Via DNAInfo, researchers from UIC and ISU just released a fascinating report, "60 Years of Migration: Puerto Ricans in Chicagoland" (PDF). It's a lengthy and data-rich study, but the first thing that struck me was not about Puerto Ricans at all. It's data about educational attainment, and specifically African-Americans.

The multicolored bars are educational attainment: from left to right, less than a high school diploma; a high school diploma or equivalency; "some college" or associate's degree; bachelor's; and graduate/professional degree. (The blue bar on the bottom is not in labor force/in labor force.)

.jpg)

The report explains that the biggest outlier—low educational attainment among Mexicans—makes sense due to immigration patterns, not to mention that Puerto Ricans, as citizens, have access to federal student aid. It's a big outlier, but the reasons behind it make sense. This is why some states have implemented financial aid as part of their own state-level DREAM Acts.

Much more curious to me are educational-attainment patterns among African-Americans, where a substantial plurality have some college or an associates—then a massive plunge, of 24 points, to the percentage with a four-year degree. (It's also interesting that the ratio between African-Americans with just a bachelor's and those with an advanced degree is the lowest among the groups, which is seemingly encouraging.) It's something to keep an eye on: The New York Times has a good piece today on how a four-year degree is increasingly a requirement for white-collar work, even very low-level office jobs.

This is not a new problem, and it's been studied a lot, though not always well. The evidence tends to point in a couple directions (PDF, emphasis mine): "The general conclusion of the reviewed research (particularly the work of Dr. Vincent Tinto of Syracuse University) is that although academic preparation and performance do play a major role in retention of underrepresented students, up to 75 percent of all dropout decisions are non-academic in nature."

* Financial: "Non-tuition expenses (books, fees, meals, etc.) can be crippling, and schools generally do not provide enough funding to cover these costs." No kidding. At one low point during college, I bought a book, read it, returned it, then at the end of the class when I needed it again, bought, read, and returned it a second time. During my last year, most of the food I ate was uneaten prepared food left over from my work-study job. (Eating free Snail Thai meals sounds great, and it is, until you get to day three or four of the same batch and the rice gets hard enough to make noise.) Which is another money issue: "part-time employment is a necessity for many students, but the presence of a job is associated with a significantly lower retention rate."

* Psychological/Cultural: College is harder if you don't have the exposure. Despite not having much money, I had a huge advantage as the kid of an associate college professor—knowing how to do research (an eternal complaint among academics about their students, even at good colleges), understanding how to structure a college paper, even just navigating the bureaucracy. It's not just a racial-minority issue; my mother spent years working with first-generation college students from Appalachia, many of whom had never seen a college, much less had family members who attended.

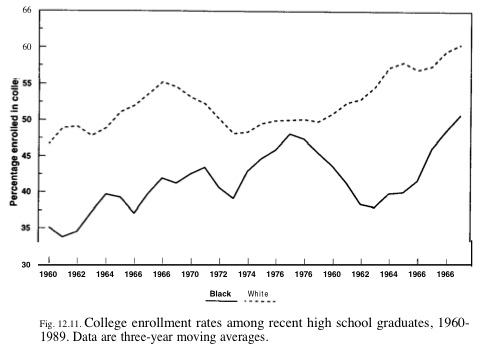

On the first point, things are going in the wrong direction, and have been for awhile. While digging around in the research, I found an old paper by University of Wisconsin sociologist Robert M. Hauser on "College Entry Among African Americans" (PDF). This chart is kind of stunning:

Hauser, back then, came to similar conclusions: "As best I can read the present evidence (which is, of course, far from complete), the major factor driving down African American college attendence was its decreasingly attractive terms of support, both financial and social. Not only was the societal package of aid for college attendance smaller relative to need, but it has been increasingly targeted to the needs and preferences of middle-income families."

And the timeline is right:

Between 1966 and the late 1970s, when grant assistance was greatly expanded, the participation of individuals from lower income groups also greatly increased. Between 1980 and the present [1990], when loans have become the dominant form of federal student financial aid, between 40 and 50 percent of the participation gains made by students from the bottom quartile of the family income distribution between the mid 1960s and the mid 1970s have been lost…. People from low family income background are—and always have been—less willing to borrow money to finance educational expenses….

Hauser notes that, from 1983-84 to 1988-89, aid caught up again: "total aid expenditures grew 23.5 percent in real dollars, while the costs of attending public four-year and two-year colleges increased by 9.7 and 10.7 percent." Since then, the costs of college have continued to increase (which colleges are, in part, on the hook for); the net cost has increased more slowly, but the nature of the aid has changed: "Over the past decade, the proportion of student loans that are subsidized — with the federal government paying the interest while students are in school — has declined considerably, with unsubsidized federal loans playing a larger role."

More recently, state budget cuts have forced reductions in aid: "States have cut the amount of money they are giving to colleges by a total of $15.2 billion since 2007, or 17.4%. At the same time, the number of students enrolled in college has risen 12%. That means the average public college gets a tax subsidy of only $6,600 per student, down from $9,300 just five years ago."

Addressing the other aspect of college completion, some colleges have become better at handling the cultural and psychological aspect of minority and low-income college persistence:

There once was a time when universities took a perverse pride in their attrition rates. Professors would begin the year by saying, "Look to the right and look to the left. One of you is not going to be here by the end of the year." But such a Darwinian spirit is beginning to give way as at least a few colleges face up to the graduation gap. At the University of Wisconsin–Madison, the gap has been roughly halved over the last three years. The university has poured resources into peer counseling to help students from inner-city schools adjust to the rigor and faster pace of a university classroom—and also to help minority students overcome the stereotype that they are less qualified.

And if a stuffy, old-line Southern private school like Washington & Lee can do it, other schools should be able to as well:

Washington and Lee is a small, selective school with a preppy feel in Lexington, Va. Its student body is less than 5 percent black and less than 2 percent Latino. While the school usually graduated about 90 percent of its whites, the graduation rate of its blacks and Latinos had dipped to 63 percent by 2007. "We went through a dramatic shift," says Dawn Watkins, the vice president for student affairs. The school aggressively pushed mentoring of minorities by other students and "partnering" with parents at a special pre-enrollment session. The school had its first-ever black homecoming. Last spring the school graduated the same proportion of minorities as it did whites.

In some ways it's progress; some college is better than none, from an individual perspective as well as a broad statistical perspective. But it's also a problem: expensive loans combined with a lack of college completion is a bad combination of debt and benefit. And if college-degree inflation—i.e. the necessity of a four-year degree for any sort of stable white-collar work, no matter its nature—continues, the problem will only get worse.