Not long ago I interviewed U. of C. prof Amir Sufi about House of Debt, his new book with Princeton's Atif Mian, about the origins of the financial crisis in household debt and the shadow it still casts. In (very) brief, their argument is that people borrowed too much money—particularly people who could ill-afford to do so—many of them putting into or taking it out of home equity. When prices fell, it represented a massive loss of wealth, which curtailed spending and continues to drag on the economy.

Now Sufi and Mian take a look at what that looked like in Chicago during the run-up to the economic crisis and after the wave broke. The patterns look extremely familiar.

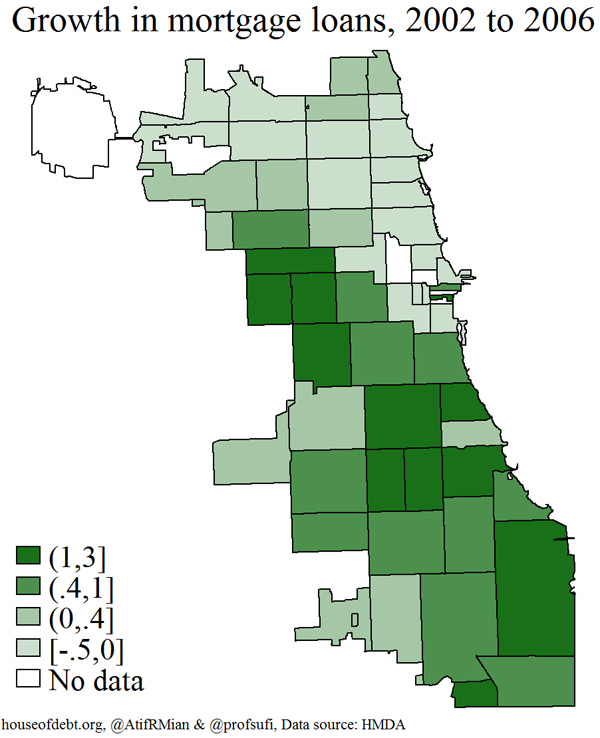

The areas with the greatest increase in mortgage loans line up almost perfectly with the city's lowest-income neighborhoods, not to mention many that were losing population, and, though with less correlation, income.

As Mian and Sufi point out, that's also where you'll find the highest density of foreclosures in 2009. (One exception to the low-income, high-lending trend: if you look close, lending was intense in the South Loop and foreclosures later on.)

So that, you might expect—more lending, more foreclosures. But the authors find another interesting geographical overlap.

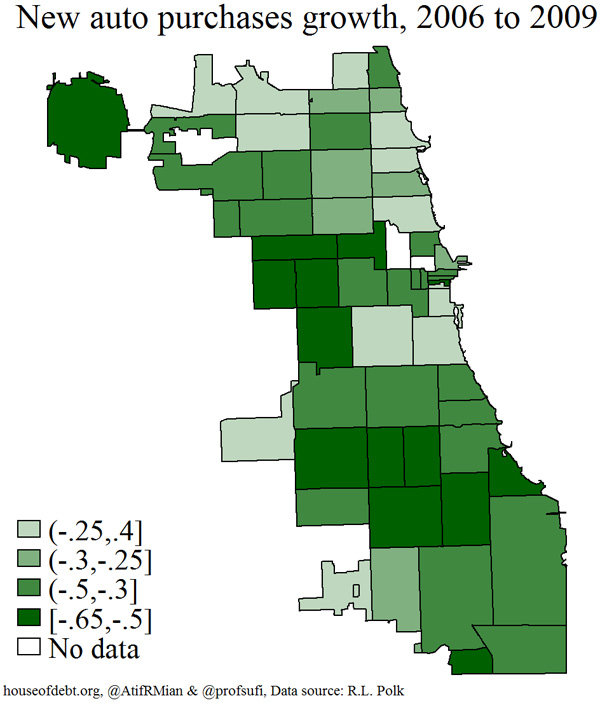

Again, pretty strong correlation between high mortgage lending and a decrease in auto purchases. (There is a drop in auto purchases on the near north side, but maybe it's because center-city dwellers are finding they don't need cars?)

Why are Sufi and Mian so interested in cars? Two reasons: it's easy to track auto sales over time and by place, and because it turns out to be predictive of GDP growth. So it could serve as a bridge between micro- and macroeconomics, reflective of trends at the zip-code level but useful to scale up to a much greater level.

It also reminds me of something I wrote on debt and its overhang, over a longer period of time—how wealth, or its absence, is passed down from one generation to the next, and how wealth at the lower end of the economic spectrum is concentrated in housing. (It also echoes issues of housing, migration, and race in places like Milwaukee and Chicago.) Destructions of wealth ripple throughout cities over decades, often with ill effects for the future. It's one reason Sufi and Mian are suggesting we rethink how we deal with debt, and rethink how we design our financial instruments to reduce and redistribute risk.