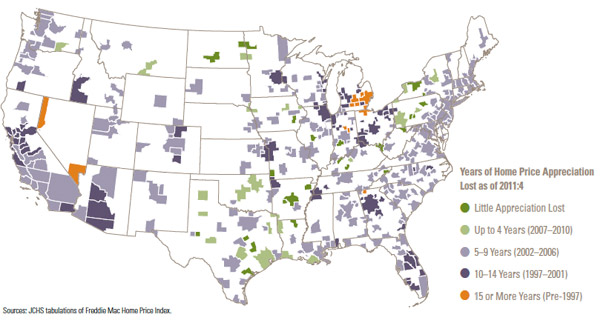

The latest local housing news: foreclosures spiked 29 percent in May, and doubled over the previous May, as the glut of underwater houses continues to wash into the courts. It's likely to push home prices down further, after the Chicagoland area has lost a decade of home appreciation.

Chicago's at the high—but not the highest—end of home-price appreciation loss, which is more typical for the Midwest and West, but not the coasts. Where are all those people going?

It hit minorities the hardest, but minority homeownership does actually remain above peak:

After jumping 7.2 percentage points from 1994 to 2004, black homeownership rates dropped back by 4.3 percentage points from 2004 to 2011—nearly twice the decline in white rates (Figure 21). As of 2011, the gap between black and white rates was wider than in 1994. Hispanics held onto more of their 8.5 percentage-point gain during the boom, losing just 2.7 percentage points since the bust. As a result, the white–Hispanic homeownership gap, though still large, was 1.8 percentage points narrower in 2011 than in 1994.

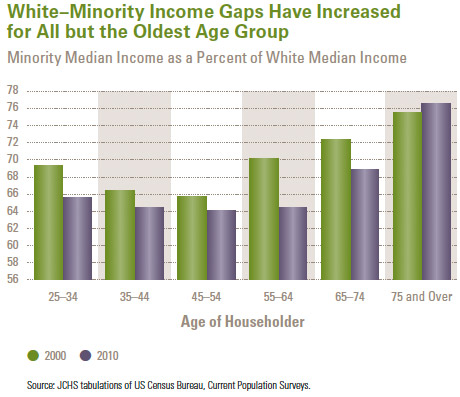

But the decline in income gaps is worrisome:

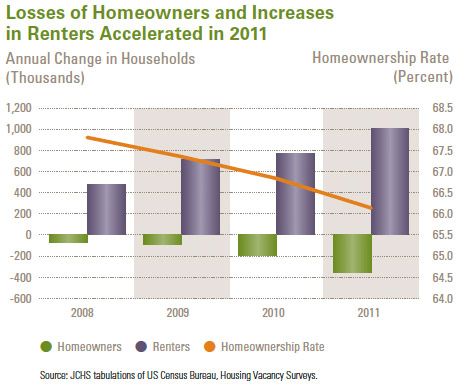

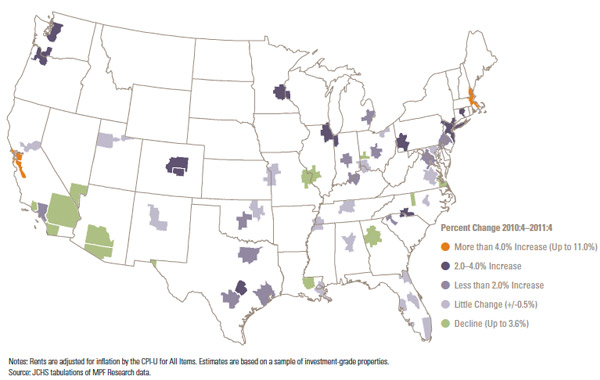

So: a steep drop in homeowners, a wider income gap, decreased access to credit, declining credit scores… all of it has the effect on rental prices you'd expect.

That's a one-year increase. The Chicagoland CPI increased 1.0 percent during that same time.

It's a regressive circle: income drops; homeownership drops; renters increase; rents increase. Those charts are from the Joint Center for Housing Studies at Harvard (PDF) via Mike Konczal, who writes about the effect that's had on rental income as a share of GDP—about four times higher than it was from 1960-1990—and its effect on the people paying that rent:

For the purposes of our rentier economy, I want to look at something they emphasize: people burdened by housing expenses. [The authors] find that, from 2007 to 2010, there was an increase of 2.3 million households paying more than half of their income for housing (what they define as "severly burdened"); that brings it to a total of 20.2 million. That is no doubt impacted by the unemployment crisis, but this is a longer-term trend too. There was an increase of 4.1 million people paying more than half their income for housing from 2001-2007….