One thing I've been puzzling over with regards to the infrastructure trust—which easily passed City Council—isn't so much about transparency/oversight issues, which have been well covered, it's about the superiority of it over the municipal bond market and the usual means of financing.

Over a five-year period, former Chicago Mayor Richard M. Daley leased thousands of parking meters, a toll highway and city-owned garages to raise $3.45 billion. Since leasing the meters in December 2008, Chicago has seen its relative borrowing costs balloon 12 times over.

That's from a recent Bloomberg piece on "one-shots": governments selling assets, or drawing substantially down on reserves, to fill in budget deficits rather than fixing the structural flaws that led to the deficit in the first place. Like the parking meters, for example. Credit markets, paradoxically or not, look askance at that sort of thing:

One month after Chicago leased the meters, the city sold tax-exempt general-obligation bonds with a 20-year segment priced to yield 4.89 percent, according to data compiled by Bloomberg. That was seven basis points, or 0.07 percentage point, more than top-rated debt with similar maturities, according to a Bloomberg Fair Value index.

In its most recent issue in November, Chicago sold 20-year debt at 4.75 percent, or 86 basis points over the index.

So the sale of the parking meters hurt the city's borrowing abilities twice over: by sending the "one shot" message, and by eliminating an ongoing revenue stream. Raising borrowing prices makes the savings on municipal bonds less attractive.

And the city's worse off than Illinois on average:

Illinois state- and local-government bonds yield about 3.72 percent on average for 10-year maturities, or 1.66 percentage points more than AAA debt, data compiled by Bloomberg show. The gap is more than double the average since 2007. The extra yield for issuers from California, with a lower Standard & Poor’s credit grade, is within 0.05 percentage point of the average. The two have the lowest credit marks among states.

* Maintenance and improvement of public assets is boring, at least compared to building new ones, so it gets neglected:

Maintaining and repairing already-built bridges, roads, prisons, parks, office buildings, levees, and a host of other fixed assets are often relegated to political backburners for a number of reasons. One reason is that the effects of inadequate maintenance in any one year are not readily apparent.

* The privatization of political will: the parking meters were, in a sense, a tax on our inability to meet market rates:

The core of [Mayor Daley's] privatization argument was that Chicago lacked the political will to raise meter rates and that desperate fiscal times demanded unlocking the value of public parking. He noted that city meters were only generating about $20 million a year, and because of neighborhood resistance, meter prices hadn't gone up in 20 years. His conclusion was that Chicago had to outsource the political will to raise meter rates.

* Low federal taxes, declining federal infrastructure support, and Illinois's perilous fiscal state is squeezing the city:

Faced with dwindling state and federal resources and strapped for bonding capacity to meet its infrastructure needs without raising taxes, city officials said the program offers an alternative to the traditional model of financing public works.

* Forcing infrastructure financing into a more logical form:

Similarly, federal, state, and local infrastructure planning needs to rely on standardized cost-benefit analysis tools so scarce public funds are invested in projects with the greatest public return. The illogical formula-based distribution of federal funds is often replicated at the state and local levels where funds are spread around so that most localities get a small bit of funding rather than making an objective decision on how best to spend the funds to meet the most compelling need for repair, congestion mitigation, or traveling efficiency.

Skeptics of the infrastructure trust can take some solace in the fact that, to begin with, the only set-in-stone privately financed infrastructure project is for a comparatively small amount of money, and the actual physical work done won't impact citizens as much as the parking meters did and do. But the flaws the trust is angled as redressing aren't just the privatization failures of the previous mayor; they're also public failures, at all levels of government. Much has been made of the Missile's role in getting it running and through City Council, but it didn't happen in a vacuum.

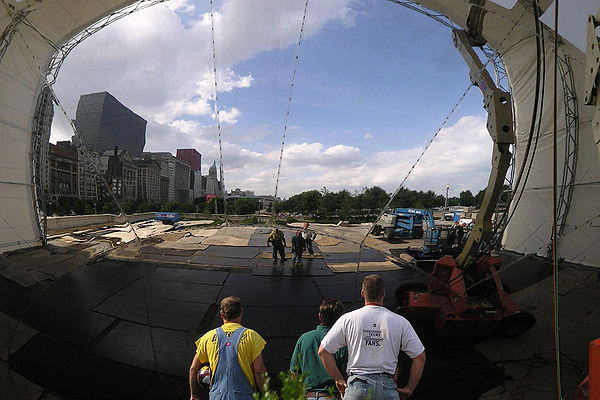

Photograph: tsc_traveler (CC by 2.0)