So when are people going to start buying houses again?

The continued trouble in the housing market has proved to be among the most vexing problems in the economic downturn. Even as the stock market has reached a four-year high, the unemployment rate has declined sharply and consumer confidence has perked up, housing remains problematic, putting a damper on economic growth.

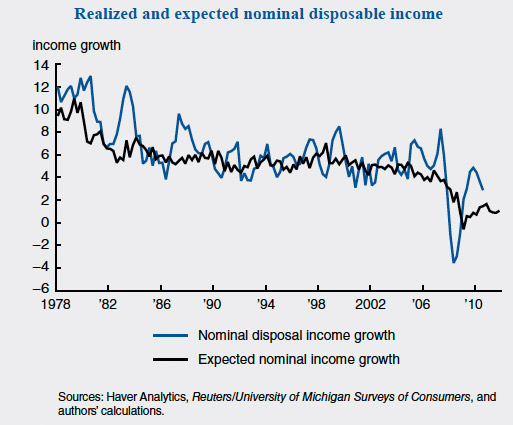

Yes, the unemployment rate has declined; yes, consumer confidence is up. But buying a house is the ultimate act of consumer confidence: expressing confidence not only that a house will be a good investment—a great deal to ask in the wake of the housing crisis—but also that the consumer will have a sufficient long-term income stream to pay a mortgage over 15 to 30 years. And that confidence is running well behind actual income trends, as you might expect.

Mariacristina De Nardi, Eric French, and David Benson of the Chicago Fed recently released a paper, "Consumption and the Great Recession," that looks not only at consumption trends, but income versus expected income. It's bad; we think it's worse; which means it might actually be worse than it is (it'll kind of make sense in a minute).

First, the Great Recession marked the most severe and persistent decline in aggregate consumption since World War II. All subcomponents of consumption declined during this period. However, the large drop in services consumption stands out most, relative to previous recessions. Second, while the decline was historic, the trends in consumption and its subcomponents leading up the recession were not substantially different from past recessionary periods. Third, the recovery path of consumption following the Great Recession has been uncharacteristically weak. It took nearly three years for total consumption to return to its level just prior to the recession. In contrast, the second-worst rebound observed in the data followed the 1974 recession and lasted just over one year. We find that this persistence is reflected most in the subcomponents of nondurables and especially in services.

So it was bad across the board, and the recovery is bad as well. And the perception of the future is just as bad:

First, expected nominal income growth declined significantly during the Great Recession. This is the worst drop ever observed in these data, and this measure has not yet fully recovered to pre-recession levels. Second, the decline exists for all age groups, education levels, and income quintiles.

In particular:

Relative to previous recessions, those with higher levels of income and education are more pessimistic coming out of this recession than their poorer and less-educated counterparts.

And in some ways, the perception is even worse than the reality:

Third, expectations for real income growth have also declined, and the decline in expected real income growth is more severe when personal inflation expectations are used instead of actual Consumer Price Index (CPI) inflation.

Which is not to say that people are pessimistically naïve (emphasis mine):

Fourth, expected income growth is a strong predictor of actual future income growth. Since expected income growth is a very important determinant of consumption decisions, the observed drop in expected income has the potential to explain at least part of the observed decline in consumption.

I.e. it's not about a current salary, it's all about reality. We've become more pessimistic over time as disposable income growth has slowed:

Realized disposable income growth is around the lows over this timeframe; expected growth is well below, and staying there. And as the authors note, for the first time that expected nominal income growth has been measured, people actually expected it to drop:

It should be noted that the most recent recession is the only one during which nominal income expectations reached negative growth rates. In all of the previous recessions that we study, even when nominal income growth rates went down, they stayed well above 4 percent.

It's pretty dramatic pessimism: the first time in over 30 years people expected not just that their income growth would slow down, but that it would actually drop.

And the authors' observations about how this pessimism plays out across income brackets has me wondering about its correlation with the political winds, and whether the occasional plaintive wails of the wealthy aren't abberations (emphasis mine):

In the most recent recession, the first quintile (the poorest) dropped their income growth expectations the least. By the end of 2010, all income levels had roughly converged to the same post-peak level and their expectations are now much closer together. This result is consistent with Petev, Pistaferri, and Eksten’s findings. First, they find that increased government transfers propped up income among the poorest households during the Great Recession. Second… they document that high-income individuals became more pessimistic than other groups during the Great Recession. Finally, using the Bureau of Labor Statistics’ Consumer Expenditure Survey (CEX), they find that respondents in the top decile of the wealth distribution are the ones who decreased spending during the Great Recession (–5.4 percent).

This is actually really interesting. In the days of "We Are the 99 Percent," a great deal of attention has been deservedly paid to the fears of… well, everyone below the one percent. But it's the one percent—or at least the top ten percent—who are apparently the most worried, at least relative to their station.

Whether or not the rich should be less worried, or the not-rich more worried, is an entirely different question. But I can't help but wonder if this non-intuitive result explains some of the disconnect at the levels of rhetoric and policy in this election season.

Photograph: HarshLight (CC by 2.0)