Last week Groupon, which famously rejected a six-billion-dollar buyout offer from Google, released its S-1 in advance of its initial public offering. It's been followed by skepticism from people who think that, with LinkedIn and now Groupon, we're commencing Bubble 2.0 (or 3.0, I forget).

Groupon's best marketing tool, at least for investors, has been Forbes's formulation that it's the fastest-growing company ever:

[T]he company is on track to pass $500 million in revenue this year, according to a report Morgan Stanley put together to win some underwriting business. No technology stalwart–including Ebay, Amazon.com, Yahoo, AOL and Google–grew that big that fast. At just 17 months old this April Groupon boasted a $1.35 billion valuation when it raised $135 million, the biggest chunk of it from Digital Sky Technologies, the curious Moscow investment fund behind Facebook and Zynga. (Mason will not disclose his stake, which he says is less than 50%.) The only company to reach a $1 billion valuation faster was YouTube (now part of Google), founded in 2005 and still waiting to turn its first profit. Groupon broke into the black just seven months after inception.

But even with the network effects of its model, that growth has come at substantial expense, as revealed in the S-1. Groupon isn't in the black over 2010 or the first quarter of 2011, having lost $420 million in the former and $117 million in the latter. (So was Groupon ever profitable? According to their S-1, yes, in the first quarter of 2010.)

Groupon's response to this is to measure something they call "adjusted consolidated segment operating income," or adjusted CSOI, which is similar to a dot-com-bubble measure called EBITADAM, which basically adds marketing expenses to the usual earnings-before list. In Groupon's case, it's specifically online marketing: "Online marketing expense primarily represents the cost to acquire new subscribers." Which is a lot of money for Groupon; as Jeff Berkovici notes, Groupon's online marketing has been a nontrivial revenue source for hyperlocal sites. And the S-1 says as much: "Online marketing consists of search engine marketing, display advertisements, referral programs and affiliate marketing and has historically represented our largest operating expense."

So the adjusted CSOI subtracts a massive expense. Shazam! Groupon is profitable. People are making fun of them for this.

But it seems excessive to call it a "Dupe de Group(on)." They're obviously not hiding their losses. Instead, the adjusted CSOI just represents an argument: lots of companies lose money by ramping up business expenses. It's a "moat," in Warren Buffett's term. Companies pour a lot of money into acquiring stuff early on in order to build an unassailable competitive advantage, and the up-front costs drop compared to revenue.

Really, the adjusted CSOI is advertising. "Look how much money we've plowed into marketing!" They're just pulling out one line item and giving it a clever name. Groupon is a marketing/advertising agency, at root; they're good at that sort of thing.

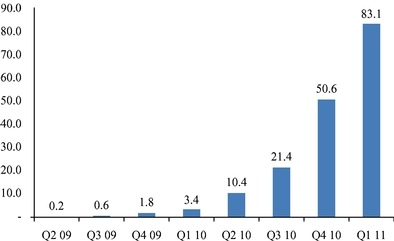

Groupon's big upfront costs involved spending piles of money on acquiring customers: "Marketing expense as a percentage of revenue for the years ended December 31, 2009 and 2010 was 14.9% and 36.8%." Not coincidentally, that's when their subscriber numbers went through the roof. In mid-2009, Groupon had about 36,000 subscribers in Chicago. At the end of Q1 2010, they had 268,000. At the end of Q1 2011, they had over 1.5 million. Here's what their subscriber base looks like overall:

All the adjusted CSOI does is raise the question: can Groupon now—or at some point before they have to turn a profit—ease back on marketing expenses and watch the ripple from that investment roll in? They think so:

To demonstrate the economics of our business model, we have compared the revenue and gross profit generated from the North American subscribers we acquired in the second quarter of 2010, which we refer to as our Q2 2010 cohort, to the online marketing expenses incurred to acquire such subscribers. The Q2 2010 cohort is illustrative of trends we have seen among our North American subscriber base. The Q2 2010 cohort included 3.7 million subscribers that we initially spent $18.0 million in online marketing to acquire in the second quarter of 2010. In that quarter, we generated $29.8 million in revenue and $12.8 million in gross profit from the sale of approximately 1.2 million Groupons to these subscribers. Through March 31, 2011, we generated an aggregate of $145.3 million in revenue and $61.7 million in gross profit from the sale of approximately 6.3 million Groupons to the Q2 2010 cohort. In summary, we spent $18.0 million in online marketing expense to acquire subscribers in the Q2 2010 cohort and generated $61.7 million in gross profit from this group of subscribers over four quarters.

If you're a skeptic, on the other hand, you might think that "Groupon without market expenses is not Groupon at all." And given that the Groupon model has always been easily replicable, there's some question as to whether the company can continue its massive lead on the competition without continuing to invest heavily in marketing.

David Sinsky, of the daily-deal aggregator Yipit, thinks Groupon might be in trouble whether it markets a bunch or not, and his argument is pretty interesting. Basically, it's this: Groupon can keep marketing, but new customers will get more expensive, due to scarcity and competition. On the other hand, if it wants to fully cash in on its subscriber base while checking its marketing growth, it has to improve targeting, which means more niche deals, which increases sales costs. Sinsky looks at Boston as a test case, using some of Yipit's data.

Groupon basically has two sets of customers, buyers and merchants, to keep in balance. It's like a fire, needing fuel and oxygen to thrive. Whether or not Groupon succeeds—and is a good investment—is a question of stoichiometrics.

Comments are closed.