Citigroup bigwig and former Congressional Budget Office/Office of Management and Budget director Peter Orszag has a plea for the one percent: let us decrease income inequality so that it'll tamp down on your income volatility.

Conventional wisdom suggests that low-income households experience the greatest changes in response to macroeconomic conditions — their income falls the most when the economy weakens, and it picks up the most when the economy recovers.

[snip]

The strengthening link between high incomes and macroeconomic activity provides some insight into a stunning set of statistics: In 2010, according to research by Emmanuel Saez, an economist at the University of California, Berkeley, households in the top 1 percent of income distribution accounted for an astonishing 93 percent of aggregate income gains. During the slump from 2007 to 2009, according to the same data set, that group also accounted for a very large share of aggregate income losses — almost half of the total decline.

But:

Finally, if anything, high-earning households should be the ones most in favor of aggressively boosting the economy in the short run — and not just out of benevolence. Yet I suspect, without definitive proof, that support for additional stimulus declines as one moves up the income scale.

I suspect that too! But I also suspect that there are logical, not just ideological, reasons why that's the case. And there's new, specific evidence, gathered right here in Chicago, that goes beyond suspicion.

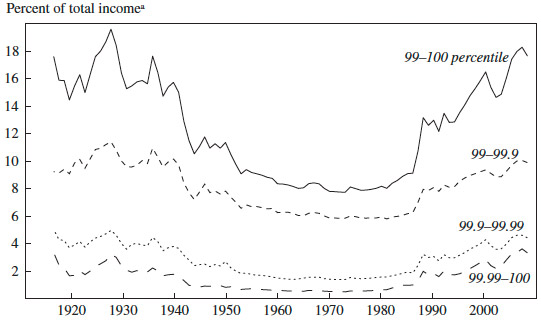

Orszag's piece is based on some interesting research by Northwestern economists. First, "The Increase in Income Cyclicality of High-Income Households and Its Relation to the Rise in Top Income Shares," by Jonathan A. Parker and Annette Vissing-Jorgensen of Northwestern. The paper is here (PDF), but the bottom line is this: "In the United States, since top income shares began to rise rapidly in the early 1980s, incomes of those in the top 1 percent of the income distribution have averaged 14 times average income and been 2.4 times more cyclical. Before the early 1980s, incomes of the top 1 percent were slightly less cyclical than average."

Here's what that looks like:

So since 1980, it's been a pretty wild ride for the one percent. And they find evidence for this across countries and sources of income. For anecdata, take most any story about bonus time at investment banks and how much that has varied recently. For harder evidence, the University of Chicago's Erik Hurst, commenting on the paper, notes that, for the top 2.5 percent of heads of household, bonuses as share of income doubled, from about five to ten percent, between 1994 and 2004. (For the 90 percent, it's around one percent of income.)

Orszag looks at this and concludes: "Introducing more progressivity into the tax code above $1 million would help to reduce after-tax income volatility at the very top."

Which, on its own, seems like a good idea. On average, people don't like income volatility, because on average people don't like to lose money. Our instinctual risk aversion is strong, Jonah Lehrer writes:

Kahneman and Tversky stumbled upon loss aversion after giving their students a simple survey, which asked whether or not they would accept a variety of different bets. The psychologists noticed that, when people were offered a gamble on the toss of a coin in which they might lose $20, they demanded an average payoff of at least $40 if they won. The pain of a loss was approximately twice as potent as the pleasure generated by a gain. Furthermore, our decisions seemed to be determined by these feelings. As Kahneman and Tversky put it, "In human decision making, losses loom larger than gains."

It's so strong it paradoxically causes us to lose money:

Loss aversion also explains one of the most common investing mistakes: investors evaluating their stock portfolio are most likely to sell stocks that have increased in value. Unfortunately, this means that they end up holding on to their depreciating stocks…. (A study by Terrance Odean, an economist at UC-Berkeley, found that the stocks investors sold outperformed the stocks they didn't sell by 3.4 percent). Even professional money managers are vulnerable to this bias, and tend to hold losing stocks twice as long as winning stocks.

(Of course, income volatility usually means a lot more to the 90 percent than the one percent. As Hurst writes, "variations in income (and, to a lesser extent, in consumption) do not map directly onto variations in standard, utility-based measures of welfare." Chris Rock's explanation is more clear, if less polite.)

So: of course Orszag's argument makes sense. People don't like to lose money even more than they like to make money, so all those rich people should want to have their incomes taxed more. Right? Well, look at the chart. Parker and Vissing-Jorgensen found, across a lot of variables, that on the macro scale high risk comes with high reward. And the research Lehrer rounds up suggests that it's true on the micro scale: people able to shut off their instinct to loss aversion when it comes to the markets stand to make more money.

Taking that logic a bit further: people become rich by making money; people make money by not being loss-averse, or at least not blindly loss-averse; rich people will be less inclined to be loss-averse; people who are not loss-averse won't buy Orzsag's argument.

Or, more simply: rich people are presumably, on the whole, good at interpreting data; the data in the chart suggests that low taxes and income volatility are a risk worth taking.

And Orszag doesn't have to "suspect, without definitive proof, that support for additional stimulus declines as one moves up the income scale." Last year, three Northwestern researchers did a survey of Chicago's wealthy (average wealth: $14 million), the first systematic one, the researchers claim, of the political beliefs of the wealthy. It's just of the local rich, but it seems unlikely that Chicago's very rich are all that different. And about one thing they were quite clear (emphasis mine):

Of those respondents who considered deficits the most important problem, mostwanted to address them by cutting spending rather than increasing revenue. None at allreferred only to raising revenue. Two thirds (65%) mentioned only cutting spending, while 35% mentioned both spending cuts and revenue increases. Their comments mentioned “reduction across the board in order to put the house in order”; “reduce government spending first and foremost”; “solve the expense of transfer programs, i.e. Social Security and Medicare. We cannot afford to keep funding these programs”; “major cutbacks in spending”; “lots of fiscal restraint… re-structuring many entitlement programs, means-testing Social Security and Medicare.”

This emphasis on dealing with deficits by cutting programs rather than raising taxes—significantly different from the view of most members of the general public—also emerged in answers to closed-ended policy preference questions that we will notdiscuss in detail here. Most of our wealthy respondents tilted toward cutting back,rather than expanding, most federal government programs (nine of the twelve we asked about), including popular entitlements like Social Security and health care. There was little sentiment for substantial tax increases on the wealthy or on anyone else.

In order to address the problem of unemployment, widely seen as very important, respondents tended to think in terms of unleashing the job-creating force of private enterprise, not about using government to stimulate the economy, to provide jobs, or to aid the unemployed. As one said, “[the most important problem is] entitlements…. this country is giving millions of dollars away that do not motivate people to go to work and[we] continue to extend unemployment benefits.” … They overwhelmingly opposed the idea that government should “provide” jobs if private enterprise cannot. There was very little support for generous unemployment insurance orfor expanding the Earned Income Tax Credit for low-wage workers.

I can see where Orszag's argument would appeal to a lot of people, since it's designed to appeal to a basic human instinct. But I also can't see it appealing to the handful of people it's actually targeted to.

Photo: renaissancechambara (CC by 2.0)