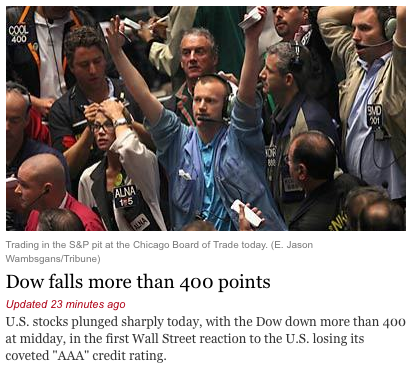

If you glanced at the headlines today, you might think the S&P downgrade sent us on a crash course with oblivion:

But if you read the articles—keep going, down a few paragraphs—the picture is much more complicated:

Investors were leaving little to chance. Despite the downgrade of U.S. debt, Treasury prices rose, pushing yields lower, as investors fled into the relative safety of government-backed debt.

The yield on the benchmark 10-year U.S. Treasury fell to 2.44 percent from 2.56 percent late Friday.

The Wall Street Journal has more in a piece entitled "Treasuries Rally as U.S. Debt Remains Go-To Haven":

"Double-A plus is the de facto triple-A," said James Paulsen, chief investment strategist at Minneapolis-based Wells Capital Management, which manages $342 billion. "There is a lot of fear in the markets right now and Treasurys are still the place to go."

So what’s going on? Barry Ritholtz has three theories, including the idea that the market decided that maybe we’d all gone a little overboard with the bull market and that it’s time to be less optimistic.

Mark Thoma: "that’s much more consistent with a story involving fears of a weak economy than it is fears about default on the debt."

Paul Krugman: "The action in the markets looks nothing like worries about US solvency; it looks exactly like what you expect to see when markets suddenly realize that the economy’s growth prospects look terrible."

Yves Smith: "But as much as the markets were psychologically rattled by the wild card of the US downgrade, the bigger deal is whether the ECB will stem the tide of the liquidity crisis underway in Europe. Yes sports fans, we also have a solvency crisis in place like Greece, but the danger of a liquidity crisis that it will lead a big financial domino to fall over and do a Credit Anstalt to the European banking system."

Dean Baker: "in the wake of the downgrade, interest rates on Treasury bonds have fallen, not risen. While this is likely the result of concerns over the survival of the euro, it indicates that financial markets are not especially concerned over S&P’s downgrade."

So people don’t actually seem too worried about U.S. debt in and of itself, even if only because it seems less risky than almost everything else. More complicated and farther above my pay grade is whether institutions that rely upon ratings agencies’ ratings will do: the "many other nooks and crannies in the financial world in which [it] may take a while to unpick what a downgrade will mean." The Financial Times has been looking at the "ripple effect" today.

I guess the takeaway is: keep an eye out for Treasuries, but make sure to diversify your panic.