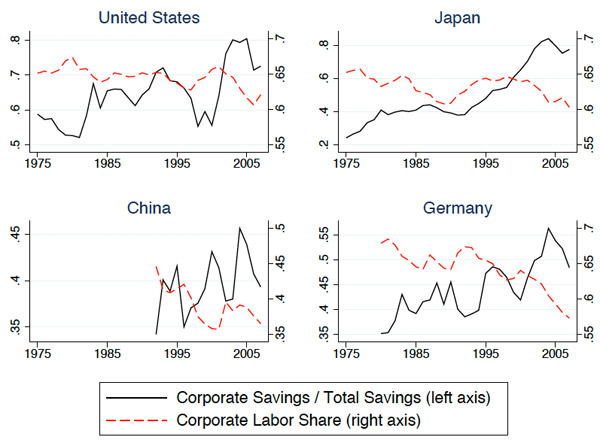

Via Dylan Matthews, a new working paper from two University of Chicago Booth economists shows that austerity isn't just for governments: the share of GDP going to labor has been in decline in recent years, while the share going to corporate savings has increased, not just in the U.S. but in many developed countries.

In short, U.S. corporations went from being net debtors to net savers. What happened? A Philadelphia Fed paper cited Karabarbounis and Neiman gives a hint:

There is no question that dividend taxation has eased up over the past 40 years. The decline has been driven by: (i) a decline in marginal income tax rates; (ii) an increase in the share of equity held by fiduciary institutions who pay no taxes on dividend income or capital gains.

[snip]

Overall, our results suggest that a decline in dividend taxes and regulations over the past 40 years, goes a long way in explaining the rise of corporate net savings to capital in the U.S. during the same period.

This leads us back to a 2005 Minneapolis Fed paper, which emphasizes something that's come up frequently with regards to Mitt Romney, Bain Capital, and the massive amounts of public-sector money driving investment institutions like private equity funds:

First, there were reductions in marginal income tax rates, with the largest changes beginning in the early 1980s. Second, and more importantly, there were changes in the legal and regulatory system that led to a dramatic increase in the share of corporate equity held by entities that pay no tax on dividend or capital gains income. The percentage of corporate equity held by these entities—namely, pension funds, individual retirement accounts, and nonprofit organizations—increased from 4 percent in 1960 to 51 percent in 2000.

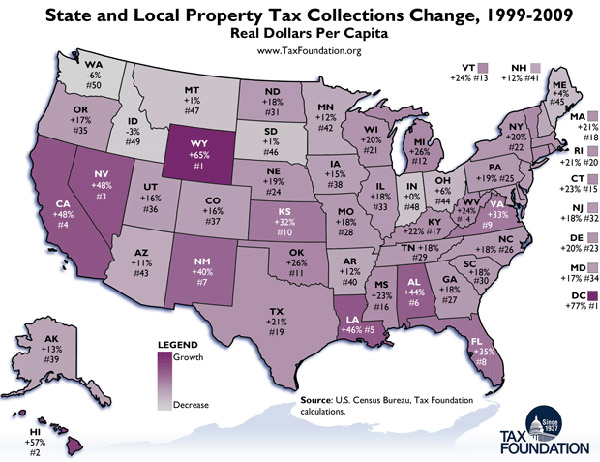

Side note: Some of it is attributed to a decline in the corporate income tax, but the decreasing tax burden on corporations, the authors write, is overstated for reasons that will sound familiar to anyone following the scramble by states and localities for dough: "Total profits tax liabilities have fallen, but by less than federal tax reports would indicate. Over time, there has been a rise in the state and local profits tax accruals relative to federal tax accruals." This is true; a map from the Tax Foundation shows how state and local tax collections increased from 1999-2009, a period that includes two recessions:

They go on to note other changes, like regulatory laws that make it less risky for fiduciaries to invest in equity. Broadly speaking, all these changes have made it cheaper for corporations to save. Meanwhile, the people that work for those corporations have seen stagnant wages, so they were saving less and borrowing more, leading to the "balance sheet recession"—grand-scale deleveraging that's reduced demand. So companies have a lot of money that they don't want to spend because domestic demand is bad, and it's obviously not so good in a lot of developed countries, particularly in Europe. Dan Froomkin calls this "corporate austerity."

It's not just a matter of companies hoarding cash and paying less in taxes. A lot of that money currently stagnating is retirement money: IRAs and pension funds, which increased for regulatory and demographic reasons. Such changes have thrown off the balance in the system, shifting the ballast during a bad storm.