You’ve been CEO of the Milwaukee supermarket company Roundy’s since 2002. Why did you decide to open Mariano’s supermarket?

We made the conclusion in 2007 [that] we wanted to expand into Chicago. There was really no one standing out to provide a full range of food shopping. Whole Foods had [high-quality] perishables, and that’s where people went to get stuff as fresh as they could. People went to stock up on toilet paper and paper towels at Costco. They went to Dominick’s or Jewel as a convenience store. So we wanted to combine a few of those trips to save the customers time, so they could get all their specialty food and organic [food], yet they could [also] get Heinz ketchup and Coca-Cola.

As a former CEO of Dominick’s, you know Chicago well. Do you still live here?

Yes [with his wife, Nina, in the northwest suburbs]. I spend two days a week in the Chicago-area stores and three days in Wisconsin.

Late last year Safeway announced it was shuttering all 72 Dominick’s stores in Chicago. Your reaction?

I was surprised, personally, that they exited altogether. I thought they might [just] close a couple stores. Honestly, I had thought that subsequent to the change in leadership [CEO Robert Edwards joined Safeway in April], they’d reengage. They have all the resources in the world. They have the right size to do whatever they choose to do. But I guess strategically that company is going in a different direction.

You recently bought 11 of the old Dominick’s locations to convert them to Mariano’s. How did you decide which locations to buy?

[Choosing any location is] first based on the sheer number of people in the area and the amount of purchasing power of those people. We’ve refined it further to look at what we call the daytime population—who’s working, what offices, what types of industry around the location.

Add those to your 13 current locations, plus five more under construction, and you get 29. Three years ago you predicted Mariano’s could handle only about 30 Chicago-area stores. Last month you revised that to 50. Why?

I think we always just tempered our expectations. We’ve always thought that there’s room for 50. Now we’ve just said it publicly.

Mariano’s is known for its prepared foods and in-store dining. How did you get the idea for those?

When I left [Dominick’s in 1998], I worked for a while to try to put a European food hall at the corner of Randolph and State, because Mayor Daley wanted it. In doing the homework for that, I traveled all over Europe, looking at food halls, food stores, and I got a lot of great ideas. Buying and eating food [in the same place] is very normal there. So if I didn’t have that experience, I’m not sure [Mariano’s] would be all that it is.

How’s the eating-in-the-store thing going?

[I was surprised by] the amount of food people will sit down and consume inside the store. [Our revenues from] total perishables [including in-store dining] are 50 percent. [In most supermarkets] it’s 30 to 35 percent. [The typical Mariano’s store makes $1 million a week in revenue.]

Did anything else surprise you about Mariano’s shoppers?

I didn’t realize the level of dissatisfaction [they] had with their [supermarket] choices. I knew they weren’t satisfied, but the intensity—it was almost like Jewel had broken a bond with them. I think it refreshed in my mind the notion that food retail is extremely neighborhood oriented. People look at these stores as theirs. And you better take care of my store. It’s very personal.

Do people shop differently now?

I think today people try to decide, What am I going to eat today? They’re not making lists [anymore]. We’re trying to plug in to today’s customers—where those millennials are, what are they looking for—and cater to their lifestyle and their food needs.

So millennials are your key demographic?

We see a broad range of shoppers. The reason I call out millennials is that they are the early movers. There’s a very economical lunch you could eat here. Soup and a sandwich, salad, which costs about $8. And you make it yourself, you manage how much of each item. There are a lot of choices.

Mayor Emanuel has pledged to open supermarkets in so-called food deserts. Are you involved with that effort?

We’ve been working [with the mayor’s office] for a long time. We have a store in Jefferson Park, which, believe it or not, was a partial food desert for a long time. We’re working on a [Bronzeville] location at 39th and Martin Luther King Drive. [But] Jewel, Whole Foods, independent stores—we all do business in the city. Each needs to step up.

What’s the status of the Bronzeville store?

Because it’s [on Chicago Housing Authority land], there are things that CHA and the city have to do to free the site up. I hope that by this time next year we’re through the regulatory phase and ready to start. We had an architectural competition with four minority-owned architecture firms, because this is a very special location. We wanted the building to be reflective and respectful of the existing architecture.

Why did you name the store after yourself?

The research [we did] suggested that a surname would play well in Chicago, because the city is neighborhood oriented. [That’s how] Mariano’s was born.

Growth Spurt

Even though Mariano’s operates fewer stores than its competitors. . .

168

Jewel-Osco

20

Trader Joe’s

18

Whole Foods

13

Mariano’s

. . .the number of stores will nearly triple in the next two years. . .

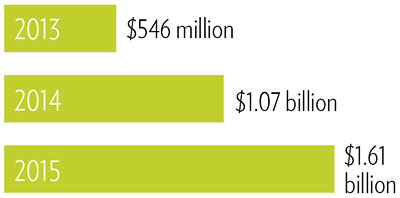

. . . as will the chain’s revenues.