A couple weeks ago Rahm Emanuel went to Springfield to lobby for pension reforms. At the top of the risk list are firefighter and police pensions, which are the least stable and also the thorniest—not just because of the reputation of public-safety professionals, but because the physical demands of their jobs are the most convincing argument for early, generous pensions.

Absent reforms, the fund for retired city firefighters would become insolvent in nine years, according to a city report issued two years ago. The police pension would go broke four years later. All four funds would be broke by 2030.

A look underneath the hood of the police pension fund shows the extent of the problem. It's pretty basic: cops are getting paid more, their retirement benefits are compounding, they're living a long time, and the ratio of active cops to retired cops has changed significantly.

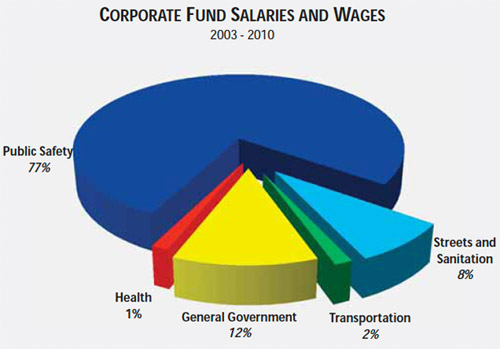

* Salary: In 1972, after four years of substantial raises (11 to 27 percent), the average CPD salary was $13,954, or $76,809 in current dollars. That fell with the crap economy of the late 1970s to $64,932 ($27,233 in 1982 dollars), rose to $70,232 in 1992 ($42,832), and after a 15 percent raise reached $80,776 in 2002 ($63,158). In 2010 the average CPD salary was $82,287. Cops have never gotten quite the series of raises they received from 1968-1971, but they were arguably very underpaid before that, making less than $60,000 in today's dollars.

* Number of police annuitants: In 1979, there were about 3,500. In 2010, there were 8,495. The increase has varied in pace, but not by a lot: from 1980-1990, the number of living retirees increased by 1,480; from 1990-2000, 1,940; from 2000-2010, 1,619.

* The number of spouse, child, widow, and disability annuitants really hasn't; they've actually decreased slightly over the past couple decades.

* The total number of annuitants increased from 7,412 to 12,381 from 1979 to 2010, driven entirely by retired cops (as opposed to disabled ones or family).

* Average annual benefit: here's a big one. 1979: $7,920, or about $25,000 in 2012 dollars. 2010? $53,060. It more than doubled: compound interest at work. By comparison, in 2000, the average benefit in 2012 dollars was $46,605.

* Meanwhile, the number of members in service has stayed about the same: from 12,427 in 1968, reaching a peak of 13,889 in 2001, and declining to 12,737 in 2010. The number of annuitants—cops and family—in 2010 was just 356 more than the number of active service members. The number of people drawing from the fund has increased steadily, while the number of people paying into the fund has stayed relatively stable.

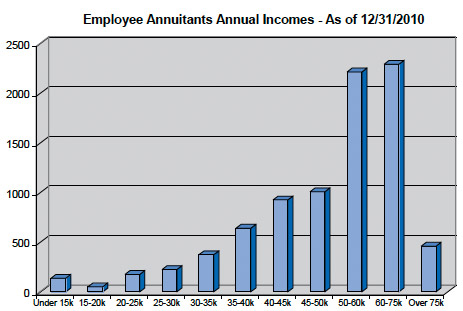

* One of the statistics cited by the Tribune was that "a retiree making a $60,000 pension in 1995 is now receiving $100,000." The vast majority of pensioners, however, bring in less than that:

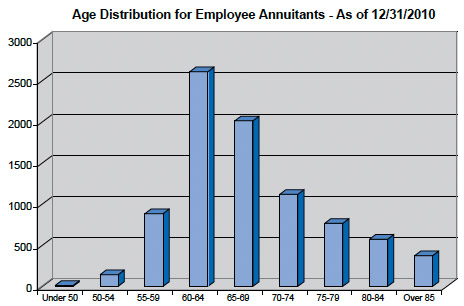

* Whose fault is this? Why, it's the boomers, of course (not that they asked to be born, so blame the Greatest Generation for their fertilty I guess):

* OK, that gives you the lay of the problem pretty well. Has the city been keeping up? Well, it has, kind of. In 1997, the city put in about $109,362,000 (rounded to the nearest thousand), a little bit over the annual required contribution. That's about $153,270,000 in 2011 dollars. In 2011, the city put in $174,501,000… which was about half the annual required contribution. The numbers are a bit funky: in 2006, employer contributions to health care were split off into a separate category. That the city's kept up with better, 72-88 percent from 2006-2010, but that's only about $10 million.

* So the annual required contribution spiked. The number of people paying into the system through employee contributions declined slightly; the number of people drawing from the system continued to increase.

The Tribune has done an extensive, excellent series on "Pension Games," focusing on lawmakers and other clouted leaders who have gamed the system for substantial pensions. A union leader who gets $158k; a lobbyist making $108k; 21 aldermen standing to make $58 million over their lifetimes; and Da Mare's $184k pension. It's both a drop in the bucket and very important. I like to think of it like broken-windows pension policing: a lobbyist pulling down $100k is mere graffiti in the grand scheme of things, but if the powerful aren't tending to their own pensions, they won't tend to the much greater problem of totally above-board pensions for average civil servants.

Meanwhile, the mayor has come out playing hardball with the firefighters as their contract is set to expire. (Then again, his tendency is to come out playing hardball, and step back to fast-pitch softball.) Why? That's where the money is.

It's worth recalling that Emanuel has played hardball/fast-pitch with the teachers union, and a Trib poll found voters provisionally in support of the union. This next step will require some interesting politicking.

Photograph: zhaonameloc (CC by 2.0)