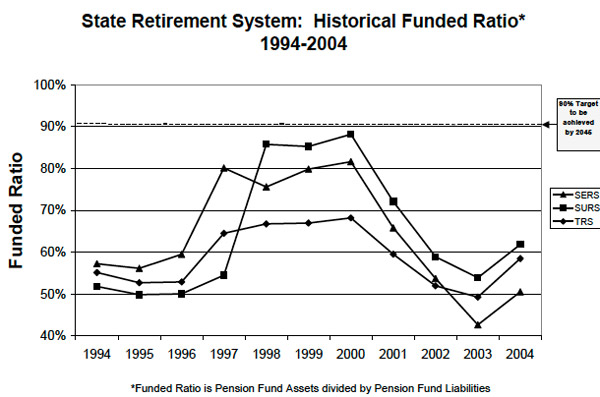

This goes a long way to explain why you've been hearing so much about pensions recently:

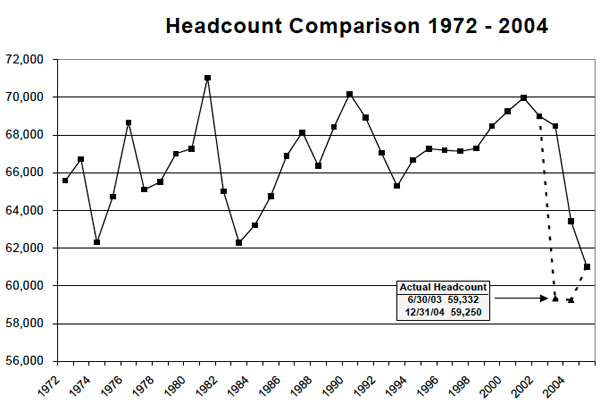

So a bit more than a decade ago, the state retirement systems were actually not in too bad a shape; 60 percent, generally speaking, seems to be the lowest level of pension funding where not everyone agrees you have a problem. What happened? It wasn't just the baby boom. Here's the broad state-government employee headcount through that time:

The 2002 Early Retirement Initiative got a lot of people to retire early—half under the age of 55, which is not what pension funds expect to handle. The ERI decreased the costs of running the state, but increased pension liabilities and threw off the employee-retiree ratio. And then there's this:

The full cost of the ERI was originally assumed to be $622 million in additional unfunded pension liabilities, or approximately $80,000 per employee. However, new calculations increased that amount to approximately $2.5 billion or $200,000 per employee. This represents an estimated $1.8 billion error.

Emphasis mine.

What were the reasons underlying the dramatic increase in early retirement benefit costs? First, instead of accruing a retirement benefit equal to 1.67% of their final paycheck for the first ten years of service, as is usually the case, retirees in “high stress” jobs such as public safety positions were credited with a 2.5% accrual rate. Approximately one third of state employees are classified as working in “high stress” positions. For all other employees, the ERI package waived the penalty that normally would have reduced annual pension payments by 6% for each year an employee was less than 60 years of age at the time of retirement. Therefore, a 50-year-old employee would reap the same benefits as a 60-year-old employee. These two changes added costs of approximately $62,000 per employee, boosting the average ERI cost of $80,000 to $142,000.

And the other $60,000 per employee?

[A]bout half of retires were 55 or younger. Consequently, the State has to pay this groups’ retirement costs for a longer period of time than is usually the case because they live longer in retirement, thereby further boosting costs. The ERI also had provisions allowing retirees to purchase additional years of service. These two additional factors added an average of $58,000 in costs per retiree for a total average cost of $200,000.

ERIs are meant to get veteran, highly paid employees off the roles. So the pensions that hit the rolls were bigger; sweeteners brought up ones that weren't as big.

The ERI only made up some percentage of the pension boom-bust of 1996-2003. A good economy boosted returns and coincided with a change to fair-market-value accounting as opposed to aquisition-cost accounting (here's a quick primer on that; a much longer one). But shifting costs from payroll to pensions put further pressure on a historically underfunded system—just as historically high returns were coming to an end.