* Yesterday, Charles Evans, director of the Chicago Fed, delivered a speech in Hong Kong. But mostly, he was talking to us:

Both public and private sector forecasts see relatively modest rates of growth over the next few years. For example, most recent forecasts by the private sector have 2012 gross domestic product (GDP) growth at less than 2 percent; a pace that may not even be enough to keep up with potential. Growth in 2013 is expected to be only moderately higher. Moreover, both the European debt situation and the looming U.S. fiscal cliff impart substantial downside risks to the forecast.

Even absent any negative shocks, such tepid growth rates would close the large existing resource gaps only very gradually. Indeed, I expect that we will face unemployment well above sustainable levels for some time to come.

* Evans has a couple ideas for how to combat this, or at least not make it worse, such as making money cheap until unemployment falls under seven percent or inflation breaks three percent. But playing defense isn't going to make anyone happy, and it's made the Trib editorial page cranky today:

From bad weather to geopolitical events, surprises periodically roil the markets. That's normal. What's abnormal (but, unfortunately, evolving toward a new norm) is the inability of policymakers to act. Their failure makes matters much worse.

[snip]

In the past, it would have been safe to assume that Washington would act to soften the blow. After the election, Congress and the president would forge a compromise that muted the short-term economic damage.

It's frustrating, but "safe to assume" seems to point to some wonderful past that doesn't exist. First, as Evans writes, the nature of the crisis made a stagnant recovery more likely:

The detailed analysis by Carmen Reinhart and Kenneth Rogoff (2009) concludes that recessions caused by financial crises generally are severe and are followed by anemic recoveries. By any yardstick, this certainly describes the U.S. recovery to date: Output growth has averaged only 2-1/4 percent annually, and resource gaps remain huge.

Second, as I wrote last week, financial crises polarize the electorate, because they pit creditors (who tend to win during financial crises) against debtors (who tend to lose). Comparing the financial crisis to "bad weather" misses a lot of important details. It's fine but not terribly useful to rail at Congress for not doing something, as a good craftsman never blames his tools. Congressmen are somewhat more sentient than a bag of hammers, but they're ultimately tools of the electorate. "America is waiting." For whom?

* Michael Roberts argues that the drought really won't effect food prices in America much, but it will hurt poor countries: "commodities are a tiny share of retail prices in developed economies. Prices of most everything, including food, is made up primarily of labor and capital costs, plus rents to producers and retailers with market power."

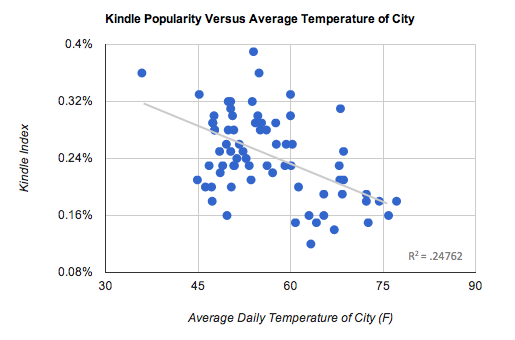

* What cities are the most e-book literate? Chicago's in the middle, not a great showing given our climate: "We couldn’t help but notice that the Kindle was least popular in places with the best weather. Perhaps people are off surfing and climbing trees instead of reading books?" It's not a perfect correlation, but it's noticable:

It seems obvious enough to me, as it should to anyone who's ever needed to get their hands on a book in Chicago, in January.