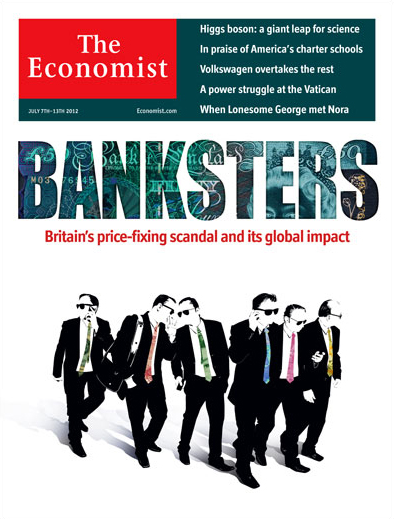

A couple weeks ago, the Commodity Futures Trading Commission announced that it was dinging the British bank Barclays $200 million for attempting to fix the London Interbank Offered Rate, better known as LIBOR. In the financial press, it's being treated like the Black Sox scandal, a loss of innocence beyond even the imaginations of seasoned observers of a rough game. For a minute there, The Economist turned into In These Times:

OK, maybe not: "Popular fury and class- action suits are seldom a good starting point for new rules. Yet despite the risks of banker-bashing, a clean-up is in order, for the banking industry’s credibility is shot, and without trust neither the business nor the clients it serves can prosper."

Yet there hasn't been much talk of it on this side of the pond, which has left some people confused, given how much of the world rests on the little number called LIBOR. One reason, perhaps, is that LIBOR is weird and confusing. Or less confusing than just weird:

The calculation of Libor is co-ordinated by just two people, who work in an unremarkable open-plan office in London’s Docklands. I watched the process, which seemed utterly routine, a couple of years ago. Just after 11 a.m. on every weekday that’s not a bank holiday, traders at leading banks send in their estimates of the interest rates at which their banks could borrow money.

[snip]

A simple computer program discards the lowest quarter and highest quarter of the estimates, and calculates the average of the remainder. The result is that day’s Libor.

So that's all LIBOR is. (It's pronounced "LIE-bor," which should, um, be easy enough to remember.) You or I could calculate it. In the arcane world of modern finance, it's almost refreshingly simple, remarkable still given what LIBOR governs, which includes massive amounts of money flowing through Chicago every day:

U.S. Dollar LIBOR is the basis for the settlement of the three-month Eurodollar futures contract traded on the Chicago Mercantile Exchange (CME), which had a traded volume in 2011 with a notional value exceeding $564 trillion. In addition, according to the BBA, swaps with a notional value of approximately $350 trillion and loans amounting to $10 trillion are indexed to LIBOR.

$564 trillion resting on a rigged number: this is not going away anytime soon.

But it's not just for the big boys of finance. If you have an adjustable-rate mortgage, there's a 50-percent chance that it's just LIBOR (the spread) plus a fixed margin (the vig). A lot of money gets lent with LIBOR as the basis, since it's sort of a gentlemen's agreement on what's a reasonable rate to lend at. It's called the "interbank offer rate" because it's an estimate of what rate banks think they could, or should, be able to get from other banks: "Each panel bank’s submission is also made public, and the market can therefore see each bank’s independent assessment of its own borrowing costs. LIBOR is supposed to reflect the cost of borrowing unsecured funds in the London interbank market."

So it's actually neither complex nor opaque. But it is a bit squishy, which is part of the problem:

Note the conditional: a Libor input is what a bank could do, not what it has done. So judgment is involved. A bank might not have borrowed anything in the minutes before 11 a.m…. ‘Reasonable market size’ is deliberately not defined exactly: it will vary from currency to currency and according to time period and market conditions. The need for judgment is why the information provided by brokers is important to the calculation of Libor…. It can take an experienced trader talking to a number of brokers with good ears to form a realistic estimate.

"Fixing" something that's already something of a judgement call can take awhile to process. But the CFTC caught Barclays with its hand in the cookie jar:

Barclays’ traders made these unlawful requests routinely, and sometimes daily, from at least mid-2005 through at least the fall of 2007, and sporadically thereafter into 2009. The Order relates that, for example, one trader stated in an email to a submitter: “We have another big fixing tom[orrow] and with the market move I was hoping we could set [certain] Libors as high as possible.”

"Set LIBORs as high as possible." That, in theory, should make people mad, because it raises borrowing costs. But right now it appears that costs were lowered more often than they were raised. So these crooks in London, they went and made your mortgage slightly more affordable: not going to bring out the pitchforks among the general public, even if it was meant to line banksters' pockets. And then there's a sympathy angle, as The Economist writes:

The second type of LIBOR-rigging, which started in 2007 with the onset of the credit crunch, could also lead to litigation, but is ethically more complicated, because there was a “public good” of sorts involved. During the crisis, a high LIBOR submission was widely seen as a sign of financial weakness. Barclays lowered its submissions so that it could drop back into the pack of panel banks; it has released evidence that can be interpreted as an implicit nod from the Bank of England (and Whitehall mandarins) to do so. The central bank denies this, but at the time governments were rightly desperate to bolster confidence in banks and keep credit flowing.

LIBOR manipulation probably didn't hurt you. (Even if your borrowing did go up, it probably wasn't by very much.) What it likely hurt was us. If LIBOR went down very slightly, the people getting hurt were the ones getting lower returns on investments, and in particular investors that are big enough that a small decline scales up to a big loss.

Investors like cities and pension funds.

In response to the probe that netted Barclays, a Chicago firm sued Bank of America and other huge banks last summer; it didn't get much attention, but that was before Barclays threw itself on the mercy of the CFTC. In May the City of Baltimore and a New Britain firefighter and police pension fund got in the queue. Nassau County in New York—the one that was taken over by the state because it was going broke last year—is kicking around the idea of a lawsuit. Charles Schwab filed a RICO lawsuit; any bank involved could be looking at billions in damages, thanks to the ubiquity of LIBOR. Investment banks don't make for appealing victims, but retired cops and firefighters, not to mention near-broke cities, will make the LIBOR fallout a lot more compelling. If you're not interested in the number yet, you will be.