she is not surprised by his description of their split. "Obviously it was not 35 years of bliss and one day I woke up and left," she says. "I'm sure that's how he saw it, but that's certainly not what I felt at the time."

Oberweis says his wife "hated politics," and Pearson acknowledges that his fledgling political career played a role in the divorce—"He chose politics over what he knew I would want," she says—though it was not the decisive factor. "I am not a political being and I am also not a Republican conservative," Pearson says. "So if you put the two things together, I was not happy to be involved in any sort of race for the Senate." Oberweis, she says, "throws his heart and soul into whatever endeavor he is pursuing, whether it's his job or a political run or whatever. That means there's a total imbalance in life, and I needed balance."

On July 4, 2007, Oberweis married Julie Malloy, a divorced information technology executive 12 years his junior, with whom he had played hide-and-seek as a child when she lived next door to his cousins in Cedar Rapids, Iowa. "I was very impressed with not only her athletic ability but her intelligence," Oberweis says of their courtship on jogging trails. Julie now works as Oberweis's vice president, sharing a glass-walled office with him at the dairy's headquarters on Ice Cream Drive, where he serves as chairman of the Oberweis Group Inc., the company that oversees his business holdings. Joe Oberweis is chairman and CEO of the dairy, while Jim's other son, Jim Jr., heads the financial firm.

Despite Oberweis's current marriage, a number of people I interviewed cited his sudden divorce as central to understanding Oberweis's political crusade. "I think he's determined to get approval," says Jack Roeser, the founder of the conservative Family Taxpayers Network and Oberweis's chief financial backer in his gubernatorial run. "He got into a fight and he doesn't want to leave the fight without winning it. I think it's a mistake on his part to think that . . . politics is going to certify you as a person."

* * *

In April 2003, the Republican U.S. senator Peter Fitzgerald announced he would not seek a second term, and Oberweis entered the crowded race to succeed him. "Peter Fitzgerald surprised the world. . . . And over the next 48 hours I got . . . over 100 phone calls from people saying would you please run for this seat," Oberweis says of his decision to run again.

In the same way the abortion flap derailed his first campaign, Oberweis's 2004 race was defined by a single event—the airing of a 30-second campaign commercial showing him aloft in a helicopter over Soldier Field, trying to illustrate the economic effects of illegal immigration. "Illegal aliens are coming here to take American workers' jobs, drive down wages, and take advantage of government benefits such as free health care, and you pay," Oberweis said gravely over the whir of the rotor. "How many? Ten thousand illegal aliens a day. Enough to fill Soldier Field every single week."

The ad was panned as scaremongering, and Oberweis wound up finishing second, 12 points behind the nominee, Jack Ryan. Later that summer, when Ryan withdrew from the race following the release of his divorce files, state party officials resisted turning to Oberweis, instead importing the Maryland ideologue Alan Keyes to strike out against the Democrat, Barack Obama.

Oberweis says he regrets the abrasive tone of the helicopter ad, but sees its content as an example of his foresight. "This was an issue that I was way ahead of the curve on," he says. "I was the only one willing to talk about it. I think that the country has come around to my viewpoint on this issue, but I think [the ad] did a lousy job of communicating that position."

In 2006, Oberweis ran for governor—again, he says, after getting "hundreds" of calls from supporters. The Republican primary was a bitter, five-way election won by state treasurer Judy Baar Topinka, a moderate on social issues. Oberweis finished a relatively close second, but the race may have cemented his reputation as the Energizer Bunny of candidates. "Once you lose three races or so, you really have to fight a stigma of perennial candidate," says the Cook Report's Wasserman. "It'll be very hard for Oberweis to shake the persona he has earned for himself as a kind of unsavory politician."

"I think he loses elections because he's perceived as a gentleman who wants an office so badly that he'll do whatever or say whatever it takes to get there," Topinka says now. "There are certain rules to the game—certain civil ways of handling elections—and I think one of Jim's problems is that he never put that line in the sand beyond which he would not go."

The line between a well-traveled, serious contender and an office-shopping perennial can be blurry. Once an aspiring candidate has crossed, it's virtually impossible to return. In 1948 Harold Stassen was a promising young governor of Minnesota when he finished second for the Republican presidential nomination. He ran again in 1952, winning some delegates, before running again and again for a total of nine bids between 1964 and 1992, never coming close to the success of his first run. Stassen also ran unsuccessfully for the U.S. Senate (twice), for governor of Pennsylvania (also twice), and once for mayor of Philadelphia. Though a member of Dwight Eisenhower's cabinet and a former president of the University of Pennsylvania, he is perhaps best known as a punch line on The Simpsons. ("Hey, who wants some eggs à la Harold Stassen?" Gil, the washed-up salesman, asks the Simpson family. "They're always running!")

"We're certainly not at the Harold Stassen stage yet," says Kent Redfield, a political science professor at the University of Illinois at Springfield. But "you do get to a tipping point where you really can't recover, and he probably is close to that. This may be pretty much it for his future as a serious candidate."

* * *

Oberweis refuses to say whether he would run again if he loses in November. The money he has spent trying to win office doesn't seem to bother him. ("I think it shows a commitment to those who've supported me," he says. "It also keeps me in a position where I can't be overly influenced.") He dismisses the perennial candidate label as a media invention and says his close-but-no-cigar showings prove that voters want him. "In reality, I've run in five primaries and one special [election]," Oberweis says, referencing his victories in two GOP primaries held the same day: the special election to fill Hastert's term and the regular party primary to decide who would be the GOP nominee in November's general election. "Won two of the five primaries by a much bigger margin than I ever lost one by, and [in] all the other primaries there were three to eight candidates and I beat some pretty strong candidates. So voters have given us some pretty strong support."

It's unclear whether Oberweis gets discouraged. Patrick Joyce, the executive vice president of Oberweis's investment firm since 1994, who referred to his former boss as a "visionary," says, "Maybe a lesser person would've stopped . . . but I think his inner desire is so strong that he continues to move forward." Each of Oberweis's five children spoke of their father's unshakable faith in himself, and Oberweis often referenced his entrepreneur's resilience in bouncing back from blows personal and professional. "Every human being has their breaking point, and I don't know where that would be for my dad," Trish Oberweis tells me. "He's human, so I'm sure it's out there, but I don't see it at this point."

Oberweis resists saying where his breaking point is. The mounting losses and the public sneers do hurt him, Trish Oberweis says, but he seems to view them less as signs than as additional obstacles on his path to inevitable political office. "There was a guy about 130 or 150 years ago who had several losses before he won," he says. "I can't quite remember his name, but he went on to become the president of the United States. His first name was Abraham. What was his last name again?"