The Merc, circa 1982. I demand a red-suit dress code as part of the tax break.

The CME-Sears tax-break bill—which also features more modest breaks for other businesses and for individuals—came to an unlikely, crashing halt late last night in Springfield. It's a mess, though the CME/CBOE and Sears elements of the bill seem to be tangential, insofar as you can separate them, from the reasons the legislation failed. The Senate version of the bill got destroyed in the House, but as the Sun-Times reports in the clearest account I've read, the differences amount to about $75 million over the earned-income tax credit and a (comparatively) small Chicago theater-district break.

Greg Hinz had an interesting reaction:

Mr. Madigan recused himself from a bill that would have given CME Group Inc., CBOE Holdings Inc. and Sears the tax breaks they say they need to continue to call Illinois home. That left the "B Team" in charge, and it performed about as well as Caleb Hanie did last weekend.

But I do have some quibbles with this:

The blame has to start with CME. It has a reasonable case to make that the state's current income-tax code is stacked against it, since it alone pays 6% of all corporate income taxes collected by the state.

But instead of making the case that helping a rapidly growing, high-value firm stay here is of value to everyone in Illinois, the company demanded tax concessions almost as an entitlement, rather than as a reasonable request.

CME and CBOE have been whipping boys in the debate, since, as a lot of people have pointed out, they've been making money hand over fist recently: CME revenues recently jumped 29 percent, thanks to economic chaos driving the futures markets. Here's what CME Group's Terrence Duffy has to say about that:

Terrence Duffy, chairman of CME Group, said Wednesday the higher rate is costing his company $50 million a year. Duffy also criticized the state for maintaining tax loopholes that grant favors to a few companies at the expense of others.

On one hand, $50 million is about one-sixth of CME's most recent quarterly income. On the other, he's right that some companies get tax breaks and others don't, though "a few" is putting it modestly (CME did get a tax break from the city, but as of earlier this month they hadn't used it yet):

Tax-break deals with 107 companies will expire in 2012, 2013 and 2014, according to records obtained by The Associated Press through a Freedom of Information request. Those deals, worth more than $100 million, run out at a time when other states view Illinois as a prime target for poaching after this year’s tax increases stirred unhappiness in the state’s business community.

[snip]

Deals that expire next year include $34.7 million in tax breaks that J.P. Morgan Chase used after agreeing to keep 2,247 jobs at locations in Chicago, Elgin and Elk Grove Village, and $6.72 million in breaks provided to the Robert Bosch Tool Corp. after that company agreed not to move 444 jobs from a facility in Mount Prospect.

The CME Group employs about 2,500 people, a large percentage in IT.

CME's case is that lots of companies get tax breaks, so why not them? That they could be more polite about it is kind of tangential; that they can afford it is a less effective argument when JP Morgan Chase ($4.26b in third-quarter profits) gets a tax break too.

Then there's Sears:

As of October 29, the company had cash balances of $632 million, down from $1.4 billion at January 29. Total debt was $4.6 billion at October 29, 2011, up from $3.5 billion at January 29.

Sears lost $412 million in the third quarter, almost double what it lost in the same quarter last year, which is why it's on a lot of corporate death-watch lists.

You could argue that CME "deserves" a break more than Sears because you want to retain strong companies ahead of weak ones. Or you could argue that Sears deserves it more because the state should give a lifeline to a large employer as it tries to figure out what it is besides a real-estate holding company. Or you could argue that CME produces a lot in corporate income taxes, and that's what we need to preserve. Or you could argue that Sears employs more people, and jobs are the point.

And if you really want to get deep in the weeds, you can start parsing through how corporations in Illinois are taxed and what loopholes/credits exist

All of which has some basis in logic, and all of which can be exploited by companies with the lobbying muscle to do so. It's a fiscal and legislative mess—besides the unfairness, it's just wildly inefficient—not easily handled by what Hinz calls Madigan's "B team."

So what to do? Why not cut the corporate tax? Like, a lot? What about all of it? Nathan Anderson, of UIC and the U of I Institute of Government and Public Affairs (and co-author Joshua Miller) make an interesting case for it.

Targeting a tax at some disembodied sector of the economy named business will ultimately be unsuccessful. People pay taxes and ultimately some person, not some legal entity, will bear the economic burden of the corporate income tax. The burden might come in the form of lower wages, higher prices, or lower after-tax profits for owners of firms. It is not known for certain which persons will bear the burden of the tax.

If a business cannot really pay a tax, then why does Illinois have a corporate income tax? One prominent argument for a corporate income tax is that corporations have a high ability to pay so they should pay more taxes than, say, a middle class family. This argument addresses the equity of the tax system and assumes that it is relatively wealthy business owners, not workers and consumers, bearing the economic burden of the corporate income tax.

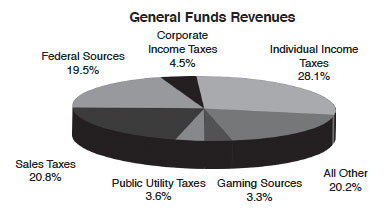

This might sound, out of context, like radical drown-the-government theorizing. But the first thing to remember is that corporate taxes don't make up that big a piece of the state's revenue right now. Here are the 2010 numbers:

("All other sources of revenue, including cigarette, liquor, insurance, inheritance, short-term borrowing, and other miscellaneous sources totaled $6.133 billion for fiscal year 2010 and accounted for 20.2%.")

4.5 percent is equal to $1.36 billion. Income tax is the largest; 28.1 percent is equal to $8.511 billion.

Anderson's preference is for lowering—or eliminating—the corporate tax and making up for it with a switch to a progressive income tax from the state's current flat tax structure, which puts the state in a minority of the states that tax personal income:

The implementation of a progressive individual tax and the elimination of the corporate income tax better serve both of the above arguments. A progressive income tax directly ensures that persons of higher means will pay more in taxes. Furthermore, Illinois already taxes the income from most corporations under the individual income tax code. Taxing individual income rather than business income would also encourage business investment to occur where it is most productive rather than where taxes are lower.

As states go, Illinois has a comparatively high corporate income tax and a comparatively low income tax, even with the jump from three percent to five percent. In the last gubernatorial election, Dan Hynes proposed a graduated, progressive income tax that started at the then-three-percent rate for all income under $200k, rose slightly for the $200k-$300k bracket, eventually going up to 7.5 percent for income over $1 million. Hynes said it would generate $5.5 billion, but Josh Kalven provided a convincing analysis that it would have generated $2.3 billion in FY 2007.

[Why those figures are so different is worth reading, if you're interested: "Using 2007 tax liability data supplied by the Illinois Department of Revenue (IDOR), Baiman estimates that approximately half of the income generated by the richest Illinoisans is actually taxable here. Hynes' projection, however, seems to assume that most of their income would be subject to his higher tax rate." Adam Doster goes into considerable detail about the significance of S-Corporations in the state's tax base. For more on those versus C-corporations, IDOR has even more (PDF).]

Hynes's proposal, while it might seem wildly progressive by Illinois standards, went pretty easy on soaking the rich: 7.5 percent is higher than most high-income-bracket taxes, but it kicks in at a much higher level than any state besides California, which taxes income over one million dollars at 10.3 percent. Most states with progressive income taxes start their highest bracket at much lower levels: Idaho's starts at just under $52k for couples; New Jersey's at $500k; Virginia at $17k; Vermont at $379k; and so forth.

Meanwhile, in FY 2007, the corporate tax brought in $2.19 billion. In other words, an income tax structure that's politely progressive would have completely offset the complete absence of a corporate tax in 2007. From a quick look at income stratification in 2007 versus 2009, I don't see why that wouldn't have been the case going forward.

How likely is any of this? Not very, at least anytime soon; changing the state tax structure would require changing the state constitution, and the CME/Sears bill ran aground on the much smaller progressivity of the earned-income tax credit. And even completely removing the corporate income tax wouldn't solve the problem of some corporations being more equal than others. Texas has no corporate tax, but that doesn't stop it from trying to incentivize certain businesses, like offering $25 million a year to Formula One racing. There will always be taxes for companies to try to lower; after all, Sears's beef is with property taxes. But it might at least slow down the stampede of incentives, which favor some companies and anger others.

And recall that there are a hundred-some breaks set to expire in the next couple years, and all that backscratching and handshaking comes at an efficiency cost on both sides, as Anderson writes: "Rather than simply facing lower tax rates in Illinois, a business is forced to navigate through a variety of tax credits, and it costs the state money to keep track of applications and the credits across years." Not to mention the economically negligible logic costs, which don't have a fiscal cost outside the desks of a handful of public-policy nerds, but are infuriating nonetheless.

Update: Another CME beef:

The bill came about after lawmakers approved an increase in the state corporate income tax that CME Group executive chairman Terrence Duffy said unfairly taxed transactions on the futures exchange that do not derive from Illinois.

Another way of putting it, from Greg Hinz:

CME has been complaining that almost all of its sales worldwide are taxed in Illinois, meaning that it alone pays 6% of the corporate income taxes the state collects annually from all companies.

There are some details in Anderson and Miller's article that illuminate this. For instance:

Currently, Illinois’ share of a company’s total U.S. taxable income equals the share of the company’s total sales that occur within Illinois. A corporation with $10 million of total U.S. income and 30 percent of its sales within Illinois owes Illinois corporate income taxes on apportioned income of $3 million.

[snip]

The 2001 switch to 100 percent sales apportionment, or single sales factor (SSF), was designed to attract and retain manufacturing firms. Under SSF, corporations making additional investments in property and increases in payroll do not incur increases in Illinois corporate tax payments. The switch to SSF, however, did not reduce total corporate tax liability for all corporations with property and payroll in Illinois. Any corporation with more of its sales in Illinois than property or payroll experienced an increase in corporate tax liability. For example, a corporation with 80 percent of its property and 80 percent of its payroll within Illinois, but 90 percent of its sales within Illinois would see its corporate tax liability increase rather than decrease. At the other extreme, a corporation with 100 percent of its payroll and property but none of its sales

within Illinois would pay no corporate income tax.

This is actually pretty important. Duffy's complaint, as I understand it, is that companies don't get taxed income on physical out-of-state sales, but his company gets taxed on sales to people out of state that "occur" on computers at CME.

Since this is as much a metaphysical and legal question as a public policy one, it's kind of bottomless, and I don't have an answer for you, but I understand the logic behind Duffy's complaint.

Photograph: MojoBaer (CC by 2.0)