Awhile back, as Mitt Romney's history with Bain Capital was making headlines, I reflected on the fact that understanding private equity as us-versus-them is a simplistic and dangerous model. Mitt might have made a killing in the industry, but the fuel for that fire comes from you and me. Those are tax dollars at work: if you live in a state, and that state has a pension plan, you're probably some small piece of the leverage in the leveraged buyout. But don't take it from me, take it from a private equity professional:

Finally, Mr. Levy said the conversation in South Carolina and the nation about private equity business is missing a crucial point. “I work for you,” he said. “Look, I’m investing the money for Colorado teachers, Colorado firemen,” he continued, “New Jersey civil servants, Montana, Missouri, New York State teachers, Oregon, Washington; that’s who the investors are, and I don’t think that’s really gotten through very clearly.”

I also noted the very difficult mountain of irony Romney has to climb: he made his living from the use of debt, and as a Republican he has to run on the platform that debt is bad. And I'm heartened to see I wasn't alone:

And, even as the G.O.P. continues to inveigh against the perils of deficits, the implicit message it’ll send by nominating Romney is quite different: Debt for me, but not for thee.

This is not to say that taxpayers aren't victims too:

As if this weren’t galling enough, taxpayers are left on the hook. Interest payments on all that debt are tax-deductible; when pensions are dumped, a federal agency called the Pension Benefit Guaranty Corporation picks up the tab; and the money that the dealmakers earn is taxed at a much lower rate than normal income would be, thanks to the so-called “carried interest” loophole. The money that Mitt Romney made when he was at Bain Capital was compensation for his (apparently excellent) work, but, instead of being taxed as income, it was taxed as a capital gain. It’s a very cozy arrangement.

Even more irony: pension plans provide a lot of the backing that gets pension plans dumped in post-M&A bankruptcies. I know we don't have referenda on how pension funds are invested, but on some level, at least, we're doing this to ourselves. This has mostly been Mitt's problem so far (via)

Coverage of Romney’s wealth, corporate history, and partially released tax situation coincided with, and almost certainly caused, a collapse in his support with white voters with income under $50,000. Republicans have enjoyed great success attracting downscale whites in recent years, but that success has hinged in part on things like not nominating standard-bearers who epitomize everything blue-collar whites distrust about their party.

But Bloomberg, in a piece entitled "Pension Funds Get Queasy Over Private Equity," has an interesting data point:

Public and private pension funds in the U.S. provide 42 percent of the capital for all private equity investments, according to the Private Equity Growth Capital Council in Washington. Public employee pension funds, which must answer to ordinary workers, are sensitive to protracted debates about managers’ compensation and whether buyouts create value and jobs, says one official who asked not to be named because he wasn’t authorized to speak on the topic. “The political attacks against Romney and Bain will definitely come up when firms pitch us their new funds,” says William R. Atwood, executive director of the Illinois State Board of Investment, which oversees $10.4 billion in pension funds. “You’d be crazy not to bring it up.” The Illinois pension board had $621.3 million, or 6 percent of its assets, in private equity as of Dec. 31, according to its website.

As Suzy Khimm points out, it puts pension funds in a tough place—private equity might be politically unpopular, or at least everyone's finally noticed the problematic nature of private equity, but what's also unpopular are wildly underfunded pension funds, many of which collapsed during the recession. And private equity is one way to catch up.

The investment of pension funds lies at the end of a Rube Goldberg machine of politics, one that makes it hard for voters to push the needle. But thanks to Mitt Romney, we're at least having the discussion.

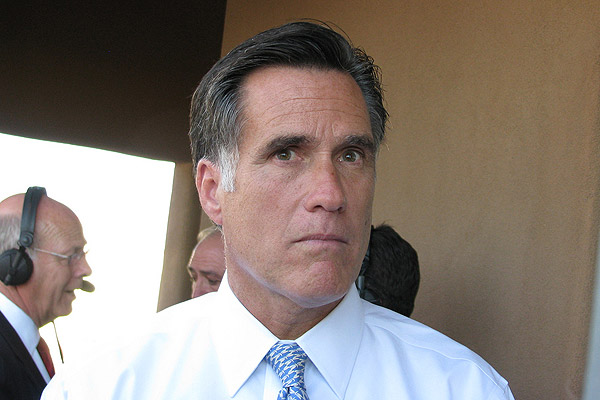

Photograph: nmfbihop (CC by 2.0)