A couple days ago, Greg Hinz reported that the CME Group, in the news for so long during its protracted state-tax-break negotiations—which I still think they had a defensible point about—decided to turn down $15 million in city TIF money, which had been in the works since November 2010. According to Terrence Duffy, "the tax law changes approved last year are much more important to our ability to serve as a leading employer in Chicago and Illinois going forward." He added, "It is my hope that formally declining these funds will allow you to put them to use in incenting economic development in the city of Chicago."

It's a bit unusual to see a wealthy company with no fear of lobbying turn down such a substantial chunk of money and ask that it be directed towards other folks who could use it more. Not unwelcomed, but surprising. Anyway, it was nice to see TIFs back in the news again.

Today Carole Brown, chair of the mayor's TIF Reform Task Force, and Mick Dumke of the Reader appeared on WBEZ's 848 to talk about tax increment financing. The segment ended up being just as much about what tax increment financing is and how it works in Chicago than it did about TIF reform, so it's a really interesting contrast between how the government views TIFs and how watchdogs view them. Brown denies that the TIF program is a "slush fund," to use Ben Joravsky's oft-wielded phrase, available for use "at the mayor's will." How it actually gets doled out is complex, as Joravsky detailed in one of the best single-article reads on tax increment financing:

One common fallacy is that TIF dollars are distributed according to the aldermen's clout. If this were so, the 14th Ward, represented by council dean Ed Burke, the finance committee chairman, would get the most TIF money. But only about $12 million in TIF funds was spent in the 14th Ward from 2004 to 2008, which puts it in the bottom half of the list.

Why? Because for all his clout Burke represents working-class communities that don't generate a lot of TIF dollars.

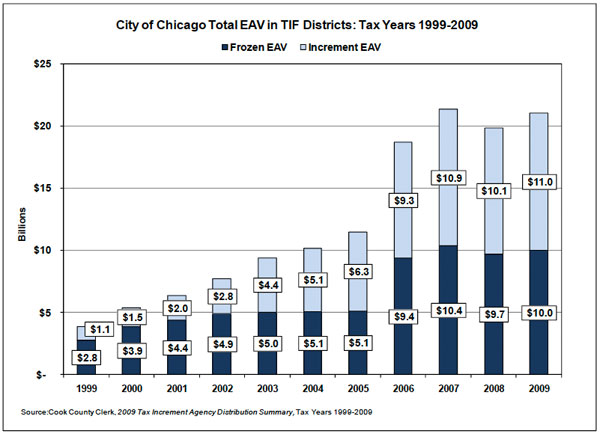

TIFs "freeze" the city's take of property-tax dollars over a period of up to 24 years. If more property taxes come in above that level, they're put in the TIF fund and used for development in that district. If a district's property-tax levy is likely to go up substantially because of density, wealth, or both, the amount of money available to that district will be substantial. If it grows more slowly, as in Burke's ward, the TIF take will be smaller.

Basically tax increment financing is meant to create a development feedback loop—more development means more money in the TIF district fund, which means more development, which means more money in the district. And it's a process that generates a lot of incremental (non-frozen) equalized assessed valuation:

It took many years just to get TIFs in the headlines regularly; it'll take longer for us to really figure out how to talk about them in the same language.