Photo: Lane Christiansen/Chicago Tribune

Illinois Speaker of the House Michael Madigan will shepherd the state budget through the legislative process.

Members of the Illinois House, back in their home districts this week, have 25 days remaining in the spring session, and a lot on their plates. There’s public pension reform, concealed carry legislation, and a potential gaming expansion.

Last but not least, there's the annual, depressing ritual of crafting a state budget.

Do you have an idea how your tax dollars should be spent? This morning, Crain’s published a nifty app that allows regular citizens to take a shot at balancing Illinois’ FY 2014 General Revenue Fund—that's the hunk of the budget subject to the appropriations process that provides support for education, health care, human services, and public safety. I wrote about the state budget consistently during Gov. Pat Quinn’s first term, and I’ve never seen an interactive tool quite like it. Everyone should check it out.

But before we play Michael Madigan for a day, it might be helpful to refresh our collective memories about where the money in the state budget comes from and what it pays for. The Crain’s site has plenty of data and charts to help with that crucial context, but I’m partial to the work of Manya Khan from Voices for Illinois Children, a top-flight, left-leaning think tank here in Chicago. Last month, Khan published a quick but thorough primer, using data from FY 2012, spelling out in clear detail the building blocks of the state’s general revenue fund.

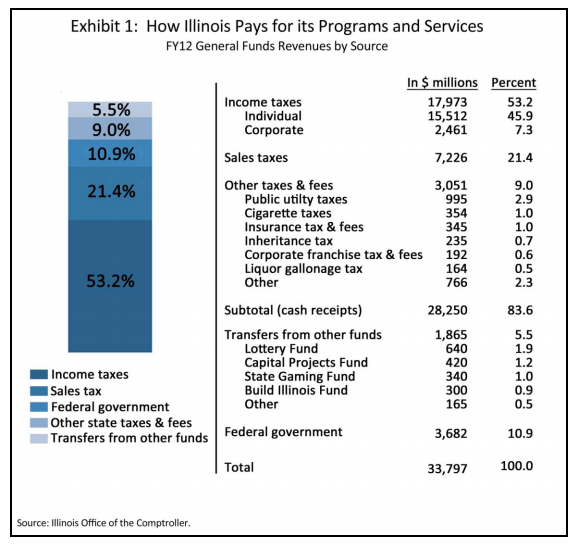

First, here's where the money comes from:

Graphics: voices4kids.org

The Land of Lincoln raised $33.8 billion in 2012, over half of which came via the income tax. The state sales tax only brought in 21 percent of total revenue. (As Whet has pointed out before, Illinois has a fairly high sales tax rate, but it has a narrow base, since consumer services are largely exempt.)

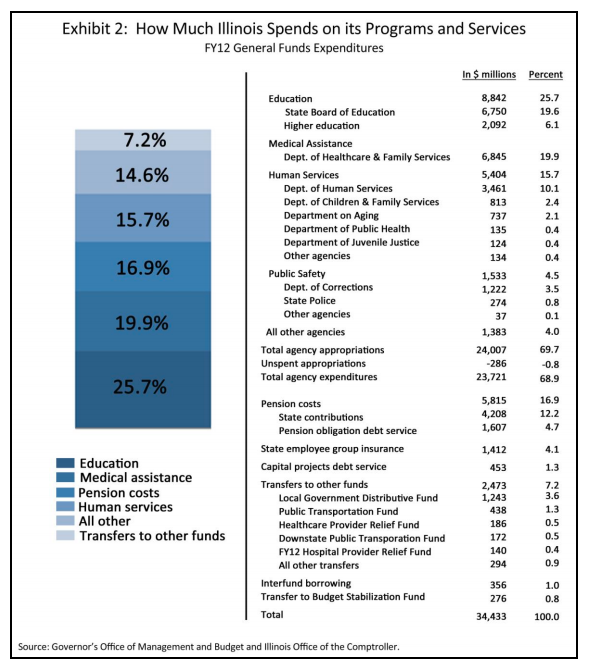

Second, this is what we spend it on:

What does this graph show?

- One quarter of our tax dollars were devoted to education, with two-thirds of that total distributed to more than 860 local districts in the form of General State Aid. (Illinois still relies heavily on property taxes to fund its schools.)

- DHFS—which runs Medicaid, the Children's Health Insurance Program (CHIP), All Kids—takes home about 20 percent. That number will rise over time as more people lose their private insurance, though the federal government is primarily footing the bill, at least for a few years, for the Medicaid expansion mandated by the federal health reform law.

- Contributions to the five state-funded retirement systems sucked up 12 percent of spending.

- In all, our lawmakers spent roughly $600 million more than they took in.

- The state also carried over about $8.5 billion in overdue bills, a number they’ve since trimmed slightly.

Public services have already been trimmed enough for my taste, so on the Crain's tool, I tinkered with the revenue side. (For what it's worth, I was not shy about my preferences a few years ago, and they haven't change dramatically since.)

The math added up on the Doster budget, but I imagine it was a bit easier without a powerful speaker staring me in the face and constituents clamoring at my office door.

Give it a try and see how you do.