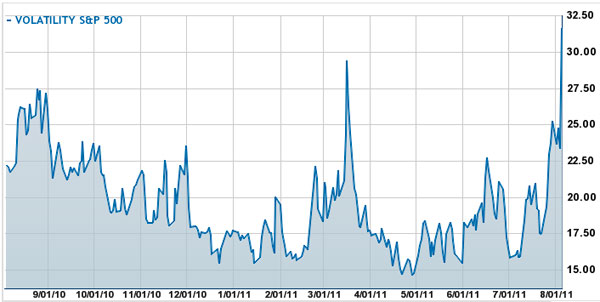

So if you want investor sentiment boiled down to a number, the Chicago Board of Exchange has a handy index called the Market Volatility Index or VIX. Its creator, Robert Whaley, explains:

The VIX has been dubbed the “investor fear gauge.” While volatility technically means unexpected moves up or down, the S&P 500 index option market has become dominated by hedgers who buy index puts when they are concerned about a potential drop in the stock market. Buying insurance is nothing new. People routinely buy fire insurance as a means of insuring their home value in the event of a fire. If the chance of a fire in your neighborhood rises, chances are that your insurance agent will charge more for coverage. The same is true for portfolio insurance. The more investors demand, the higher the price. VIX is an indicator that reflects the price of portfolio insurance.

Earlier this week observers sensed a red wind:

* "We should really hold a mirror up to the VIX’s face to make sure it’s still alive."

* "The VIX: Still Going Nowhere, but Faster"

Today the other shoe dropped:

* "The Chicago Board of Options Exchange on Thursday said its Volatility Index will establish a single-day record in trading volume."

* "VIX Action Shows High Level of Fear Going into Friday"

* "Investors Buying VIX August Calls, Anticipating Continued Surge"

* "Dow dives 500+, VIX soars on world economy fears"

Panic? Not necessarily. The NYT‘s David Leonhardt argues that stocks were overpriced anyway (and still are). And Jonathan Bernstein advises a caution I hear a lot and never seems to happen: "a bad day for the Dow, or even a terrible month for the Dow, doesn’t mean much this far in advance of the election. What you want to look at instead are broad measures of the economy, especially hints of how it’s going to be doing next spring and summer."

Chart: CBOE