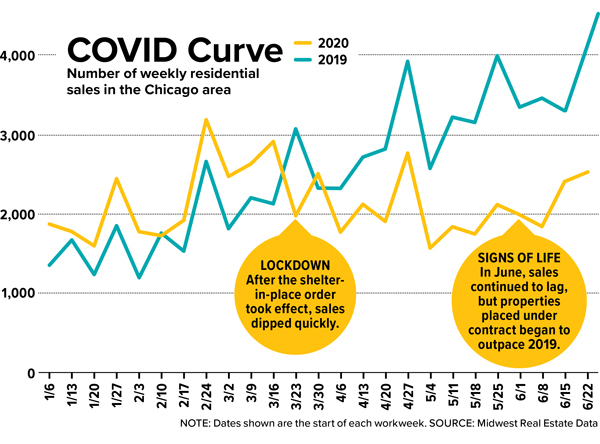

If you went into this year planning to buy or sell a home, COVID-19 likely made you question taking such a big step. The pandemic all but froze the real estate market through May. But now activity is picking back up. The Lowe Group — a part of Compass that operates within the city’s priciest community area, the Near North Side — is on track to match last year’s sales, $268 million, the highest among agent teams in the Chicago area. The Dawn McKenna Group — a part of Coldwell Banker that works mostly outside of the city limits, from the North Shore to the west suburbs — had the second-highest team sales in the Chicago area in 2019, $201 million, and is expecting its best year ever. We spoke to the principals of these groups, Jeff Lowe and Dawn McKenna, in mid-June about how the local market has weathered the pandemic, the outlook for the coming months, and what all this means for buyers and sellers.

What direct impact has COVID-19 had on your business?

Lowe: We came into 2020 with the most pending sales we’ve ever had, but we lost three out of 24 just because of COVID-19 — people getting nervous or not getting their mortgages. As April went on, people became a little bit more comfortable getting out and looking at homes. And there is a lot of pent-up demand because we typically list most of our homes in March and April. So May was crazy with inventory coming on the market.

McKenna: We didn’t take any listings off the market. We weren’t running around having open houses, doing things that were irresponsible, but we definitely put our foot on the gas when it came to prep and doing virtual tours. I sold probably eight homes myself; one was for $4 million.

How would you assess the current state of the market?

Lowe: The big concern right now is the quantity of job loss. We still have major hurdles to overcome, but I think people are less concerned that the economy is going to take a huge nosedive right this moment, especially compared to ’08–’09. A lot of families are feeling like their kids are homeschooling all day and need to be able to get outside and get rid of some energy. So larger houses in the city with some outdoor space, those are at a huge premium right now. I think that’s helping the suburban market a bit.

Do you think the pandemic is sparking an exodus out of the city to the suburbs?

McKenna: We’re seeing that if you have a couple of kids and were thinking about moving to the suburbs in two to three years, that is definitely accelerating. I don’t think we have enough data to predict a mass exodus out of the city.

Lowe: At this moment, the secondary-home market, especially if it’s driving distance from the city, is on fire. In Michigan, Indiana, and Wisconsin. Anybody leaning more toward the city, they’re just kind of hanging in there to see what happens.

Is this a buyer’s or seller’s market?

Lowe: It really depends on the subset of the market. Single-family homes between, say, $900,000 and $1.5 million? Right now, there’s a huge supply of buyers in that range. In March and April, a lot of buyers that had liquidity and weren’t super worried about the market were definitely out there looking for COVID-19 pricing. And the sellers weren’t willing to give it yet because they just weren’t sure that things weren’t going to turn back to normal. So we were getting just some ridiculously bad offers, especially in April.

What’s the best advice you could give to someone interested in selling right now?

Lowe: You really have to be analytical on your pricing. I tell my sellers: “The buyer coming in to look at your house is sophisticated enough that if they like it enough to make an offer, I have to be able to explain how we came to our pricing.” With the markets going like this, you can add 5 percent to a price and kind of see how the market reacts, but you have to be fine-tuned.

How have the near-record-low mortgage rates influenced what buyers are doing?

McKenna: If you have money at one of the big banks, you can almost consistently get a 2.5 percent rate. We’re seeing very few cash offers.

Lowe: Rates have been low for some time. So the huge refinance market we saw late last year has already come and gone. People almost take great interest rates for granted. At some point, those rates will start inching back up. And that always creates a new buyer pool, too, because people feel like they don’t want to miss out on the great rate they could get today.

Do you see the pandemic affecting the market long term, or is it more of a blip?

McKenna: I am very bullish on the market. I think that we are going to end the year very strong. Right now, I am $40 million from what I did all of last year.

Lowe: I see it as a blip. Going under the assumption that the majority of people would be going back to offices in 12 to 18 months, people will still want to be in urban environments. If the COVID-19 numbers here continue to decline, 12 months from now, the world looks a lot more like it did four months ago. I certainly hope I’m right.