* Over at Gapers Block, Ramsin Canon has two good pieces on the Chicago Infrastructure Trust. Here's the one just after it was passed:

Taking a step back and considering the broad view, this is an astounding progression of events. Over the last twenty five years, Chicago's corporate and political leadership has drained the city of revenue through creation of TIFs as a condition to invest capital in neighborhoods–the whole point of TIFs is that available capital is being withheld until the public provides better incentives for its investment. The billions of dollars diverted into these funds contribute to not only to budget shortfalls but, amazingly, increase taxes on middle class taxpayers, as the school district and other bodies have to raise their tax levy to meet their obligations.

[snip]

The result is a public sector starved of revenue which must then turn to selling off (or "long-term leasing-off") its assets. This in turn, by the way, reduces a city's credit-worthiness even more, making it more difficult to issue bonds in the future and narrowing the city's tax base.

And here's the other. This reminded me of an important point. At yesterday's City Council hearing, the cautionary tale often cited was the sale of the parking meters. The only mention of TIFs I heard came from Ed Burke, who described how they economically reinvigorated downtown. And if you go back to the first TIF, established under the administration of Harold Washington, you could perhaps make that case. They also grew to encompass vast swaths of the city, pooling money into inflexible surpluses, contributing to budget deficits and causing taxes to go up. As Canon writes, this in turn leads to a decline in creditworthiness (as I mentioned yesterday, the bond markets don't like that sort of thing), making things like the Infrastructure Trust more fiscally appealing than they'd otherwise be.

TIFs are also a good precedent in that sense. In the abstract and in some instances, tax increment financing can be a reasonably good idea; even TIF bird-dogger Ben Joravsky has sensibly floated the idea of a TIF for the increasingly decrepit and hazardous old central post office (it's not in a blighted area, but it's basically its own blighted area). Left to cover the city like kudzu, they've contributed to massive structural deficits. When Mick Dumke writes that our ignorance of the Infrastructure Trust vastly outpaces what we know ("we won't know that until they actually sign the deal") he's got a point. It's a tool, which can be used for good or ill, and the most important lesson we've learned from TIF use in Chicago is that its use has to be monitored very, very closely, much closer than TIFs were monitored for decades by anyone but Joravsky. It's hard to push back on the CIT when it's merely a gleam in the mayor's eye attached to a comparatively small infrastructure project, but it can get more traction once the numbers start rolling in (and the dollars start rolling out).

* One criticism of the CIT has been of the usual canard that the entrance of private money brings efficiencies not found in public life. But to play privatization's advocate, I can think of a counter-example to the parking meters: the CTA airport express station under Block 37.

The goal of offering world-class airport express service could lead to the completion of a costly hole in the ground below Block 37 in the heart of the downtown. That's where the city and the CTA have sunk more than $250 million to construct the initial phase of a subway "super station'' that was to have served as the hub for nonstop rail service to O'Hare and Midway Airport.

City Hall and the transit agency mothballed the superstation project in 2008 after cost-overruns and the prospect of spending at least another $100 million to complete the subterranean station and a connector tunnel linking the State Street and Dearborn Street subways.

So the city got hundreds of millions of dollars into the project, hit a wall when the city and state ran out of money, and was left with what's so far been a total loss.

As a cheapskate, the idea of a slightly faster, much more expensive alternative to the Blue Line from O'Hare seemed totally weird. But the private, conceptually identical Heathrow Express (in England, which as a country has vastly more experience with public-private partnerships) has done well—lots of business passengers means lots of expensed rides. Had the city sought to back the CTA express with private finance from the get-go, perhaps it would have been completed, or not started in the first place because of its impossibility with given infrastructure. Boondoggles like this make the case for PPPs more appealing, at least in concept.

* Another problem floated, this one by Mark Brown in the Sun-Times, is fee and fare hikes:

I asked [Joe] Moore after the vote how he expected the Trust might pay back such an investment if private funding were used to fund CTA improvements.

At first, he demurred, saying he “just threw that out” as an example his constituents could understand, but when I pressed, he offered: “Potentially, you could pay for it through the fare box.”

Meaning a fare increase?

“Possibly,” Moore said.

Probably, Brown contends. Because that's how it's done now:

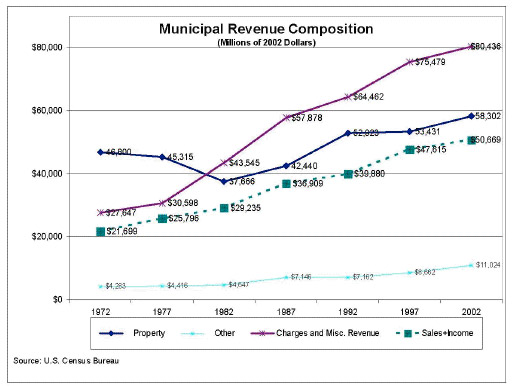

That graph is from Michael Pagano and David Perry's well-titled paper "Financing Infrastructure in the 21st Century City: 'How Did I Get Stuck Holding the Bag?'" It notes that "charges and misc. revenue" grew from 18.5 percent of revenue in 1972 to 40 percent of revenue in 2002, most of that replacing a decline in reliance on property taxes. Charges, fees, and such fed revenue bonds, which grew as the federal government pulled back its investment in infrastructure:

While federal funding of infrastructure increased substantially during the 1950s to the 1970s, when it started declining in the late 1970s the cities again turned increasingly to public authorities and to revenue bonds. The share of revenue bonds in the tax-exempt securities market increased from 34 percent in 1970 to 71 percent in 1980. The share of tax-exempt securities issued by public authorities, as compared to general purpose governments, jumped from 31 percent in 1970 to 54 percent in 1979. The dominance of revenue bonds and public authorities continued, such that in New York State local governments and local public authorities each had a nearly equivalent level of debt outstanding in 1999, with $14.3 billion and $14.1 billion, respectively.

And this changed the way cities approach the concept of governance:

After the Tax Revolt of the late 1970s, governments furiously searched for services that could be apportioned to consumers and charged a fee, thus protecting their embattled general tax revenue for more ‘public’ services. The increased use of governmental prices or charges has been associated with a growing interest in how the governmental sector can contribute to greater economic efficiency, defined as supplying goods and services in conformity with the preferences of the community.

[snip]

Over time, the increasing use of fees and charges as market-like pricing mechanisms affected the way government officials understood the behavior of citizens as consumers of public services. Increasingly, citizens have been described as customers. Cities are willingly employing appropriate technology to monitor customers’ consumption of units of public services.

In some ways, the CIT is radical; in others, it's the logical next step.

* Speaking of fees and public governance (emphasis mine):

Struggling with a budget deficit in 2004, the City of Chicago looked for ways to maximize its assets, including the Chicago Skyway, a 7.8-mile toll road connecting Interstate 94 to Interstate 90. During the 47 years the city’s Department of Streets and Sanitation managed the Skyway, toll changes were infrequent, with tolls even decreasing by approximately 25 percent in real terms between 1989 and 2004.

This was part of the logic behind the parking meter deal. No one wants fees to go up; pols don't want to raise fees; so we brought in someone to be the bad guy. And it's not just a state and local problem:

At one time the gas tax was largely sufficient as a funding source, but its buying power has plummeted over the past decade, and it hasn’t been raised since 1993 when it went from 14.1 cents a gallon to the current 18.4 cents. Adjusted for inflation, that makes the current tax equivalent to just 12.4 cents a gallon in 1993 dollars. Proponents of increasing the gas tax point to the fact that Belgium, France, Germany, Italy, Netherlands, and United Kingdom have instituted gas taxes that are on average ten times higher than they are in America! But the U.S. Department of Transportation has been actively opposed. “A substantial increase in the nation’s gas tax is ill-advised,” wrote Secretary of Transportation Mary Peters in a Washington Post editorial last summer, “Of far greater promise than traditional gas taxes is direct pricing of road uses similar to how people pay for other utilities.”

Granted, we're operating in a period of ever-increasing gas prices, that are likely to continue increasing as long as the developing world keeps developing. Nonetheless, as inflation erodes national infrastructure financing, momentum moves to state and local infrastructure projects financed by direct pricing, or something closer to direct pricing. Someone has to keep up with inflation, so fees increase. And privatization is a tempting outlet valve for that political pressure.

Photograph: davidwilson1949 (CC by 2.0)