INTRO

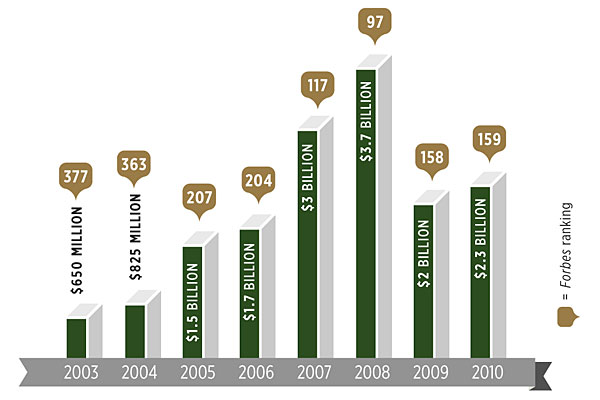

In the last ten years or so, Ken Griffin has become one of the most prominent names in Chicago business, philanthropy, and—to a less visible extent—politics. As the founder and head of the Chicago-based hedge fund Citadel, Griffin is reported to be worth $2.3 billion, making him the fifth-richest Chicagoan and 159th-richest American, according to the 2010 Forbes 400, as well as an outlier for the New York–centric hedge fund world. He and his wife, Anne Dias Griffin, have put a huge stamp on the Chicago arts scene, most notably with a $19 million donation for the Modern Wing at the Art Institute. And lately they have been major players in the world of political money: Campaign finance records show that Griffin and his wife have donated more than $3 million to candidates and political action committees—including $450,000 last fall to Republican Bill Brady in the tight 2010 Illinois governor’s race.

Who is this guy who has taken such a significant role in the life of the city? Griffin guards his privacy carefully. While he has participated in several profiles over the years (including one in this magazine in October 2005), he declined an interview for this story through a spokeswoman. Nonetheless, we compiled a dossier of information about Griffin, producing a portrait of a passionate, motivated, and phenomenally rich man.

BIO

Griffin married Anne Dias, another hedge fund manager, in 2003; they held their wedding reception at Versailles.

Kenneth Cordele Griffin was born October 15, 1968, and grew up largely in Boca Raton, Florida, with some time in Texas and Wisconsin. He attended Boca Raton Community High School, a public school, where he was president of the math club. He began his investing career while still a Harvard undergraduate, coaxing the school administration into allowing him to install a satellite dish on the roof of Cabot House to receive stock quotes. Griffin’s earliest investment strategy took advantage of a systematic inefficiency in the market for convertible bonds, which are company bonds that can be converted into stock. A 2001 profile in Institutional Investor magazine reported that he got his first fund up and running with $265,000—including money from his grandmother—in time to make a killing from his short positions when the market crashed on October 19, 1987, just days after his 19th birthday. After graduating in 1989, Griffin moved to Chicago to work with the investor Frank Meyer, who ran Glenwood Capital Investments. Meyer entrusted $1 million of Glenwood cash to Griffin, who produced an attention-getting one-year return—The New York Times reported it as 70 percent. The next year, Meyer helped Griffin raise $4.6 million to found Citadel Investment Group (known now as Citadel).

The hedge fund grew rapidly, often making high-profile moves to snap up distressed or unpopular assets. In 2002, Citadel entered into energy trading after the collapse of Enron. When Amaranth Advisors ran into trouble on bad natural-gas investments in 2006, Citadel bought its positions at a steep discount. Citadel peaked at $20 billion in assets in mid-2008.

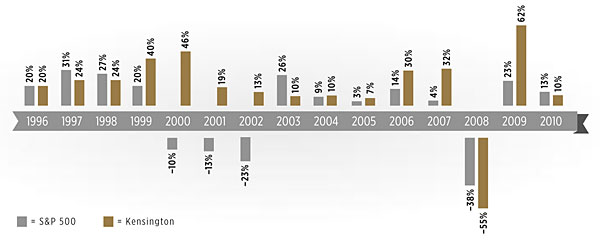

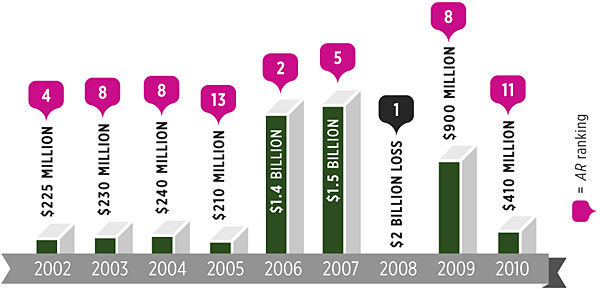

In the second half of 2008, as the economic crisis that took down the investment banks Bear Stearns and Lehman Brothers deepened, the market for convertible bonds froze up when major financial institutions ran low on cash. Citadel’s assets plunged in value, and Griffin found himself forced to “put up gates” (that is, forbid investors to withdraw their money). Leverage, or borrowing to increase the size of an investment, magnified the losses: In October 2008, in the midst of the crisis, the Chicago Tribune reported that Citadel’s leverage, which had been 7 to 1—that is, it borrowed $7 for each $1 in assets—had diminished to a still-high 4 to 1. The two biggest funds at Citadel finished the year down 55 percent. Although those two funds made up some of the lost ground with 62 percent gains in 2009, they were still down 27 percent over the two years. Citadel now controls about $11 billion in assets. The $9 billion decline from the high-water mark can be attributed to both lowered asset value and withdrawals by investors after the gates came down.

Despite a rough 2008, Griffin acted in 2009 to build an investment-banking operation to take advantage of the market hole left by collapsed i-banks. Citadel issued its first bond in November 2009. It’s not the first time the company has entered into business areas that are unusual for hedge funds—for example, Citadel created and sells administrative services for other hedge funds, although a late-March report indicated it may sell that part of the company to Northern Trust.

In 2003, Griffin married Anne Dias, who runs the hedge fund Aragon Global Management, which deals in communications, financial, and consumer stocks. The publication US Banker reported Aragon’s value as $68 million in 2009, making it the largest hedge fund run by a woman. Their wedding featured a reception at Versailles that Fortune says included performances by Cirque du Soleil and Donna Summer.

Photography: Bill Hogan/Chicago Tribune; Joe Schildhorn/patrickmcmullan.com/Sipa Press/0910302023; Illustration: Lorenzo Petrantoni

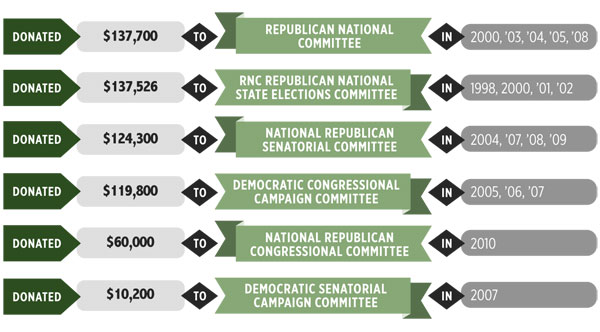

POLITICAL DONATIONS

Griffin has hedged his political bets, giving money to politicians on both sides of the aisle, including Representative Paul Ryan and Senator Tom Coburn, both Republicans, and the Democrats Rahm Emanuel (both for Congress and for mayor) and Senator Evan Bayh. Nonetheless, the preponderance of the donations has gone to Republicans. Federal and Illinois databases for political contributions contain 275 records for Ken and Anne Griffin, totaling $3,038,091. (The couple often split their political donations, each giving half on the same day.) In 2010, the Griffins’ donations increased in both frequency and amount, as well as taking a rightward turn. Their 65 donations last year, totaling $1,869,400, included $450,000 to Bill Brady’s gubernatorial campaign—all during October—and $500,000 to a right-leaning political action committee. In a 2007 article in Portfolio, Griffin denied any political aspirations of his own.

$500,000 The largest donation: In 2010, Ken gave $500,000 each to two different political action committees—on October 25th to American Crossroads, an organization, according to its website, “dedicated to renewing America’s commitment to individual liberty, limited government, [and] free enterprise” and on December 15th to Stand for Children Illinois, a lobbying group focused on issues related to public education.

$140,000 in October 2010 to Two Party System, a political action committee that fights “Illinois’ one-party system” by supporting the state campaigns of Republicans and independents

During the 2008 presidential election, Ken was a bundler for both Barack Obama and John McCain, according to OpenSecrets.org.

$2,000 The earliest donation in the databases: On June 12, 1998, Ken gave two separate $1,000 contributions to Daniel Inouye, the Democratic U.S. senator from Hawaii.

$200,000 to Rahm Emanuel’s mayoral campaign

$150,000 to Mayor Daley in 2006

During the 2010 elections for Illinois state legislative seats, the Griffins were the number one donors to Republicans, giving $445,000 according to the Illinois Campaign for Political Reform.

Ken gave $70,000 to Rod Blagojevich in 2002 and 2003.

NATIONAL COMMITTEE DONATIONS*

* cumulative totals for multiple years

ART COLLECTION

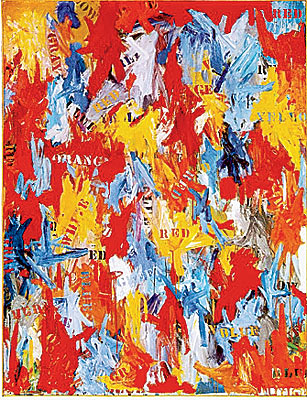

Griffin collects impressionist and postimpressionist art with the same passion he brings to running a hedge fund. He and Anne were first named to ARTnews’s (unranked) list of the world’s top 200 collectors in 2004 and have appeared every year since, including in the (also unranked) top-ten list in 2007. While the Griffins’ love for art is widely known, the art world’s secrecy keeps specific acquisitions and their prices from publication. For the most part, only auction prices appear in the public record, and big-ticket buyers often buy auction items anonymously. Here are some pieces known to be in the Griffins’ collection:

False Start (above)

Jasper Johns, 1959

Bought in 2006 for $80 million, the most expensive sale ever for a work by a living artist

Curtain, Jug, and Fruit Bowl

Paul Cézanne, 1893–94

Bought in 2004 for an undisclosed amount; the painting sold at auction in 1999 for $60.5 million

Self-Portrait

Paul Cézanne, 1895

Water Lilies

Claude Monet, 1905

Green Dancers

pastel, Edgar Degas, circa 1878

Little Dancer, Aged Fourteen

(right) bronze sculpture, Edgar Degas, circa 1879–81

Photography: (top) © Jasper Johns/licensed by VAGA, New York, NY; (bottom) courtesy of the Philadelphia Museum of Art (which also owns a copy of the sculpture)

MEMBERSHIPS

KEN, CURRENT:

Trustee

Art Institute of Chicago

Trustee

Museum of Contemporary Art Chicago

Vice Chairman

Chicago Public Education Fund, a charity that raises venture capital for public education programs

Member

G100, an invitation-only organization of CEOs of “the world’s largest and most significant companies”

Member

World Economic Forum

Member

Committee on Capital Markets Regulation, a nonprofit research organization “dedicated to improving the regulation of U.S. capital markets”

Member

Economic Club of Chicago

Member

advisory board, Eurasia Group, a research and consulting firm that advises businesses and government on working in politically uncertain areas of the world

KEN, FORMER

Member

board of directors, Chicago Public Library Foundation

ANNE, CURRENT:

Trustee

Chicago Symphony Orchestra

Member

board of directors, Children’s Memorial Medical Center and Children’s Memorial Foundation; Children’s Memorial Investment Committee

Trustee

Museum of Modern Art, New York

Trustee

Whitney Museum of American Art, New York

Member

advisory board, WomenOnCall.org, a network that connects women with volunteer opportunities at nonprofits

ANNE, FORMER:

Member

board of directors, Friends of Island Academy, an organization working to reduce recidivism among criminals released from custody in New York City

PROPERTIES

Griffin’s Chicago residences have been in buildings known for luxury. After selling his place in Lake Point Tower, he now owns the penthouse in the Park Hyatt and a condominium in the same building that houses the Four Seasons Hotel. In the past two years, he has bought four out-of-state properties: a floor of a building overlooking New York’s Central Park; a mansion in Aspen; and a vacation home—as well as a separate parcel of land—on Hawaii’s Big Island. The combined cost of these four properties is comparable to the budget of the government of the South Pacific island nation of Vanuatu.

132 East Delaware Place

The Residences at 900 (North Michigan)

Unit bought 11/16/95 for $1.015 million

Assessed value: $1.3 million

Property tax: $19,971 paid in 2010

800 North Michigan Avenue, penthouse unit

Park Hyatt

Bought 8/2/00 for $6.9 million

Assessed value: $7.3 million

Property tax: $113,833 paid in 2010

820 Fifth Avenue

New York City

Unit bought 12/16/09 for $40 million

Mansion

Aspen, Colorado

Bought 7/8/09 for $13.25 million

Assessed value: $10.5 million

Vacation home

Kailua-Kona, Hawaii

Bought 3/4/10 for $13 million

Second Hawaiian property

Bought 6/29/09 for $11.375 million: two parcels of land totaling about 4.2 acres in the same resort complex as the Waiulu Street house

Photograph: (800 North Michigan) Todd Urban; Illustration: Lorenzo Petrantoni

PERFORMANCE OF CITADEL

Kensington Global Strategies Fund is one of Citadel’s two largest funds (the other is Wellington). The following annual return numbers were generated from data collected from public sources by the investor Graham Giller and from published sources.

CHARITABLE DONATIONS

Griffin’s philanthropy has centered on the arts, children, and education. Some of his charitable contributions are distributed by the Citadel Group Foundation (CGF), a private foundation. Griffin serves as CGF’s president and biggest donor—in 2007, for example, he gave 98.5 percent of the funds the foundation received. He and Anne also started the Kenneth and Anne Griffin Foundation in October 2009. Here is a partial list of their contributions (because public access to charities’ tax documents lags behind their activity by more than a year, donations from the foundations in 2009 and 2010 may be missing from this list):

$19 MILLION to the Art Institute in 2006 for the Modern Wing; the main hallway and atrium off the Millennium Park entrance are now the Kenneth and Anne Griffin Court

$996,440 in total from CGF to the Chicago Symphony Orchestra (2002, 2003, 2005, 2007, 2008, 2009)

$675,000 in January 2007 to a program at the Chicago Public Education Fund designed to prepare teachers and principals for public schools

$500,000 and the loan of the Jasper Johns painting False Start to a 2007–08 Art Institute exhibit called Jasper Johns: Gray

$240,000 in total from CGF to the Latin School of Chicago (2005, 2007)

$10 MILLION from the couple’s foundation in October 2009 for the Griffin Early Childhood Center in Chicago Heights, an experimental school headed by the University of Chicago economist John List that opened in September 2010; some children attend free preschool while the parents of other students attend courses at the Parent Academy

$480,171 in total from CGF to Absolute Return for Kids, a London-based charity promoting child health, education, and protection (2002, 2004, 2005)

$675,000 in total from CGF to Paul Tudor Jones’s Robin Hood Foundation (2001, 2002, 2004, 2005, 2006)

$566,200 in total from CGF to the Chicago Public Library Foundation (1999–2010)

$16 MILLION from the couple’s foundation to Children’s Memorial Hospital in January 2010 for an emergency care center in the new building under construction in Streeterville

$2.25 MILLION in 2005 to Woodlawn Secondary School, a charter school operated by the University of Chicago

Between $500,000 and $1 MILLION to Chicago 2016, the nonprofit that ran Chicago’s bid for the 2016 Summer Olympics

$403,200 in total from CGF to the Museum of Science and Industry (2006–09)

WEALTH

Griffin first appeared in Forbes magazine’s list of the 400 richest Americans in 2003. He has made the list every year since.

The magazine AR analyzes the personal earnings of hedge fund heads annually. (This list first ran in the magazine Alpha, which merged with Absolute Return to become AR.) Griffin has frequently appeared near the top of the list of biggest earners—and once at the top of the list of the biggest losers, for Citadel’s disastrous 2008.

CITADEL TODAY

Citadel’s offices are at 131 South Dearborn Street in a 37-story building called the Citadel Center. The company employs 1,200 people, including many math and physics Ph.D.’s and several meteorologists.

Because it uses computerized trading algorithms, Citadel executes a large number of trades—approximately 8 percent of all trades on U.S. stock markets, as well as 30 percent of all U.S. trades of options, The New York Times reported in 2008. Hedge funds typically collect a flat 2 percent of what investors place with the fund and keep 20 percent of the gains. Citadel charges a higher management fee—in the past, as high as 8 percent—based on its higher operating costs.

Reports suggest that Griffin is not a natural manager. He’s known to frequently read books about management, hewing to the style of Jack Welch (the former General Electric CEO): having lunch with small groups of employees, for instance, and taking suggestions.

Photograph: Todd Urban

CITADEL EXECUTIVE TEAM

GERALD BEESON The chief operating officer, Beeson joined the firm as an accounting intern in 1993, according to a BusinessWeek online profile. The son of a Chicago cop, Beeson is a trustee at DePaul University.

ADAM COOPER The chief legal officer, Cooper sits on the boards of Northwestern University’s law school and the Children’s Memorial Foundation. He holds degrees from the University of Michigan and Northwestern Law.

ALEX LURYE Lurye heads global portfolio construction and risk, gauging the firm’s risk tolerance. He earned a bachelor’s degree from Polytechnic Institute in Brooklyn and an MBA from New York University.

JAINE MEHRING A graduate of Yale with an MBA from Cornell, Mehring runs human capital management and development. She previously worked as an analyst of food markets for Salomon Smith Barney.

TOM MIGLIS Miglis is the chief information officer. He oversees the creation of the trading technology that forms the essence of Citadel’s business. He holds a bachelor’s degree from Baruch College, a branch of the City University of New York.

Illustration: Lorenzo Petrantoni

FORMER CITADEL EMPLOYEES

Hedge funds, especially the math-focused quant funds such as Citadel, have a reputation for hiring the best and brightest. Citadel employees have frequently followed their boss’s entrepreneurial spirit and struck out on their own, founding new financial firms, including Polygon Investment Partners, Headlands Technologies, Senrigan Master Fund, RoundKeep Capital Advisors, Whiteside Energy, Steeplechase Group, and Abax Global Capital. Griffin told the Chicago Tribune in 2006, “I hope in 15 or 20 years we’ll have the same reputation that General Electric had: People have great careers at Citadel, and if they leave, they have great careers elsewhere.” Not every Citadel vet has had smooth sailing, however:

|

ALEC LITOWITZ An employee until 2003, Litowitz created the Evanston-based hedge fund Magnetar in 2005. The website ProPublica reported that Magnetar provided key funding for collateralized debt obligations (CDOs) backed by mortgages before the financial crisis while also betting that CDOs would fail. When mortgage-backed securities began tanking in 2007, Magnetar’s fund with the greatest exposure to CDO trades went up 76 percent, according to ProPublica. In November 2010, ProPublica reported that the Securities and Exchange Commission is investigating Magnetar’s CDO transactions.

|

MIKHAIL MALYSHEV Malyshev, known as Misha, left Citadel in February 2009 along with Jace Kohlmeier to form Teza Technologies. Citadel sued Malyshev and Kohlmeier in July 2009, claiming they violated their contractual noncompete clause. After discovering that Malyshev had used scrubbing software to erase files on his home computer even though he had been told not to, Judge Mary Rochford penalized him $1.1 million, payable to two Chicago charities. Rochford was unconvinced by Malyshev’s argument that he was only deleting pornography.

|

JULIO DePIETRO After 11 years working on convertible bonds, DePietro left Citadel in 2003 to become a filmmaker. He wrote and directed the 2009 feature The Good Guy, starring Anna Chlumsky, Alexis Bledel, and Andrew McCarthy. An excerpt from Roger Ebert’s review encapsulates the movie’s tepid reception: “Will you like ‘The Good Guy’? I think you might.”

MISCELLANEOUS

The New York Times reported in October that Griffin was one of the attendees of a secretive conference in Aspen, Colorado, put on by Koch Industries, an energy and manufacturing company run by the libertarian billionaires Charles and David Koch. Politico says the purpose of the conference was to raise money for “the institutions that form the intellectual foundation—and, increasingly, the leading political edge—of the conservative movement.”

In November 2009, The Wall Street Journal reported that Griffin occasionally sends his driver to bring back milk shakes from LeDuc’s Frozen Custard in Wales, Wisconsin.

Portfolio reported in 2007 that during their courtship, Anne told Ken that she outgrew the impressionist movement as a teenager. Then she visited Ken’s apartment and saw his impressionist collection. The surprise became a running joke.

An article in the South Florida Sun-Sentinel in 1986 described the 17-year-old Griffin’s software distribution company, EDCOM, which sold discounted educational software to college professors. Griffin avoided revealing his age when buying and selling. “Do you think anyone would trust their product line to a 17-year-old kid?” he told the paper.

Photograph: Jim Shackton