Interview by Elizabeth Fenner

You were named president of the Chicago Fed in 2007, right as the economy started to head south. What was that like?

As a trained economist [and research director at the regional Fed bank from 2003 to 2007], I thought I was prepared for everything we would be facing. But then the financial crisis hit and Lehman Brothers filed for bankruptcy [in September 2008], and it was a whole new ball game.

Why is it taking so long to recover from the recession?

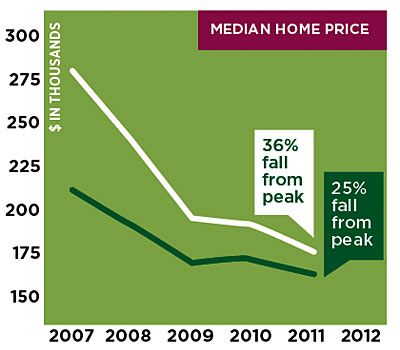

From the peak in 2007 to the trough in 2009, Americans lost $11 trillion of net worth for households and businesses. Plus, we’re facing a lot of headwinds—uncertainty about the global economy, the regulatory environment, the tax situation, fiscal cliff issues—so a lot of businesses have been putting growth activities on hold.

You’ve been more vocal than most Fed economists—for example, advocating aggressive moves to boost the employment rate. How has that gone over?

Central bankers tend to be conservative by nature. [But] the chairman [Ben Bernanke, who got the top job at the Federal Reserve in 2006] talks about the virtues of having a lot of people providing insight so that we don’t get caught up in groupthink. If you pursue the policies that have been pursued in the past, it’s unlikely that you’ll grow very fast. It’s important to think about what has not been done.

Such as?

The goal of everything we’ve tried so far is to reduce financing costs so that households and businesses can spend and invest. In addition to cutting the benchmark federal funds rate [the interest rate banks charge to one another, slashed to a superlow 0.25 percent], we decided to embark upon purchases of long-term mortgage-backed securities, in addition to long-term Treasuries.

How well is that working?

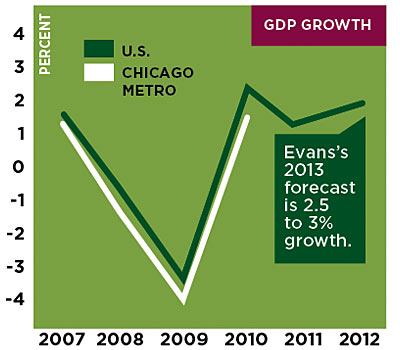

The Fed’s policies have been helpful—the bond purchases, for example, have reduced long-term interest rates—but they haven’t been so helpful that we’ve got the economy where it needs to be, which is about 4 percent growth [see chart below].

Where do you think the economy is headed in 2013?

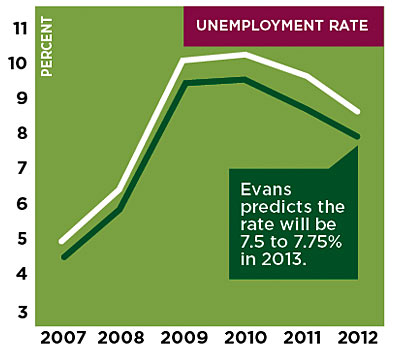

We’re expecting that GDP [gross domestic product] growth nationally will be on the order of 2.5 to 3 percent. That assumes that nothing bad happens in Washington regarding the fiscal cliff or in Europe in terms of how they negotiate their financial difficulties. The year after, we’re expecting that growth will pick up to about 3.5 to 4 percent. As for unemployment, by the end of 2013, we expect it to be about 7.5 to 7.75 percent.

What about the Chicago economy, specifically?

If the national economy improves, Chicago will improve. We have a large business service sector that services companies across the country, and a large transportation sector including O’Hare and rail and freight. The fundamentals are really quite good.

Yet unemployment here is still higher than the national average [see chart below]. You have children, ages 20 and 25. What do you tell them about their job prospects?

Work hard! Study hard! [Laughs.] My daughter studied to be a teacher. She graduated two years ago from Keene State College in New Hampshire and didn’t find a job out there, so she moved home. We were very happy that, after about nine months, she moved from unemployment to underemployment. She’s not a teacher, but she’s an aide at an elementary school.

Is the Fed willing to risk higher inflation to boost job creation?

Currently, at slightly below 2 percent, inflation is not that big of a problem. As long as unemployment is over 6.5 percent, I would like to keep the federal funds rate where it is. I don’t foresee inflation increasing much above our objective [2 percent]. If it rose substantially above that, say 3 percent, we would seriously consider backtracking.

What’s the biggest challenge facing the local economy?

Our pension system for state employees is vastly underfunded: over $100 billion. All the promises that have been made to government employees—funding the pension systems and the health care systems—present tremendous fiscal challenges.

Can growth alone get us out of that mess?

Growth can help, but it’s not going to solve the problem. You can’t do it through increased tax revenues alone, either. The state has to right-size its obligations.

Of all the worries that you deal with in your job, what keeps you up at night?

The possibility that this entire mess goes on much too long. I look at Japan, which had not a lost decade but a lost two decades [of economic stagnation following its financial crisis in the early 1990s]. That’s why I would prefer to be more aggressive—so that we don’t find ourselves experiencing that.

* * *

Signs of the Times

The recession hit Chicago hard, as shown by these three key indicators, but Evans is optimistic about stronger growth in 2013.

NOTES: The Chicago metro area is defined as Chicago-Joliet-Naperville. Numbers for 2012 are projections. Figures for Chicago-area GDP growth are not available past 2010. Median home price is for single-family detached homes through 2011. Sources: Bureau of Economic Analysis, Bureau of Labor Statistics, National Association of Realtors

Photograph: Chris Strong