For an intensely private billionaire, one who had spent much of his adult life behind an impenetrable wall of plush, January 14 had to have been as agonizing as a bolt-up-in-bed naked-in-the-classroom night terror.

Yet, with no choice left him, there he stood, like a circus curiosity on full display, in the harsh fluorescence of a packed 23rd-floor courtroom in the Everett M. Dirksen U.S. Courthouse, the media and onlookers straining for a glimpse at the entrepreneur who has been called Chicago’s Howard Hughes. For a 69-year-old, he had oddly taut skin. His eyes darted behind rose-colored lenses set in tortoise frames. He rubbed his upper lip nervously. His hands fumbled with a set of headphones provided to help him better hear the arguments on which rested the potential for an even more unthinkable indignity: prison. “He looks like he should be in a wax museum,” someone whispered.

When U.S. District Court judge Charles P. Kocoras swept into the room, the man rose. He rose again when a name pierced the silence of the hushed room: H. Ty Warner.

The mastermind behind Beanie Babies—still considered the most successful toy launch in U.S. history—is among the richest people in America, and one of the most secretive. But on this day, Warner had nowhere to hide. As he walked to a court lectern in an impeccably tailored dark suit, his ginger-colored hair flaring copper under the stark lights, he looked as tentative as a modern-day Willy Wonka clomping across the plaza of his ruined reclusiveness. “I never realized that the biggest mistake I ever made in life would cost me the respect of those most important to me,” he told Kocoras, his voice a murmur.

Advertisement

A few months earlier, in federal criminal court, Warner had wept as he pleaded guilty to that most clichéd of rich-people crimes: stashing millions (by the time he was caught, more than $100 million) in a Swiss bank account and lying about it to the Internal Revenue Service. “This is a crime committed not out of necessity, but greed,” argued federal prosecutors in a sentencing memo to the judge.

But once Kocoras began to speak, it became clear that Warner wouldn’t spend one day behind bars for tax evasion. The judge all but produced a sword, asked the toy man to kneel, and tapped him on each shoulder. “Mr. Warner’s private acts of kindness, generosity, and benevolence are overwhelming,” Kocoras said after reading aloud letters from Warner’s supporters.

He further lauded Warner for already paying a civil penalty of $53 million (which amounts to just 2 percent of the billionaire’s estimated net worth), plus back taxes. “I believe . . . with all my heart, society will be best served by allowing him to continue his good works,” the judge concluded. In lieu of the four-year-plus prison term recommended by federal guidelines, Kocoras sentenced Warner to two years of probation, 500 hours of community service, and a $100,000 fine.

A few weeks later, the prosecution team, led by the U.S. attorney for the Northern District of Illinois, Zach Fardon, filed a notice of appeal for a new sentencing hearing. (At presstime, Fardon’s office was still awaiting approval from the Department of Justice.) But reversing the sentence of a federal judge is a long shot, so the mysterious man behind Banjo the Dog and Buzzie the Bee is likely to triumph.

If Warner was gloating on January 14, however, you couldn’t tell. At hearing’s end, he thanked his lawyers, caught an elevator downstairs, and, without a word, ducked through a cold rain into a waiting limousine.

Warner’s success at dodging the public eye for decades is quite an accomplishment for someone Forbes routinely lists as one of the world’s wealthiest people. (This year he ranks 663rd, with $2.6 billion; court documents filed by Warner’s lawyers say that his net worth is only $1.7 billion.) To date, Warner has granted only one in-depth interview that I could find: in 1999, to People magazine. Not surprisingly, he declined my interview requests through his publicist. (Prosecutors also declined to comment, citing the pending appeal.)

The more I pored through court documents and spoke with those I could persuade to talk—including former classmates and coworkers, plus a rare interview with the daughter of Warner’s former girlfriend (a young woman whose family lived with the billionaire as the Beanie Baby craze was taking off)—the more the mystique of this never-married college dropout unraveled. Warner began to seem like the great and powerful Wizard of Oz: mysterious until a dog named Toto—a pet that might have made for a great Beanie Baby—yanked a curtain with his jaws and revealed the lonely person behind it.

In a memo to the court pleading leniency, Warner’s lawyers paint a classic Horatio Alger up-by-the-bootstraps picture. “Ty emerged from an unhappy family and a youth devoid of educational advantages to become a self-made American success story,” the memo says. Warner’s “humble” beginnings were described as days of little money and parental indifference that were almost Dickensian.

But the house in which H. Ty Warner grew up with his parents, Harold “Hal” and Georgia, and his much younger sister, Joyce, is no hovel. It’s a lovely two-story Prairie-style home designed in the late 1800s by Frank Lloyd Wright. (The real-estate website Trulia currently values it at more than $600,000.) Known as the Peter Goan House, it is in La Grange, ranked in Chicago’s April issue as one of the five best places to live in suburban Cook County.

In the People story, Warner told correspondent Joni Blackman that his father was a jeweler, omitting the fact that for the bulk of his career Hal was a toy salesman. (Joyce, 57, who lives in Washington State, declined to comment for this story.)

From kindergarten to the age of 13, Warner attended the historic Cossitt Avenue Elementary School; at 14, he entered Lyons Township High. After just three terms there, his parents packed him off to boarding school at St. John’s Northwestern Military Academy in Delafield, Wisconsin.

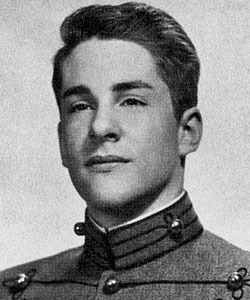

It’s unclear why he was sent away, says the writer Zac Bissonnette, who is finishing a book about the Beanie phenomenon scheduled to be published this fall. Apparently, Warner was neither unruly nor in need of discipline. In the People interview, Warner told Blackman that at the academy he played baseball, football, and basketball and became a member of the Stars and Circles, a school honor society. A photo from his student days shows a handsome dark-haired teen in a pristine military tunic, gazing off into the distance. (On Warner’s instruction, the school would not release information about his time there.)

Graduating from St. John’s in 1962, Warner entered Kalamazoo College in Michigan that fall. There he studied drama, winning the lead role of Creon in the student production of Antigone Succeeds! in his freshman year. “He is to be praised for his near and sometimes completely successful acting,” wrote a reviewer in The Kalamazoo College Index. (One criticism: “His voice was a bit tiring.”)

“He just loved commanding the stage,” recalls classmate Amy Hale, now a retired executive in Virginia. “He was very dramatic, with very broad gestures. One friend said she thought he continued to wear makeup for days afterwards, he loved the theatre so much.”

At the end of his freshman year, Warner dropped out of Kalamazoo—forced to, according to the leniency memo filed by his lawyers, “because he could no longer afford tuition . . . [and had] no family support.” True? Who knows. But rather than seek loans or a part-time job, he left for Hollywood to try his luck at acting. He had to hustle to make ends meet, busing tables, parking cars, and selling cameras and encyclopedias door to door.

After five years, with no big breaks in sight, Warner returned to Chicago. Despite his lawyers’ insistence that he received no parental help, some digging reveals that Hal Warner actually set his son on the path to riches by giving him a job with his own employer, the San Francisco–based Dakin Toy Company. To be precise, Hal “gave Ty a job as a ‘sub rep’ [representative] in Ohio,” recalls Harold Nizamian, Dakin’s CEO at the time.

Nizamian says that the “very personable” Hal had a rather distant relationship with his son. “I had the feeling that it was hard for them to communicate,” says Warner’s former boss, who now lives in Palo Alto, California.

The fate of Warner’s mother, Georgia, sheds some light on that distance. She suffered from untreated mental illness for years, and in 1971 Hal and Georgia divorced. Later that decade, at Elgin Mental Hospital, she would be diagnosed as a paranoid schizophrenic. From court filings, it’s clear that Warner blamed his father for not taking a more active role in her care.

Advertisement

Whatever problems the family may have had did not hurt Warner’s job performance. Nizamian says that he was a “darn good salesman” who earned six figures. On calls, he reportedly pulled up in a white Rolls-Royce Silver Shadow and stepped out in a fur coat and top hat, carrying a cane. “I figured if I was eccentric looking in Indiana, people would think, What is he selling? Let’s look in his case,” Warner told Blackman in 1996. “Then it was easy to sell.”

In the office, recalls Virginia Kemp, a former Dakin designer who now owns a small gift shop in Pacifica, California, “he would talk to all the young pretty girls.” But his flamboyance wore thin. “He wasn’t particularly well liked,” she told me. “He thought a lot of himself, let’s put it that way. Ego. Very much so.”

Part of that ego, she says, manifested in a sense of mystique he seemed determined to cultivate. As she told Blackman, “I think he likes the public to feel he’s like Howard Hughes, because it makes people want to know more about him.”

In 1980, after Warner had been at Dakin for about ten years, his career there came to an ignominious end. Nizamian recalls getting a phone call from one of the company’s customers saying, “What’s going on? Ty’s [selling] some plush of his own, and he’s still selling your line.” Nizamian says the company “got an investigator, and it proved correct. My sales manager fired him on the spot.”

Rather than immediately plunging into business himself, Warner packed his things and flew to a village near Sorrento, Italy, to visit friends. He wound up staying three years. “Everyone knows each other,” he told Blackman. “They have a three-hour lunch, swim, lie in the sun. It’s a very enjoyable lifestyle.”

It also proved pivotal. In Italy, he came across a line of plush cat toys unlike anything he’d seen in the United States. “I decided to come back and do something that no one has done,” he told Blackman. “Make a good cat.”

Once again, his father played a key role that Warner never mentions. In May 1983, while playing tennis, 81-year-old Hal collapsed and died from a heart attack. A substantial bequest from his father, combined with cash from a mortgage on his Hinsdale condo and his own savings from his time at Dakin, enabled Warner to launch Ty Inc. out of his home in 1986.

Warner produced his company’s first toy cats in Korea and gave them whimsical names such as Smokey, Ginger, and Peaches. At an Atlanta toy fair, he rented a table from another wholesaler and sold $30,000 worth of the cats in one hour. “I knew I had a winner,” he told Blackman.

But cute names didn’t make the toys a success. It was a genius production decision: understuff the animals with tiny PVC pellets. “At first everyone told me I was cheap,” he said to Blackman. “They didn’t get it. The whole idea was it looked real because it moved.”

Around this time, the still-unmarried Warner traded up from his Hinsdale condo to an all-white contemporary 4,500-square-foot split-level in the Oak Brook subdivision of Ginger Creek. During renovations, he brought in a divorced 35-year-old lighting designer named Faith McGowan. In the first and only interview she has granted about Warner, McGowan’s daughter Lauren Boldebuck says her mother “didn’t really like [Warner] at first.”

But Warner eventually won her over, adds Boldebuck, 31, a naturopathic doctor in Lombard. (McGowan’s other daughter, Jenna, did not return calls.) In 1993, McGowan and her

elementary-age daughters wound up moving into Warner’s Oak Brook house. “Ty was very much a part of our lives,” says Boldebuck. “We really thought of him as a dad.”

Later that year, Warner introduced the first Beanie Babies—palm-size versions of his original full-size plush animals—at the World Toy Fair in New York City. He set the price at $5, another stroke of genius. “At that time, there wasn’t anything in the $5 range that I wouldn’t consider real garbage,” Warner has said.

The toys easily supplanted other fads such as Ninja Turtles and Cabbage Patch dolls partly because of Warner’s strategy of deliberate scarcity. He rolled out each one—Spot the Dog, Squealer the Pig—in a limited quantity and then retired it. That, Forbes observed, “pumps up word-of-mouth demand to a frenzied level.”

“At the height, they were shipping more than 15,000 orders per day to retailers,” says Bissonnette, the author. “It just never seemed as ubiquitous, because he was limiting each store to 36 of a style. That’s actually why they were able to work as a collectible: People just had no idea how many of them he was shipping.”

It also created a huge secondary market on eBay, feeding the frenzy still more. Suddenly a $5 Chocolate the Moose was selling for four figures. In Oak Brook, it wasn’t uncommon to see 100 mothers and their kids lined up in front of Galt Toys for the new shipments.

Three years into the Beanie craze, Warner boarded a plane bound for Zurich, where he would make the biggest mistake of his life. In 1996, at UBS, one of Switzerland’s largest banks, he opened a secret account invisible to the IRS. The exact amount he deposited is unknown, but by 2002 it had grown to $93 million. To keep the account’s existence from prying eyes, including those of his own accountants, he signed a “hold mail” form that instructed the bank not to send any mail related to the account to the United States and to destroy any documents in his file when they became five years old.

The money Warner stashed in Switzerland remained there, compounding tax-free, for the next dozen years. And each time Warner got to the part on his tax return that asks if the taxpayer has any foreign accounts, he checked the box that said no.

As his net worth skyrocketed over the next few years, thanks to his 100 percent ownership of Ty Inc., Warner couldn’t help bragging about his success. In 1998, experts questioned his claim to be the world’s top toy seller. (Unlike public companies, private companies are not obliged to release revenue figures.) Miffed, Warner took out a full-page ad in The Wall Street Journal stating that his company had $700 million in profits in 1997. If true, that would have made it more profitable than his two top competitors at the time, Hasbro and Mattel, which reported $560 million in combined profits that year.

By this time, Warner’s mystique was firmly established. He refused interviews. He refused to put Ty Inc.’s name on its Westmont headquarters. He made it extremely difficult for anyone to reach the company by phone, even customers. He maintained such a low profile that Forbes initially left him off its 1998 list of wealthiest Americans. (He debuted on the list in 1999 with an estimated net worth of $4 billion.)

Then, when it looked as if the Beanie fervor might be waning, Warner seemingly pulled the rug from under his own company. At the end of 1999, a news flash (the typical way a line’s retirement was announced) snapped on the Ty Inc. website, terse and cryptic: “All beanies will be retired.”

Advertisement

Hysteria seized the toy industry. “Internet chat rooms went crazy,” The New York Times reported. Some smelled a publicity stunt.

Sure enough, another news flash appeared on the site three months later, on Christmas Eve. “After much thought, I am willing to put the fate of Beanie Babies in your hands,’’ Warner wrote, asking the world to vote on whether he should bring back the Beanies. Not surprisingly, collectors voted overwhelmingly to keep them going.

Great wealth seemed to change Warner, and around 2001 he and Faith McGowan broke up, says Boldebuck. He became distant, had less time for the girls, and didn’t seem to care for the fact that they didn’t “kiss up” to the billionaire the way everyone else did. What’s more, McGowan grew to resent that she had been an active participant in Ty Inc.’s rise yet was not a paid employee.

Her daughter says that after the breakup, Warner gave McGowan a lump sum for an undisclosed amount. The girls got nothing. “No tuition help, nothing,” says Boldebuck, who nonetheless insists she has no hard feelings toward Warner. Apparently, however, the two stayed in touch. When McGowan died last June, Warner attended the funeral.

After bringing the Beanies back from retirement, Warner began to do what any smart businessman would: diversify. In his case, that meant real estate. For his first big splurge, in 1999, he plunked down a cool $275 million for the six-year-old Four Seasons Hotel New York. The crown jewel—and his personal pet project—was a lavish $41,000-a-night penthouse with 360-degree views of Manhattan that he outfitted with fabrics woven with platinum and gold and equipped with the services of a personal butler, personal trainer, and private chauffeur.

The next year, for an undisclosed sum estimated to be as high as $200 million, Warner bought a five-parcel getaway compound in Montecito, a palatial estate dominated by an Italianate mansion. (One California real-estate website says the property is currently assessed at $160 million.) He continued to round out his portfolio through much of the early to mid-2000s, adding the nearby Montecito Country Club, the San Ysidro Ranch, and the Four Seasons resort hotel in Santa Barbara, among other high-profile properties.

The splurge turned out to be shrewd. In 2002, his estimated net worth ballooned to a staggering $6 billion, Forbes estimated, placing him at No. 65 on its annual list. By then, he’d also introduced Teenie Beanie Boppers (launched by McDonald’s as part of its 25th anniversary celebration for the Happy Meal), Punkies, Pluffies, and Beanie Buddies.

As with any fad, however, the inevitable crash came. While Ty Inc. has never disclosed sales figures, by the mid-2000s it became clear that demand was tapering. As the sole owner of the company, Warner saw his estimated net worth begin to drop as well, from its $6 billion high to $3.2 billion in 2009, according to Forbes. At the same time, thousands of investors suffered big losses as the secondary market began to plummet, says Beanies expert Leon Schlossberg, who runs the website Ty Collector. “There were just too many of them,” says Schlossberg. “He oversold the market.”

As the craze receded, so did Warner, vanishing ever further from the public eye.

Still, year by year, Warner continued to maintain his secret account, reporting neither the income he earned on the stashed funds nor their existence. In 2002, in fact, he transferred what was then more than $93 million in funds to a different Swiss bank, Zürcher Kantonalbank, and had them listed under the name of a shell organization: the Molani Foundation. The move was prompted by rumors that the IRS was pressuring Warner’s original bank, UBS, to expose some of its suspect clients, according to prosecutors. As he had with UBS, Warner ordered his new bank not to discuss his account with anyone in any way. “Non-compliance will have consequences,” a letter bearing his signature threatened darkly, court documents revealed.

But in 2008, tired of wealthy Americans parking vast fortunes in secret overseas bank accounts, the Department of Justice and the Securities and Exchange Commission launched a crackdown*. The initial target was UBS. Among the first to fall was one of its bankers, Bradley Birkenfeld, who was indicted for helping a U.S. customer evade taxes.

A year later, the bank agreed to secretly provide a list of 285 U.S. clients with undeclared accounts. According to prosecutors, that list included Warner’s name. Now known to the government as a tax scofflaw, he was blocked from joining an amnesty program started around this time that spared thousands of others from criminal prosecution.

In 2009, major newspapers reported that a fellow toy manufacturer, Jeffrey Chernick, had pleaded guilty to hiding funds in a UBS account and was headed to prison. That was bad news for Warner. The two men, as it turned out, shared the same banker at UBS, a man named Hansruedi Schumacher.

Later that year, Schumacher himself was indicted on conspiracy charges. (At presstime, he was a fugitive.) Meanwhile, Warner, not knowing he was on the government’s list, tried to enter the amnesty program, only to be denied.

One morning last October, Warner stepped out of a car at the Dirksen U.S. Courthouse downtown, rushed past the media gathered for a rare glimpse of him, and swept into an elevator bound for the courtroom of Judge Kocoras.

With his attorney, Gregory Scandaglia (pronounced scan-DAY-leeah), at his side and a packed courtroom looking on, he answered the judge’s boilerplate questions patiently, one after another. Yes, he admitted, he had opened the Swiss bank account in secret. Yes, he had lied about its existence on his tax forms for a dozen years. Yes, by 2008, he had amassed more than $107 million in the account.

When it came time to recite his crime, his voice thickened. “I opened up a foreign bank account in Switzerland about 20 years ago,” he said, sounding like a child forced to confess that, yes, he had driven the family car without permission. “I didn’t tell my accountants. I didn’t tell the government. I didn’t tell anyone.

“There is no excuse for these actions,” Warner said, beginning to sob. “I made a mistake. I am fully responsible. I am pleading guilty because I am guilty.”

In the days after, neither the media nor the public offered much sympathy. “What a cry baby!” smirked Britain’s Daily Mail.

Advertisement

The blowback spread when Warner escaped prison time, especially in light of his defense team’s suggestion that his difficult childhood may have played a role in the crime. “So an unhappy childhood is a valid defense for a rich asshole?” one commenter fumed on the local website Chicagoist. “Why isn’t it a valid defense for others who aren’t billionaires?”

Even Warner’s old boss at Dakin was appalled. “It’s the usual justice in favor of celebrities,” Harold Nizamian told me. “You have money, you buy yourself out of anything.”

Not surprisingly, Scandaglia scoffs at the idea that Warner bought his way out of jail. Instead, he paints his client as someone whose generosity far outweighs a dumb mistake. At the sentencing, the judge clearly agreed, reading verbatim from some 70 letters of support written by beneficiaries of the billionaire’s largess.

“Over the last 13 years, Warner and Ty have donated to the Children’s Hunger Fund more than 11 million plush toys that have been distributed to children in need all over the world,” said the organization’s president.

From the Andre Agassi Foundation, which predominately serves at-risk youth in Las Vegas, came a letter praising a $6 million donation. “Mr. Warner’s gift remains in the top ten most generous the Foundation has received to date,” said a letter signed by the organization’s chief executives.

The letters prove, Scandaglia argues, that his client does not merely write checks but invests himself deeply in causes he chooses to support. For example, though the billionaire could just as well supervise from Chicago, he has scheduled a trip to China to personally oversee production of a Leo the Lion mascot for Leo Catholic High School in Auburn-Gresham, one of three local schools Warner must assist in order to meet his community service requirement.

Prosecutors portray his charity in a different light, saying in court documents that Warner’s giving—barely more than 1 percent of his net worth—is “hardly exceptional” and often comes in the form of boxes of plush toys. More to the point, they argue in the sentencing memo, “charity is not a get-out-of jail card.”

But unless something unusual happens with the appeal, Warner will have gotten just that, escaping prison time and paying relatively minimal fines. Meanwhile, he continues to push new lines of plush, including a family of toys called Beanie Boos. Introduced in 2008, the tinier, doe-eyed versions of the palm-size Beanies have been marketed in almost exactly the same way as the originals. But it’s unlikely that lightning will strike again, says Leon Schlossberg. “Unfortunately for Ty, the old Beanie Baby collectors remember the sobering experience of declining values,” he says. “They aren’t likely to repeat that experience with the Boos.”

Then again, Warner has been underestimated before.

At the end of a winding driveway in suburban Westmont, past a row of low-slung, nondescript industrial offices, rises an unmarked building of blue-green curving glass. There is no visible address or mailbox. Only a “No Trespassing” sign guards the driveway.

These are the headquarters of Ty Inc.

For a moment, I consider pulling a Michael Moore–like stunt, swinging into the drive and then striding up to the front desk, demanding to see Warner. He is in town, I understand. As I continue to drive by, I notice smaller warning signs every couple hundred feet, like sentries silently warding off intruders. And then I remember what somebody told me, someone who has seen the inside, that there’s a different reality behind the Oz-like façade. When the glass curtain is pulled back, it is really just an office.

*Correction 4/23/14: This story incorrectly stated that a crackdown on offshore tax-avoidance schemes began under the Obama administration. The crackdown began while George W. Bush was still in office.

Comments are closed.