Photo: Chris Walker/Chicago Tribune

A kindergarten graduate at Trumbull School, which will be closed under the CPS consolidation plan, June 24, 2013

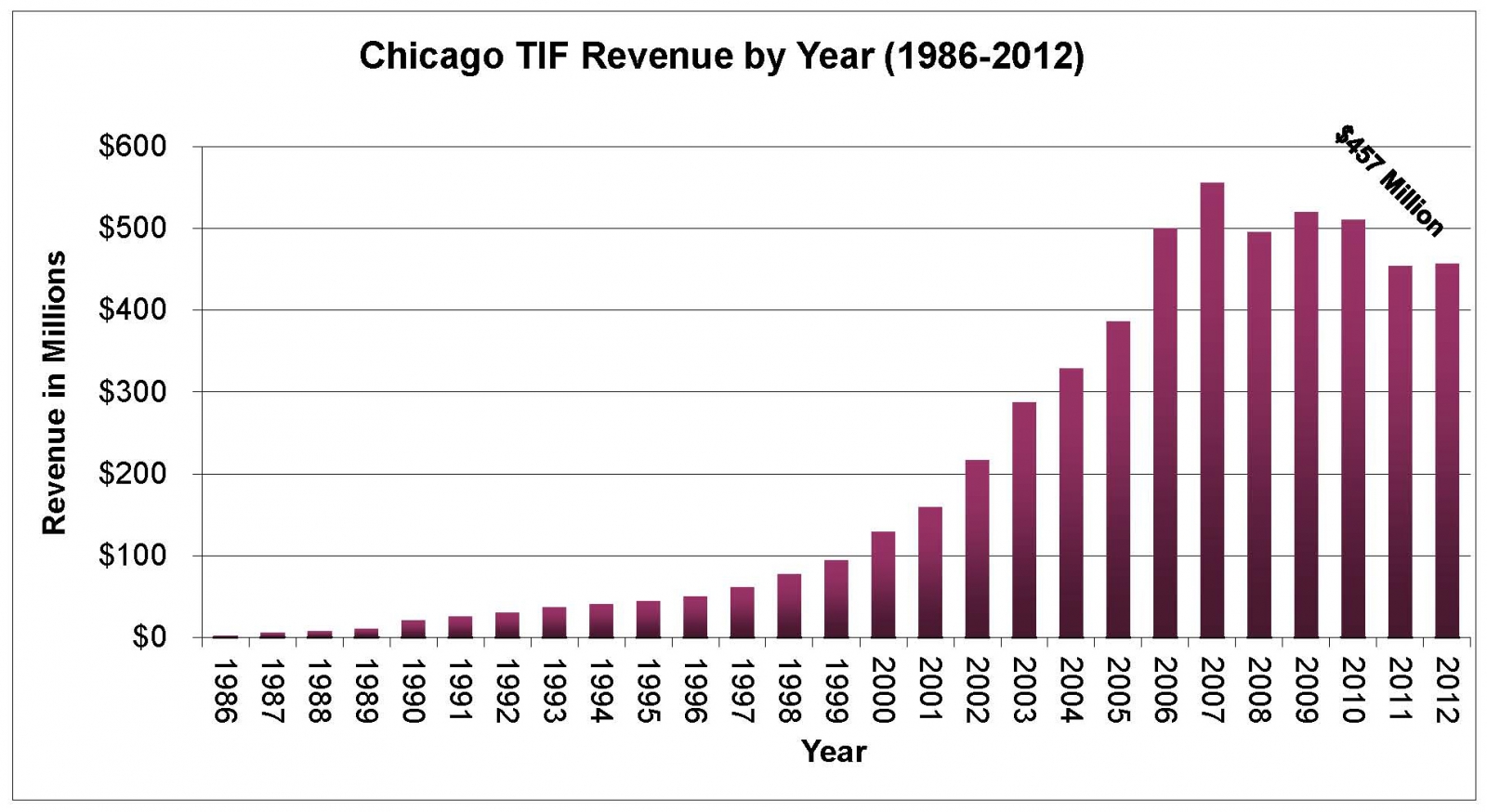

Today David Orr released his annual TIF (tax increment finance district) report. TIF revenues are up (one percent); the number of TIF districts is down (nine were terminated, and zero were created in 2012); the improving economy and the drop in districts essentially canceled each other out. As always, it's a reminder of their explosive growth in the past decade in Chicago, and the more gradual growth of TIF districts in suburban Cook County:

Orr calculates that $5.5 billion has gone into TIF districts in Chicago in the past 26 years—about half that in the past few years. (A brief reminder of how they work: when a district is created, the property taxes it generates are "frozen," and everything above that level—not adjusted for inflation—is theoretically used for development in the district, for 23 years.)

One case against TIFs, particularly pressing right now, is that they take money away from Chicago Public Schools, by capping the amount of money going into the system and letting it pool in the TIF districts, some of which are quite wealthy and thriving and arguably don't need any development assistance from a program originally intended to build up "blighted" areas.

But it's complicated by a lot of things (here's a thorough explanation). If the TIF district created revenue growth by being a TIF district, then CPS isn't losing out on that money; if that growth would have occurred naturally, it is. Some TIF money goes to CPS; state aid arguably makes up for some or even all of the TIF cut; and so forth. Putting an actual number on what CPS loses to the program is extremely difficult, made more so by the program's lack of transparency.

So it follows that determining what "surplus" a TIF district incurs is also hard. The city's returned $182 million to CPS in the past five years, $10.2 million last year, and Orr wants the city to increase that. But Orr keeps running into the fuzzy wall of the surplus, as he told reporters today.

The reason the city was able to come up with surpluses —last year they took money from 105 TIFs to do the surplus, so somebody had to do some evaluation. But it also suggests that there are a lot of these TIFs that are sitting there collecting money that there aren't real, hard plans for…. We keep collecting money in some of these TIFs, but do we need them all to be in those TIFs? So when we talk about surpluses… it's because we all suspect that there are not airtight, top priority plans for each of those TIFs into the 15th, 20th year.

Are there airtight, top-priority plans? The latter is sort of in the eye of the beholder; the former, um, "yes":

Many of the items in the TIF budget seem to be pretty far along. Most are categorized as "appropriated," meaning the expenditure has already been approved or finalized, or "committed," meaning it's "locked in" or expected to be shortly, according to community development department spokeswoman Molly Sullivan, who provided written answers to our questions about the documents after her department declined our FOIA request. Fewer projects are listed as "pending," meaning they've been proposed.

"The designations are informal and used only for budgeting and planning purposes," Sullivan wrote. "There is nothing binding about the terms in this context; they are in fact determined by DCD TIF staff as a way to prioritize potential expenditures."

So the terms that seem to indicate what is or is not airtight actually indicate what is prioritized. If that makes sense, you may be qualified to actually audit the city's TIFs; if not, the inclusion of TIF data on property tax bills, beginning next summer, will at least get you started with how much of your own property tax goes into the TIF kitty.