Joseph Berrios faces a tough November election for Cook County assessor.

Related:

CURIOUS DEALS »

Board of Review probe centers on Joe Berrios’s office

THE FRIENDLY BAR »

Cook County campaign contribution limits to Board of Review commissioners

are not being enforced

JOE’S TIME, OUR DIME? »

Is Joe Berrios conducting political and personal business on government time?

BOARD OF REVIEW DOCUMENTS »

Confidential transcripts from the board’s investigation

Joseph Berrios is a jovial, roly-poly Chicagoan who has spent virtually his entire adult life in politics. At 58, he can point to several heartening milestones on his resumé. In 1982, for example, he became the first Hispanic elected to the Illinois General Assembly (some fellow lawmakers assumed he’d be “wearing a sombrero and not speak English,” he recalls), and in 2007 he became the first Hispanic selected to lead the Cook County Democratic Party.

Since 1988, Berrios has served on the Cook County Board of Review, the influential yet largely invisible three-member elective panel that hears and decides appeals of tax assessments. Now he is running for county assessor, the powerful official who determines the values for all homes and commercial properties in Cook County. He won a primary election in February, and he has earned the support of many of the state’s top Democrats, from Governor Pat Quinn and House Speaker Michael Madigan to Toni Preckwinkle, the odds-on favorite to be the next Cook County Board president. (Mayor Richard M. Daley so far has not officially endorsed him.)

But Berrios also stands as a prime example of the kind of closed, self-interested politics that plagues this state. The Board of Review, where he has spent the past 22 years, is an opaque operation dominated by a tight circle of politicians and tax attorneys. During his time there, Berrios has been a stalwart opponent of efforts to take clout out of the system and make it more transparent.

He holds a position fraught with potential conflicts—none more obvious than those relating to his second job as a Springfield lobbyist, where he presses the interests of clients in a legislature led on the House side by Michael Madigan and on the Senate side by John Cullerton. Both are property tax lawyers whose firms regularly bring appeals before Berrios and the Board of Review.

His campaign coffers reflect hefty contributions from the attorneys who appear before him, presenting more potential conflicts of interest. For example, the Chicago News Cooperative reported in The New York Times that the law firm Crane & Norcross donated more than $143,000 to Berrios over the past decade, and between 2006 and 2008 alone, the firm’s clients received $467.6 million in assessment reductions—second only to Madigan’s law firm, Madigan & Getzendanner, which won the largest total of reductions in that time, $490.4 million.

Overall, the generosity of the property tax bar raises questions about whether the county’s campaign donation limits are being ignored. (See “The Friendly Bar”) And the lawyers contribute in other ways, too: When Berrios is on the ballot, for example, it’s not uncommon to find property tax attorneys standing outside polling places passing out campaign pamphlets on his behalf, even in the frigid winter primary season. “It seems to be a clear conflict of interest to accept campaign contributions and other political assistance from lawyers with such obvious financial stakes in government decision making,” says Andy Shaw, the executive director of the Better Government Association (BGA).

The Cook County state’s attorney is investigating a possible influence-peddling case involving tax appeals that has been linked to Berrios’s office. The case centers on allegations that Paul Froehlich, a Democratic state representative from Schaumburg, worked through close associates of Berrios to win tax reductions for constituents in return for campaign donations. (See “Curious Deals”)

For many years, Berrios’s critics have said that he gives preferential treatment to politically connected favorites and to the property tax attorneys who bankroll his campaigns. Drawing on Freedom of Information Act requests and campaign finance records, an investigation by Chicago and the BGA shows that Berrios has met in his office with property tax lawyers who have soon after contributed to his campaign funds. Two sources have described for Chicago how Berrios takes advantage of the loose board procedures to operate independently in some instances, without the expected board checks.

Berrios insists that money and politics have no bearing on his rulings and that neither he nor anybody on his staff plays favorites. “I don’t care who you are or where you’re from,” he says. “I judge each case only on its merits.”

Berrios receives far more in donations than Larry Rogers Jr. and Brendan Houlihan, the other two board commissioners. Since 2007, the first year that the current commissioners served together, Berrios has raked in more than $2 million, the majority coming from property tax attorneys. By comparison, Rogers has collected about $685,000, while Houlihan has raised just $500,000.

Why the big disparity when the commissioners are equally powerful? John K. Norris, a lawyer and a lobbyist for the Illinois Property Tax Lawyers Association, says, “It’s not because Joe Berrios is necessarily the better of the three [commissioners]. Joe Berrios has been around for a number of years. He has always been taxpayer friendly, and when I say ‘taxpayer friendly,’ I don’t mean that he’s favoring just tax attorneys who handle big commercial cases. His office tends to give reductions to everybody.”

Perhaps the Berrios friendliness reflects his warm relations at work. Though he has campaigned on a promise to cut patronage from the assessor’s office, the employee roster of the Board of Review reads like the invitation list to a Berrios family reunion: His son, Joseph, is a computer operator at the board. Berrios’s sister Carmen works there, too. So do two sisters-in-law and a brother-in-law. A daughter, Vanessa, already works at the assessor’s office.

In short, Berrios is a consummate insider in Illinois politics, a member of the fraternity of the well connected who are in positions to manage the system to their advantage—but not necessarily yours.

* * *

Photograph: Chicago Tribune photo by Antonio Perez

Related:

CURIOUS DEALS »

Board of Review probe centers on Joe Berrios’s office

THE FRIENDLY BAR »

Cook County campaign contribution limits to Board of Review commissioners

are not being enforced

JOE’S TIME, OUR DIME? »

Is Joe Berrios conducting political and personal business on government time?

BOARD OF REVIEW DOCUMENTS »

Confidential transcripts from the board’s investigation

First: a brief civics lesson on tax assessments. (Sorry, I know this is boring, but the tax system is incredibly important—affecting everything from those property tax bills that homeowners get twice a year to the number of cops on the corners and teachers in the schools.)

In Cook County, the assessor’s office sets the valuation for tax purposes for all parcels of land in the county—roughly 1.8 million units. One-third of the county is reassessed each year. Basically, property values are determined by comparing similar properties in the same neighborhood and recent sales prices. If taxpayers think the assessor has overvalued their property, they can either ask the assessor’s office to reconsider or appeal the matter to the Board of Review. (Property owners who still aren’t satisfied can further appeal to either the circuit court or the Illinois Property Tax Appeal Board.)

The process at the Board of Review works something like this: The three commissioners act, in effect, like judges. But because of the enormous volume of work—typically 200,000-plus appeals are filed every year—each commissioner has a staff, including a deputy commissioner and a crew of analysts, clerks, and hearing officers, to assist in making rulings. At least two commissioners—or authorized members of their staffs—must sign off on every board decision.

Berrios often cites the board’s administrative checks and balances as a shield against charges of favoritism. “I’m one voice out of three at the board,” he told me in a recent interview. “Everything is set up so that no one commissioner can make a decision on any case whatsoever.”

In practice, however, because of the heavy workload, the second approval is somewhat perfunctory—commissioners and their staffers often do little more than rubber-stamp the first evaluation. (Public hearings are held in only about 20 percent of the cases; the rest are handled internally.)

What’s more, the commissioners and their subordinates have a lot of discretion. Assessing properties is as much an art as a science, and a slight tweak in the numbers can save a property owner thousands, sometimes millions, in tax dollars. “I’ve seen Joe Berrios just lop $100,000 off here, another $100,000 there, no rhyme or reason to it,” says a current board insider. “He’s learned over the years here that, as long as he can make the math work in some crazy, random way, he can do whatever he wants.”

One last important point: Anytime the Board of Review lowers one property’s assessed valuation, the tax burden gets shifted from that property to all the others. In other words, when a downtown office building gets its assessment dropped, lowering its tax by $1 million a year, that lost money must be made up by other property owners. The reductions quickly add up. In the 2008 tax year—the last year for which figures are available—the board granted more than $2 billion in assessment cuts, about 2.8 percent of Cook County’s total assessment of $72 billion. The assessor’s office granted another $2 billion in cuts, bringing the total to more than $4 billion, which was ultimately shifted among taxpayers. That burden seems to fall heavily on homeowners: A few years back, the Chicago Tribune found that commercial and industrial properties received $7.75 in breaks for every $1 homeowners received.

“The firepower that’s produced by the big-money interests and the commercial property owners—it’s just completely unbalanced,” says Don Haider, a property finance expert and professor at Northwestern University. “In the last couple of years, for sure, we’ve seen the impact: a steady shift from income-producing and commercial properties to single-family homeowners.”

* * *

The workings of the board of review have recently come under heavy fire from Victor Santana, Berrios’s former political right-hand man. Santana worked for Berrios at the board for ten years until he resigned in 2002 and currently works as a political consultant. In August 2009, he filed a federal lawsuit against his former boss, Berrios, and the other board of review commissioners, and their top board staffers after the commissioners banned him from the board offices because of his ties to the Froehlich scandal. (Santana had been helping Froehlich with the controversial appeals.)

More recently, on July 29th, Santana added federal racketeering charges to his existing lawsuit, accusing all three Board of Review commissioners of engaging in “institutional bribery and pay for play” through the collection of campaign contributions from property tax lawyers. The charges fall under the Racketeer Influenced and Corrupt Organizations Act, or RICO. According to allegations in Santana’s complaint, the commissioners have committed bribery, money laundering, and extortion.

Santana’s suit is currently proceeding in federal court, and U.S. District Judge Milton Shadur is scheduled to rule September 21st on whether the RICO counts have merit. Steven Puiszis, an attorney who is representing Berrios and Berrios’s chief deputy, Thomas Jaconetty, in the case, says that Shadur has already twice dismissed Santana’s RICO charges against the board principals and he expects the judge will do the same on the latest charges. “Our plan is to file a motion to dismiss or an objection,” he says. The new RICO complaint, filed by Santana’s lawyer, R. Tamara de Silva, says there is new evidence that will prove that the Board of Review is indeed a “racketeering enterprise.”

* * *

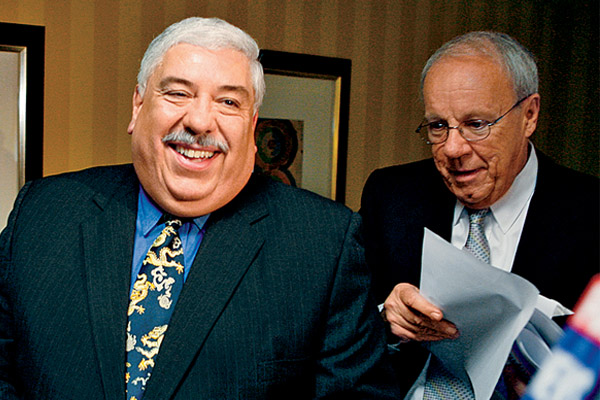

Berrios celebrates in 2007 with Robert Martwick Sr. (right) after party leader select Berrios to lead Cook County’s Democratic Party. Martwick, the secretary of the party in Cook County, is also a tax appeals attorney who appears before the Board of Review.

Related:

CURIOUS DEALS »

Board of Review probe centers on Joe Berrios’s office

THE FRIENDLY BAR »

Cook County campaign contribution limits to Board of Review commissioners

are not being enforced

JOE’S TIME, OUR DIME? »

Is Joe Berrios conducting political and personal business on government time?

BOARD OF REVIEW DOCUMENTS »

Confidential transcripts from the board’s investigation

Over his years on the board of Review, Berrios has essentially developed two ways to circumvent the usual appeals process, according to two sources, a board insider and a political operative who has worked with Berrios in the past. (Both sources asked to remain anonymous because of their current positions.) The first is by meeting privately with attorneys in his board office to discuss tax appeals. Such meetings would show a blatant disregard for board protocol. “I’m not aware of anything illicit or improper going on in those meetings,” Larry Rogers Jr. told me. “It’s not been my practice to have those meetings. I’ve always felt it was important to avoid the appearance of impropriety.”

The Froehlich scandal last year prompted concerns that some people had inappropriate access to the nonpublic areas of the board’s offices in the Cook County Building, and since May 2009 the board has required visitors to sign in. Chicago and the BGA used a Freedom of Information Act request to obtain copies of those visitor logs, which reveal Berrios has regularly met in his private office at the board with lawyers—at least 30 by our count, many of them repeat visitors—and he was the only commissioner to do so. (He strongly objected to the sign-in policy but was overruled by the other two commissioners, according to transcripts of a board investigation into the Froehlich matter.)

Berrios scoffs at insinuations of backroom dealing with attorneys. “I have an open-door policy—I’ll meet with anyone,” he tells me. “We’re there to serve the public, whether they’re attorneys or they’re homeowners. That’s our job.”

The Chicago/BGA investigation also found that at least five attorneys and a property tax appeals consultant who visited Berrios at his county building office made contributions to him on the same day as or within a few days of the meeting. The lawyer Arnold Siegel, for example, has met with Berrios nine times since May 2009. State records show that after two of Siegel’s visits, Berrios’s campaign recorded contributions from him for $2,000 and $1,000, respectively.

Berrios has also met in his office with Robert Martwick and his son, Robert Jr. The elder Martwick is a property tax lawyer who doubles as the Democratic committeeman of Norwood Park Township and serves as secretary of the Cook County Democratic Party. The son is also a tax appeals attorney and an elected trustee in the Village of Norridge who runs a political consulting firm that has done work for Berrios. The Martwicks have met with Berrios, separately and together, 17 times, and on three occasions father or son quickly followed up with donations of $1,000, $200, and $3,000. Dean Katsaros, a tax consultant, met with Berrios 19 times, twice giving him contributions almost immediately afterward totaling $3,500.

Berrios calls the timing of the contributions a “total coincidence.” (Siegel, the Martwicks, and Katsaros did not respond to repeated requests for comment.)

The board’s outreach programs also enable Berrios to avoid the usual checks and balances. The three commissioners (or certain staff members) regularly travel around their election districts and make presentations to community groups on how to appeal their property taxes—a way for the commissioners to reach out to property owners who (presumably) vote. Homeowners and business owners attending these outreaches can fill out appeals forms and submit their own evidence for why they deserve an assessment reduction. (Business owners must file through an attorney.)

Typically, each commissioner sets up his own outreaches, and his staff analyzes the cases before they are signed off on by another commissioner’s staffer. The board insider says that Berrios has arranged to have favored cases placed among the outreach cases, assuring that his office will have control over the outcome. “If a file is labeled ‘outreach,’ it always goes to the staff that brings it in,” says the insider. “Like anything else, it can certainly be abused and used to funnel files from friends and contributors, or whatever.”

“If that’s true, that’s a huge potential problem,” said Rogers when I asked him about the allegation. “Our staff—we are stringent about no files being added to outreach. If it wasn’t part of an outreach, it shouldn’t be part of the outreach files.”

Berrios calls the claim that he or members of his staff misuse the outreach process “absolute bull.” He adds, “Again, everything is set up so that no one commissioner can make a decision on any case whatsoever.”

* * *

Photograph: Chicago Tribune photo by Charles Osgood

Inside Berrios’s world: Hefty campaign donations from tax attorneys have raised conflict issuesThe oldest of seven children born to Puerto Rican natives, young Joe Berrios got his start in politics after his family moved from Cabrini-Green to Humboldt Park. As a teenager, he worked precincts for the alderman Thomas Keane’s powerful 31st Ward political organization. Back then, Hispanic immigrants were rapidly altering the landscape of the Northwest Side, and Keane was looking for more Latino faces for his political crew. After Keane was convicted of fraud and conspiracy in 1974 and forced out of office, Berrios, a loyal Democratic machine soldier, continued to climb up the ward ladder.

In 1980, Berrios, who has an accounting degree from the University of Illinois at Chicago, got a patronage job as an accountant at the Board of Review—then a sleepy backwater called the Cook County Board of (tax) Appeals. In 1982, he was elected to the Illinois Statehouse but continued to work for the board.

Related:

CURIOUS DEALS »

Board of Review probe centers on Joe Berrios’s office

THE FRIENDLY BAR »

Cook County campaign contribution limits to Board of Review commissioners

are not being enforced

JOE’S TIME, OUR DIME? »

Is Joe Berrios conducting political and personal business on government time?

BOARD OF REVIEW DOCUMENTS »

Confidential transcripts from the board’s investigation

After the ward boss who succeeded Keane was convicted on extortion charges in 1987, Berrios became the new boss, a post he still holds. A year later, he left the state legislature to run successfully for commissioner on the Board of Review. He’s been there ever since, today earning $100,000 for the part-time job.

In his other career, as a lobbyist in Springfield, he won an astonishing victory last spring for one of his clients, the Illinois Coin Machine Operators Association, when the state legislature voted to permit video poker in bars, restaurants, and truck stops across the state. The measure swept through the Madigan-dominated house, 86–30 (and one “present” vote), with little prior warning and no public hearings. Madigan and Berrios denied any backroom horse-trading, both insisting that the legislation had nothing to do with either their close political ties or their side business dealings before the tax appeals board. Others were skeptical. It must have been, as Greg Hinz, the political columnist for Crain’s Chicago Business, wrote with oozing sarcasm, “another one of those remarkable Springfield coincidences.”

People who know Berrios say he has always had his eye on another prize: the assessor’s office. In the machine hierarchy, the assessor’s office traditionally has been one of the plummest of the plum political jobs—a bastion for patronage and big campaign donations. In fact, Thomas Hynes, the assessor from 1978 to 1997, gave up the state senate presidency for the lower-profile job, which is currently held by the Democrat James Houlihan, who isn’t running for reelection.

Flush with campaign money and backed by party regulars, Berrios seemed a shoo-in for the assessor’s job. He announced his candidacy in August 2009 without much fanfare—actually in a press release put out on the same day he underwent gastric band surgery. But the race was not a cakewalk. In a three-way primary contest last February against two lesser-known opponents, Berrios squeaked by with 40 percent of the vote. Soon after, Forrest Claypool, the reform-minded county board commissioner, entered the assessor’s race as an independent against Berrios and the token candidates for the Republicans (Sharon Strobeck-Eckersall) and the Green Party (Robert Grota). The election will be held on November 2nd.

In the primary, Berrios tried to claim the mantle of reformer, promising to “clarify, demystify, and simplify” aspects of the county’s tax system. Yet during his time as a commissioner, he has regularly fought efforts to move the board out of the Paleolithic era—for example, he long resisted computer-assisted techniques, which can result in bringing more transparency and accuracy to the process. To this day, commercial appeals are still calculated manually, with pencils and paper. A few years ago, he even opposed the passage of a county board ordinance requiring the Board of Review to post its rulings on the Internet. “He fought it to the bitter end,” recalls Mike Quigley, the North Side congressman who sponsored the ordinance back when he served on the county board. (The measure passed, and all Cook County tax appeal results are now listed online.)

In making his case to be elected assessor, Berrios cites his vast experience working on property tax issues. By comparison, he points out, his leading opponent in the race, Claypool, worked at the county’s tax appeals board for only a short time during the early 1980s. “I know what I’m doing, and Forrest [Claypool] does not,” he says. “Five months’ experience at the Board of Review doesn’t give him the knowledge and the ability to work in the assessor’s office.”

The newspapers have been harsh on Berrios’s run for the job. The Tribune said his slating by the county’s Democrats was a “miserable mistake.” The Sun-Times called his candidacy a “tragedy.” Some Board of Review observers worry that if Berrios wins in November, he’ll become even more emboldened to play politics with the property tax system. Unlike with the board’s built-in system of checks and balances, such as they are, the assessor acts largely on his own. As the current board insider puts it, “Nobody will be watching Joe.”

Illustration: Jay Taylor