.jpg)

I just finished up a column on the state's January bond downgrade, why it happened, and what the outlook is for the future. It's not good, even from a bond-rating perspective, which can be improved by action towards greater solvency, not just when the flow of black ink actually arrives. Recently the state has made efforts towards balancing the state's finances, and it has legitimately cut its expenses. But ratings remain low, in part, because of the future tsunami of expenses. A new report by the watchdogs at the Civic Fed looks at what's coming up in coming years—what the state needs to be planning for now. And it's bad (PDF).

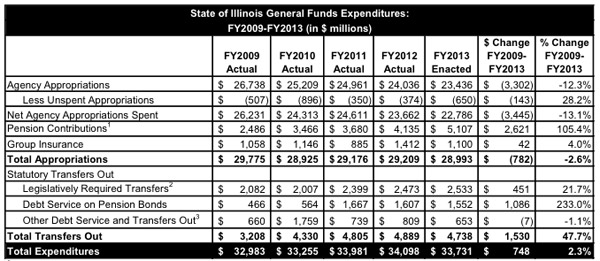

Appropriations have actually declined. Pension contributions have doubled; debt service on pension bonds has tripled. Derided as Squeezy the Pension Python was, this is the Squeezy principle at work: to hold the line on spending, pension obligation increases have to be balanced out with service cuts just to hold the line on expenditures. And those pension expenditures? "Pension contributions in FY2010 and FY2011 were made primarily by issuance of pension obligation bonds, rather than from General Funds."

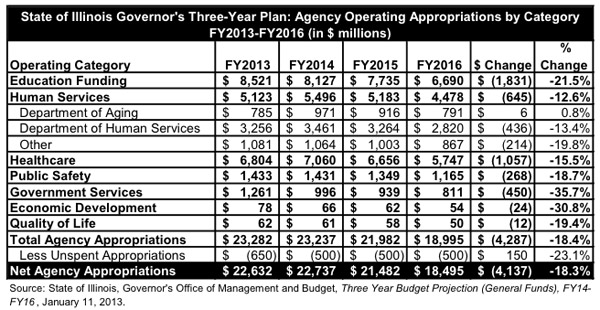

Here's what those cuts are projected to look like:

Education takes the largest cut by raw dollars; government services are projected for a massive 36 percent cut. And Illinois has fairly low per capita government spending, especially on a state level. Even in 2006 Illinois was 23rd by combined state and local government spending (PDF). If that seems crazy, it's because many government functions are dealt with at the local level, particularly education. The state has high per capita local government spending, low per capita state government spending, and they average out to the middle of the pack.

One of the big budget crunches comes in 2015, when the income tax hike partially sunsets. That's why this is happening:

Now, state Rep. Lou Lang, D-Skokie, has proposed doing what everyone figured had to happen. He’s introduced a bill to make the income tax increase permanent, to fund pensions so that in 50 years, the five state pension funds will be 80 percent funded. Illinois’ unfunded pension liability is approaching $100 billion, the highest of any state.

Lang's proposal attracted a lot of attention for the obvious reasons. But making the tax increase permanent is only part of it. Note this: "the five state pension funds will be 80 percent funded." The previous proposals have aimed for 100 percent in a similar timeframe, which would be great, but is arguably unnecessary, or at least too drastic given the difficulty of doing so. The income tax part of Lang's proposal will grab the headlines going forward, but changing the pension funding schedule, while arcane, could be of great importance.

Photograph: Hello Turkey Toe (CC by 2.0)