In 2009, about the time the American economy had really gone to hell, NPR Planet Money reporter Adam Davidson caused a fuss with a surprisingly contentious interview with Elizabeth Warren. The contentiousness was sure to get attention—Davidson later apologized—but a lot of people zeroed in on one statement from Davidson, one of the best-known financial journalists in America:

I talk to a lot of left, right, center, neutral economists [and] you are the only person I’ve talked to in a year of covering this crisis who has a view that we have two equally acute crises: a financial crisis and a household debt crisis that is equally acute in the same kind of way. I literally don’t know who else I can talk to support that view. I literally don’t know anyone other than you who has that view, and you are the person who went to Congress to oversee it and you are presenting a very, very narrow view to the American people.

Davidson's comment surprised a lot of people because, well, lots of perceptive, well-educated people have a lot of debt—it's almost part and parcel now with becoming well-educated—and, even if they don't have the data at hand, they had a lot of experience suggesting that household debt is problematic. Particularly by 2009—if you'd recently graduated college and bought a house not long before, then you'd done both at peak both. Perhaps you knew people who'd done it, or just ran the numbers on doing it. (His comment didn't age well, as Mike Konczal points out.)

So where did it Davidson's point of view come from? Yesterday I had the chance to ask an actual economist about it, as part of a longer interview coming later.

In the forthcoming book House of Debt, U. of C. economist Amir Sufi and co-author Atif Mian use that Davidson quote in building their thesis (which they're also blogging about regularly in advance of the book): household debt was the really big problem behind the Great Recession. That thesis might seem more familiar now, but in 2009 the rhetoric was much different, and Davidson's charge was more in touch with the short-term mainstream of economics. So I asked Sufi why that was. And he had a worthwhile reminder.

I think we have to remember that economists are subject to what's going on in the financial press as well. Every day on TV you're hearing "financial crisis," "stock market collapsing," "banks are failing," the president is going on TV and saying "if we don't save the banks, than the economy is going to collapse." Even economists are subject to the notion that whatever's acute and right in front of you, you're going to blame for what we're going through.

What we decide to measure is determined by choices that aren't made in a vacuum; neither are the measurements that get the attention.

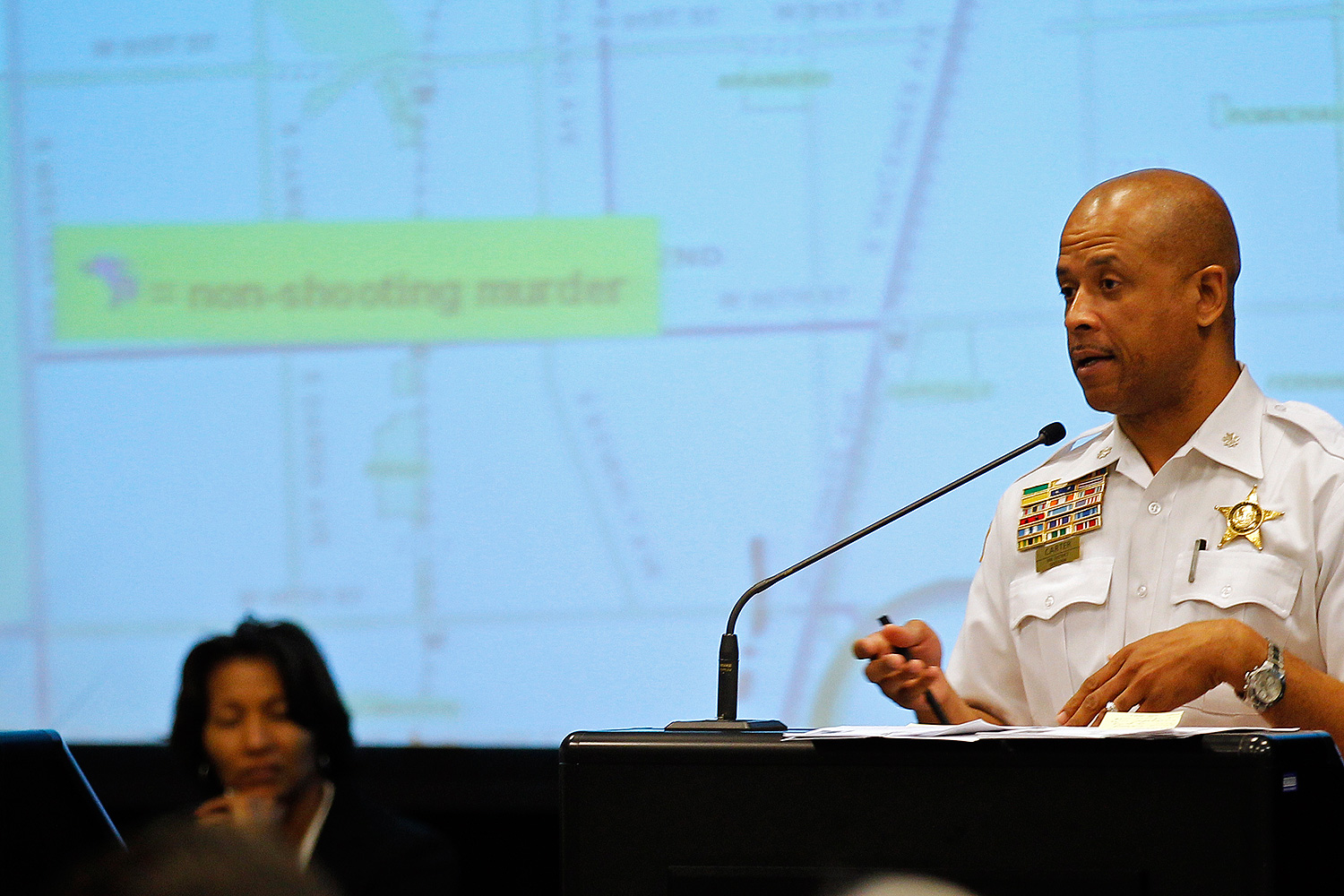

It brought to mind the piece on Chicago crime data by David Bernstein and Noah Isackson that Chicago just published:

But why settle there? According to police insiders, McCarthy and his deputies now hungered to reach a new goal: to keep 2013’s number of homicides below 400, the lowest level since before Americans first landed on the moon. “They wanted to really have the big headline,” says a detective.

Maybe we could switch from a base-10 counting system; that would help with the obsession with big round numbers, at least for awhile.

More broadly, it's indicative of our obsession with homicide statistics, and the pressure put on the police—and almost entirely the police alone—to bring them down. On one hand, homicide deservedly gets the most attention because it's the most irreversable of crimes; on the other, the line between a homicide and a nonfatal gunshot is often an impossibly thin one. A number of crimes that would be homicides aren't, and vice versa, because of a number of factors—the path of a bullet, the physical condition of a victim. The homicide rate is important because it's the most important goal, but there are a lot of numbers behind it that might give better ideas of what's going on, and how to bring the most important number down.

This pressure falls on police, perhaps out of proportion to law enforcement's ability to address the problem. If pedestrian deaths or car crashes spiked in Chicago, the CPD would likely be called to account for it, since they bear responsibility for traffic enforcement. But so would CDOT and IDOT—they create the conditions that protect pedestrians or endanger them.

While the police are critical, the cops versus crime narrative is a narrow one. Today I spoke with Andrew Papachristos—whom I've written about before and will have more shortly—a Yale sociologist from Loyola and the U. of C. who's still studying crime in Chicago, and he touched on this subject.

With the last series of mass shooters, the discussion was about mental health. For a good reason—we don't want crazy people with guns. And that discussion should be had. But the real reason we should be talking about mental health is for what the mental health of, say, mothers does for their family. Even in adverse conditions, even in high-crime communities, high-poverty communities, disadvantaged communities, if the mother of a child is mentally stable and healthy, the child does better. We know this. We know this from clinical trials. We know this from all sorts of things. Yet we never discuss that as a part of safety. Or childhood well-being.

It does happen here and there—safety crops up as part of the discourse around Chicago Public Schools, for instance, or in the cost-benefit-analysis coming out of the U. of C.'s Crime Lab about various educational programs. Which is good, but it's still gaining momentum, and there needs to be more of it. The only thing worse than massaged data is no data at all.