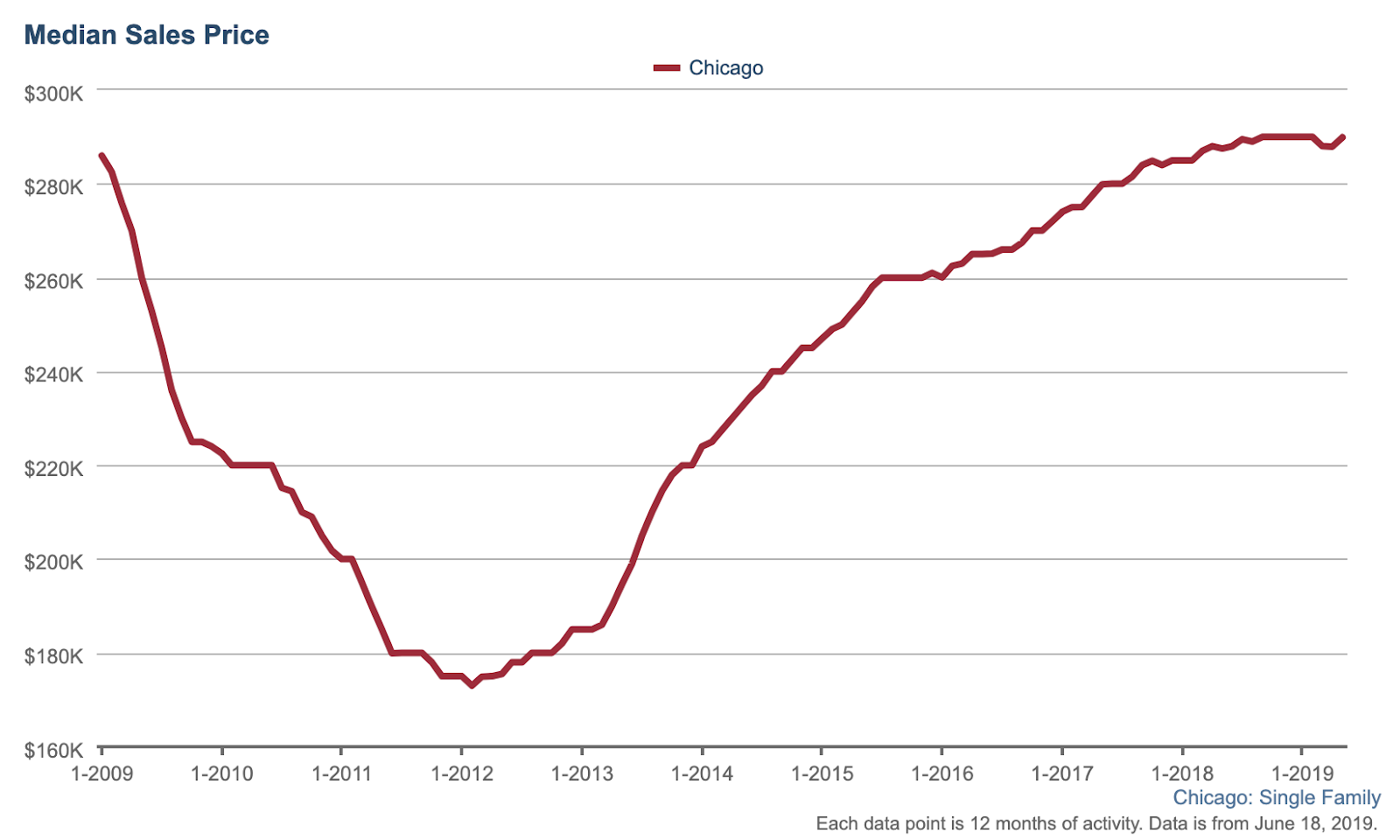

For home sellers, the good times keep on rolling. Despite fears of a looming international trade war and a brutally cold winter, a report from brokerage RE/MAX indicates that overall home prices remain high throughout much of the Chicago metro area.

However, there's been one significant change in buyers’ favor: Inventory is on an upward trend, providing more options to shoppers while also creating competition for sellers. Additionally, mortgage rates continue to hover near historic lows (around 4 percent on a traditional 30-year mortgage), providing further incentive for buyers to take the plunge into homeownership.

Including all closed residential transactions, RE/MAX’s latest figures show that sales are down compared to the same period last year in Cook, Kane, Lake, McHenry, and DeKalb counties. Meanwhile, Kendall and Grundy counties — which have a much lower volume than other Chicago metro area counties — are up.

Prices continue to rise, however: In May 2019, the median sale price in Cook County was $270,000, a nearly 4 percent gain from last May’s $260,000 median sale price. DuPage County maintains the highest median sale price at $292,250, up from $285,000 this time last year.

According to Paul Wells, an agent at RE/MAX of Barrington, roughly 43,000 homes are listed on the market right now — though the true inventory may be closer to only 28,000, as the remainder are either pending sale or temporarily off-market. But the figure is still higher than the 41,000 properties listed during the same period last year.

What do these numbers mean for the health of the Chicago area market, and what can we expect going forward? According to Wells, like last year, mid-range housing (roughly around the $500,000 price point) is becoming increasingly competitive while inventory of high-end homes ($1 million or more) continues to pile up. However, fire sale prices on large houses that have languished on the market for months — or, in some cases, years — are finally starting to lure buyers.

“We’re seeing activity because prices have come down so much that people see [upscale homes] as good values,” Wells says of the trend. “Granted, those higher values come with higher taxes and more maintenance, but you’re getting a lot of bang for your buck in sheer size.”

Ultimately, though, Wells still finds that overall condition and listing presentation make or break a home sale. Buyers overwhelmingly choose homes with updates and improvements versus a fixer-upper.

“I’ve never seen condition have as high of a factor on price [before this year],” Wells says. “People want something that’s ready to go. Economically, there’s some sense in that, because you’re financing the improvements someone else has made.”

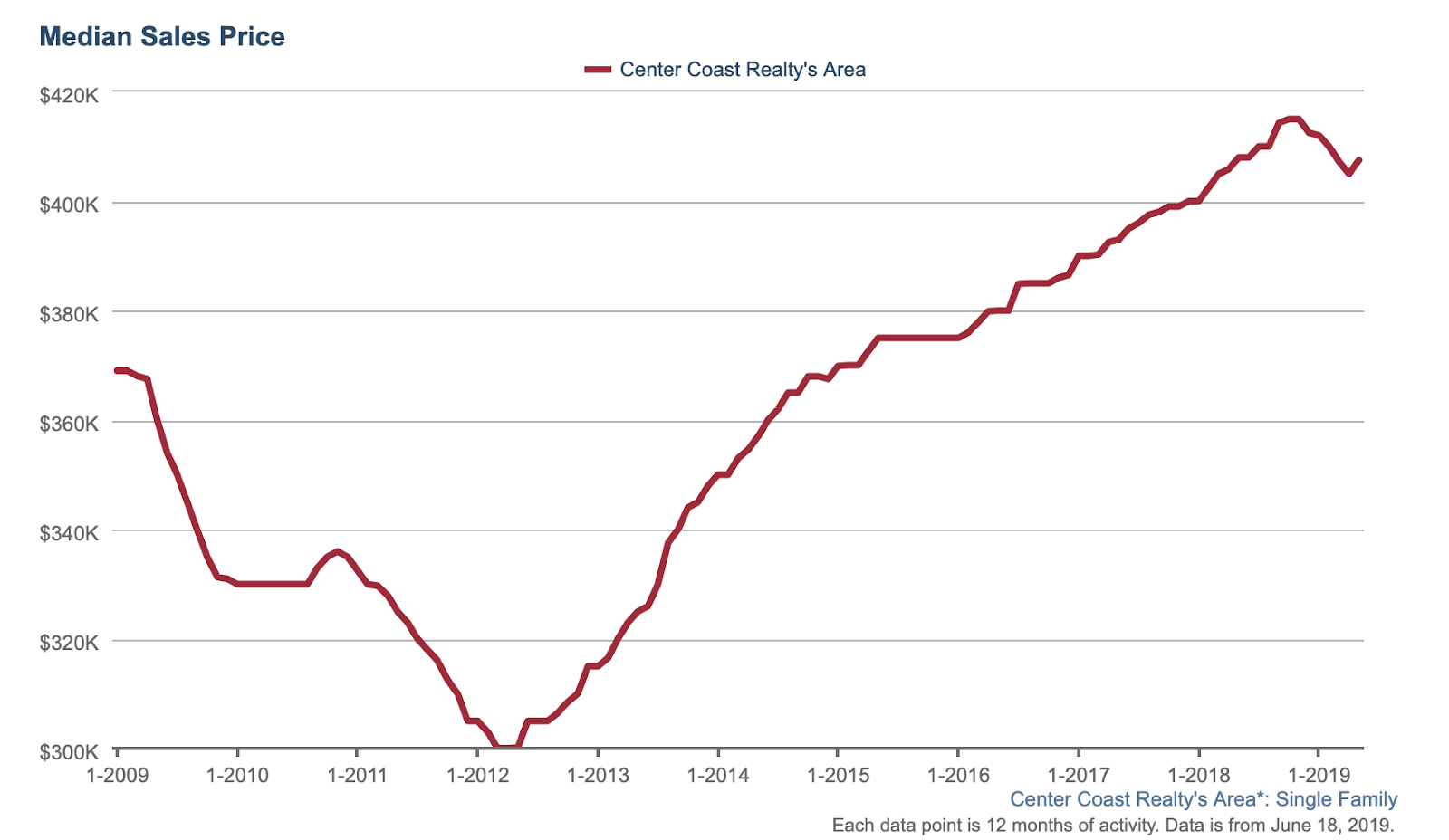

Narrowing the focus to just Chicago’s downtown and North Side neighborhoods paints a slightly different story: The median sale price began to slide late last year and continued to do so for six straight months until April, says Mike McElroy, founder and managing broker of Center Coast Realty.

“I haven’t seen [the median sale price] go down that many months in a row since 2011,” McElory says of the market slip. “In previous years, … if it were a good listing, there’d be a few offers on it [immediately]. Now, you might see a great opportunity and have time [to buy].”

McElroy claims it hasn’t been this good to be a buyer in years, citing not only slipping prices in hot North Side and downtown markets but also increased inventory, which is up nearly 5 percent year over year. The trend signals stability, or, in McElroy's words, “more balance” in the housing market. It ought to provide a much-needed confidence boost to buyers discouraged by the bidding wars of recent years.

This leads us to the age-old question: Do buyers continue to wait things out in hopes of even better conditions, or just go for it while interest rates are still low?

Of course, the answer is entirely dependent on the needs of each individual, but McElroy offers some advice. “If you’re a cash buyer making investments, you may want to wait a little bit. But if you’re a buyer looking to live in a home, buy it when it makes sense for you.”