Update: The CTA is looking at PPPs; it'll be interesting to see how governments decide to approach the next generation of public-private partnerships, given how problematic so many have been recently (which, of course, were inked shortly before the economy collapsed).

The Wall Street Journal reports that New York City has decided not to sell its parking meters. You're no doubt used to this by now:

The decision by the nation's largest city comes amid a backlash in Chicago, whose 2008 deal to lease rights on 36,000 parking meters to private investors for 75 years for about $1.2 billion was the first parking privatization by a major U.S. city. Chicago residents and policy makers—including Mayor Rahm Emanuel, whose predecessor presided over the deal—have criticized it for selling the rights too cheaply and for including clauses that have ended up costing the city additional funds. Pittsburgh and Los Angeles also have put privatization plans on ice.

But it's not just parking meters, and not just New York. Cate Long, whose Reuters blog Muniland is a must-read if you're into the vagaries of privatizing public services (not to mention state debt news and anything else having to do with the area where government money and private finance collide), had a roundup a couple weeks ago of U.S. governments that are reconsidering their public-private parnership deals:

An academic paper “Is there ‘value for money’ in transportation PPP’s?” looked at the efforts of the Australia infrastructure firm, Macquarie, in building private toll roads in the United States. The paper, published in 2007, included this table of Macquarie’s U.S. projects. The record for these projects is abysmal.

Two of the projects declared bankruptcy. The assets of one, Pocahontas, were written down to zero by its new owner, and two were bought by the government jurisdictions where they were located. Another is in negotiations to be bought by the state of Virginia. None of these projects fulfilled their initial plans to operate successfully as profitable, private companies. Macquarie’s most substantial U.S. project, the Indiana Toll Road project, is near insolvency and attempting to restructure its loans.

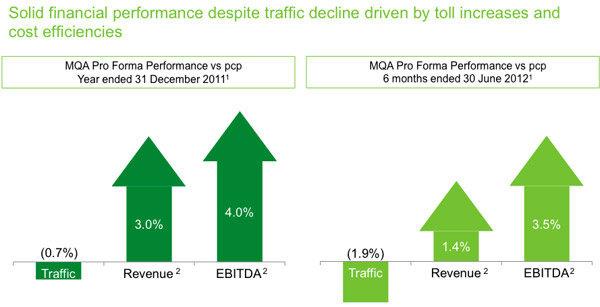

The paper doesn't include the Chicago Skyway, which was leased for 99 years to Macquarie in 2004. It's also an old report, as these things go; but Long gives an update for all the projects mentioned in it, and they're all struggling, either because the deals weren't profitable for Macquarie (which lost $77 million in the first half of 2012 on its toll roads) or because the governments aren't happy with rising tolls. Macquarie has been struggling with traffic counts (PDF), but has "solid financial performance" which is "driven by toll increases and cost efficiencies":

(The Chicago Skyway tolls just went up again, to $4 from $3.50.)

Its investment in the Indiana Toll Road could potentially get wiped out. And Macquarie has been taking it on the chin more generally. Anyone want to buy an old "millionaire factory"?

Profits and return on equity have been falling for several years as Macquarie—once known as Australia's millionaire factory—has struggled to balance costs and revenue. Earnings in the six months to Sept. 30 were about 10% below analysts' forecasts, UBS says.

Macquarie has some strong suits—Macquarie Funds has seen a steady rise in assets under management, for instance. Also, its world-leading unlisted infrastructure funds will benefit as deficit-laden governments turn to private sources of finance, says CLSA's Brian Johnson.

Or not; Long thinks that governments will keep building toll roads but keep them in-house. Of course, there's always more stuff to privatize; Long rounds up the controversy over Pennsylvania's lottery privatization. They might want to look to us as another cautionary tale.

The Illinois Lottery is not a model Indiana should follow in seeking a private manager to boost revenue, according to Illinois’ own lottery chief.

[snip]

Illinois in 2010 became the first state to privatize its lottery, and the process was fraught with controversy.

Less than a year after winning a 10-year contract, Northstar Lottery Group sought a change in terms that could mean the state will owe it millions, rather than the company having to pay fines for failing to bring in the profit promised in its bid. Illinois Lottery and Northstar are in mediation over the issue.

Next on tap looks to be New Jersey's lottery. Perhaps Illinois could consult on it; that service, at least, still seems to pay pretty well.

Photograph: two stout monks (CC by 2.0)