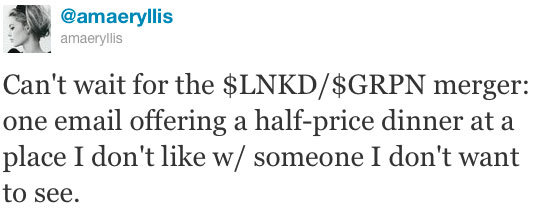

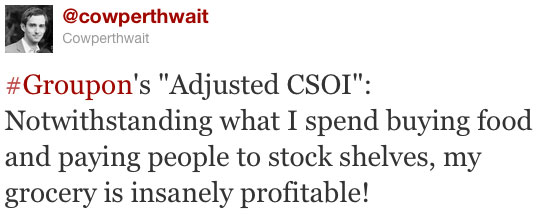

It’s been a tough week for Groupon, or at least as tough as you’d expect for a start-up working towards its initial public offering: analysts have been pouring over their S-1 filing, leading to critiques and cracks about some of their accounting measures and business plans:

So it’s probably pretty tempting for Groupon to defend themselves.

But they can’t, exactly.

The SEC has this thing called a "quiet period." It’s an old rule dating back to the Depression, meant to prevent employees from talking up their company in advance of a public offering outside of their SEC filings; all the relevant information about the offering is supposed to be contained in the prospectus, and the market is supposed to be allowed to work in peace and quiet without having to deal with the braggadocio of corporate directors.

Well, co-founder and chairman Eric Lefkovsky broke the quiet period with the shocking statement that Groupon will be "wildly profitable." Fortunately, there’s a somewhat absurd fix for that:

To reconcile Lefkofsky’s comments with SEC rules, the company could file regulatory documents that say Groupon may be “profitable” over the next decade or two, without saying exactly when, said Marc Morgenstern, managing partner of Blue Mesa Partners, a San Francisco-based investment firm.

The SEC’s dealt with this sort of thing before. Google’s Sergey Brin and Larry Page gave a long interview to Playboy that debuted just before their IPO, offering a mere tsk-ing from the SEC, while Salesforce.com had their IPO delayed a month for similar behavior. In the wake of Google’s jaywalking, the SEC decided that IPO’ers could talk to the media as long as they filed their remarks with the SEC.

Meanwhile, financier Peter Cohan takes to Forbes to argue that the SEC should put the brakes on Groupon’s IPO because "Groupon has no competitive advantage and has yet to show it can create one." Unlikely, but it’s an interesting argument.