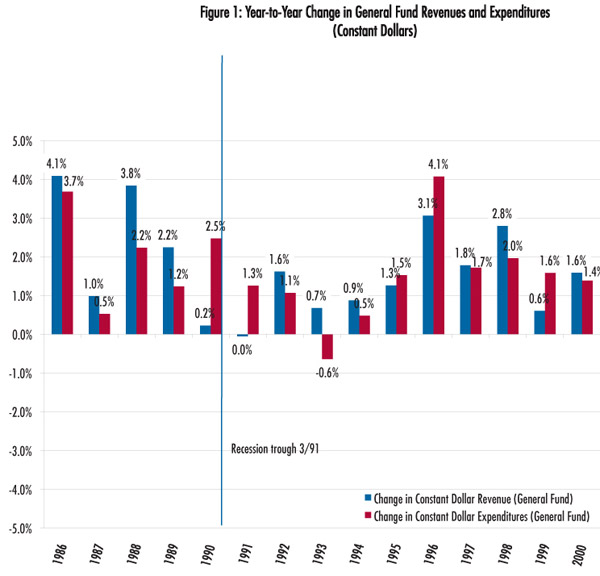

Via UIC's Michael Pagano, a graph from the National League of Cities that really surprised me. Here are city revenues and expenditures from the 1980s and 1990s, in inflation-adjusted dollars.

A mixed bag, but revenues are increasing. Now, the 2000s and 2010s:

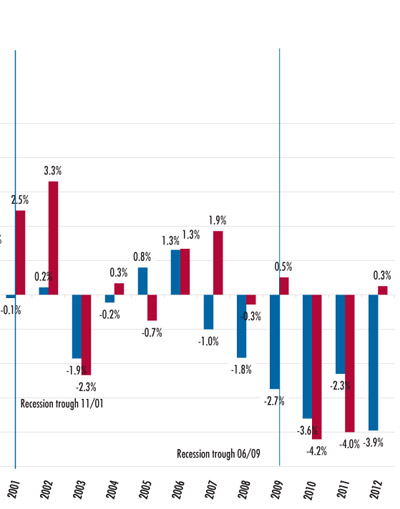

That's a decrease in revenues in nine out of twelve years. Here's a look at how revenues changed over that time (again, constant dollars):

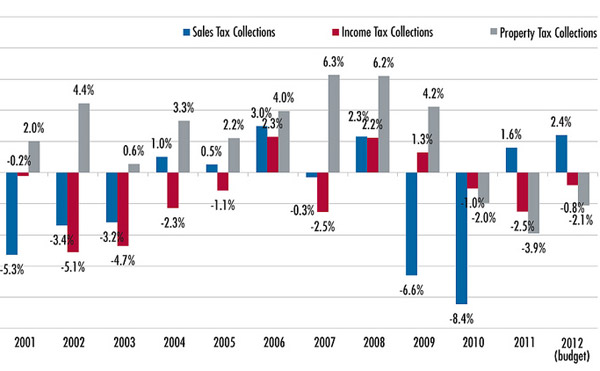

Property tax revenues increased every year up until the Great Recession hit (really, until a couple years after it did). The real culprit's income and sales taxes:

City income tax receipts have been fairly flat, or have declined, for most of the past decade in constant dollars. Local income tax revenues are driven primarily by income and wages (not by capital gains). The lack of growth in these revenues suggests that economic recovery following the 2001 recession was, as many economists have noted, characterized by a lack of growth in jobs, salaries and wages.

The other day, Greg Hinz noted that stable or rising property taxes in a time of very diminished real property value is enough to cause a run on pitchforks, and he's got a point:

Based on tax assessments and other factors, the federation found that the market value of property in both Cook County and Chicago in 2010 declined for the fourth year in a row. And not by a little, either.

In the city, the market value of all real estate dropped 17.2 percent in 2010 from 2009. Compared with the 2006 peak, Chicago property values are off 29.7 percent.

[snip]

According to the federation, the total property tax levy in Cook County has kept chugging up each year, good or bad. In 2010, local governments levied $3.67 billion, 23 percent more than $2.98 billion in 2001. And since 2003, the year total values peaked before heading south, the collective property tax levy in Cook County has risen $543 million a year, up about 20 percent.

Obviously, Hinz and the Civic Fed aren't the only people noting this; Ben Joravsky has long written about this in the context of TIFs. But it's also the most leverage cities have in terms of tax revenue, because the property tax system is malleable, unlike sales or income taxes. When people make less, they generate less income and sales tax revenue, and the hollowing of the middle class has caused a serious revenue problem for cities.