Chicago's lease of its parking meters has been widely reviled, both by those of us who pay the fees and by the advocates who argue they were given up for far less than their long-term value. It's a clear-cut case of selling the future to pay for the present, expensive as the present may have been.

Less criticized has been Indiana's lease of its toll road, which was leased shortly after Mayor Daley leased the neighboring Chicago Skyway. At the beginning, it looked swell, John Gilmour writes in a study of the deal:

As Indiana was engaged in the leasing process, the state commissioned a study of the ITR lease by a consulting firm, Crowe-Chizek of Indianapolis. The Crowe-Chizek (2006) study found that if the ITR remained under public control and tolls rose about as fast as they had in previous decades over the next 75 years, the net present value of future tolls, less operating costs, would be $1.92 billion. The cash payment that the state received was about $2 billion higher, indicating that the state received a very good price.

If you're familiar with the lease of Chicago's parking meters or controversies over recent toll increases in Chicagoland, one reason for skepticism should be apparent: tolls have a tendency to not rise very quickly, because it's politically unpopular, so assuming that a private, profit-making company would stick to the same recalcitrant schedule is, well, generous. Warning flares went up (emphasis mine):

Enright (2006) conducted an alternative evaluation of the value of the lease. He contended that the Crowe-Chizek study had relied on low estimates of future traffic growth and high estimates of future maintenance costs and employed too high a discount rate. Using estimates that he contended were more appropriate, he found that the present value of the 75-year stream of revenue from the ITR exceeded the up-front cash payment by more than $1 billion.

So: the discount rate. The most basic way to look at it is that it's a reverse interest rate, how much money your dollar loses over time: (PDF): "In economics lingo, the degree to which a dollar in revenue next year is perceived to be less valuable than a dollar received today is known as the 'discount rate.'"

But it's also a very tricky area where math and ethics intersect.

Everyone actually does this in their own lives. A dollar now is worth more than a dollar next year, because you can earn interest on that dollar; if you can get ten percent on it, it'll be worth $1.10 next year (minus inflation). That's part of the rationale. But there are others, that get a lot trickier. Here's one:

Postponed benefits also have a cost because people generally prefer present to future consumption. They are said to have positive time preference.

Now instead of the comfortingly tangible world of interest, we have preference. And then:

if consumption continues to increase over time, as it has for most of U.S. history, an increment of consumption will be less valuable in the future than it would be today, because the principle of diminishing marginal utility implies that as total consumption increases, the value of a marginal unit of consumption tends to decline.

So on top of preference, we've added assumption. Which have to be stuffed into a number by consultants so they can tell politicians to buy or sell stuff.

Which they do, even though there's wide disagreement on what that number should be, depending on the timeframe. For obvious reasons: it's one thing to ask you what your consumption preference is now compared to, say, ten years from now (generally, you prefer it; look, economists say you do, so play along). It's another to ask you what your consumption preference is compared to the preference of your potential future grandchildren or great-grandchildren, who could be squashed by an asteroid or toiling under the socialistic tentacles of one-world government.

In that case, your dollar wouldn't be worth a damn thing, meaning the discount rate is very high.

According to the OMB, you should care about your potential future grandchildren, or at least those of other people, and calculate "intergenerational discounting" differently from intragenerational discounting:

Some believe, however, that it is ethically impermissible to discount the utility of future generations. That is, government should treat all generations equally. Even under this approach, it would still be correct to discount future costs and consumption benefits generally (perhaps at a lower rate than for intragenerational analysis), due to the expectation that future generations will be wealthier and thus will value a marginal dollar of benefits or costs by less than those alive today. Therefore, it is appropriate to discount future benefits and costs relative to current benefits and costs, even if the welfare of future generations is not being discounted. Estimates of the appropriate discount rate appropriate in this case, from the 1990s, ranged from 1 to 3 percent per annum.

The OMB is saying that you should assume your dollar now is more valuable than people often assume (anywhere from three to 15 percent). So if you're selling the future value of something now, you should, obviously, ask for more money. But consider the other side of the deal: the buyers want to pay the least amount possible, either because they want to get rich or because they foresee more risk than you do, and risk means a higher discount rate. That's what William Blair told the OIG when he said the parking meter sale was a bum deal:

Second, the Blair analysis found that the OIG used an inappropriately low discount rate (7.0 percent) in estimating the meter system's value, based on a faulty assumption that the parking meters are a "very low risk" enterprise. By contrast, in its own valuation analysis, the city used discount rates in the range of 10 to 14 percent to reflect a medium-to-high degree of risk. Blair notes that there are substantial risks associated with the operation and value of the system that were transferred from the city to the concessionaire in the deal, including system utilization risk, long-term operational risk and other risks associated with the potential for changes in population, economic activity, technology, public transit usage, fuel costs and numerous other factors that affect the long-term economic value of the system.

I.e. when President Malia Obama bans cars and makes everyone ride bikes and buses to work, the parking meters are going to be worth exactly squat, so that money could discount really fast. Or something less drastic: the decline in vehicle miles traveled implies that people will just continue to drive less, and thus park less often.

So it's hard. The OMB (and some economists) think the discount rate for something like a 99-year meter lease should be really low because they don't want us to screw our kids: one to three percent. Investment banks are jumpy about a low discount rate because of all the terrible things that could happen that would make their dollar now totally worthless when our kids are totally done with cars: 10 to 14 percent.

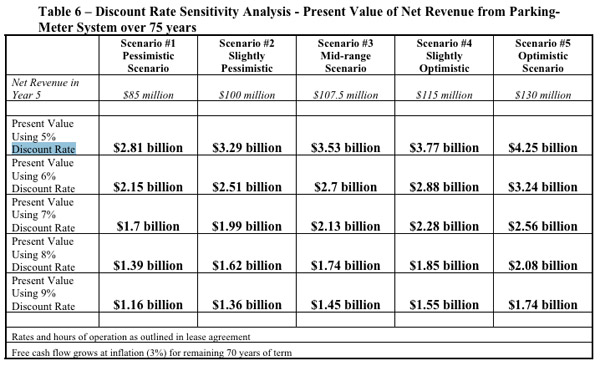

Felix Salmon describes the second half of the parking-meter lease as "option value": "there’s a possibility that it might be hugely lucrative, but there’s also a possibility that it’ll be worth nothing. Looking at the price, it doesn’t seem that the buyers paid anything at all for the option, so it was silly of Chicago to just give it away." (FWIW, he describes the idea of a three-percent discount rate as "ludicrous" and 11 percent as "pretty high.") Chicago's OIG calculated the value of the parking meters for different discount rates, lower than the 11 percent used, and found this:

Under the most pessimistic scenario, the difference within a fairly narrow range of the discount rate can take the deal from "not bad" to "we got completely screwed."

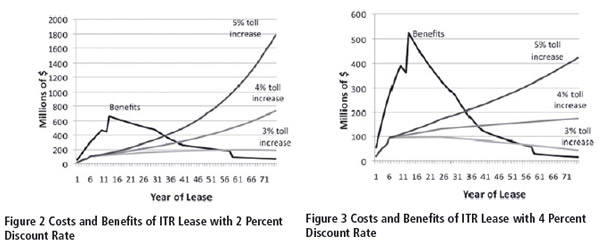

Here's what that actually looks like, using Gilmour's calculations of the Indiana Toll Road as an example.

While Gilmour is critical of the ITR deal, he does note that it's much better than Chicago's two big leases:

The ITR lease is particularly useful for this purpose because, of all of the major leasing arrangements, it is structured in a way that most protects future generations by directing the bulk of the proceeds to investments in roads that will pay significant long-term benefi ts to the public. By contrast, the up-front payments received by the city of Chicago in exchange for the Chicago Skyway and parking meters largely went to pay for current government operations or to provide benefits over a few years.

Gilmour argues that it's a good deal for politicians, because high discount rates make their deals look awesome while being far too dead to care once the costs start significantly outweighing the benefits, and the complexity of this sort of deal means that constituents don't know the difference. But it's less complex than it is controversial and confusing. The idea of a discount rate really isn't that difficult. The math is tricky, but there are plenty of people out there to run whatever numbers you want. Much harder is assigning social values to it.

Photograph: billjacobus1 (CC by 2.0)