Booth and Kellogg, the business schools of the University of Chicago and Northwestern, have been producing something they call the "Financial Trust Index" for a couple years, inspired by the financial crisis (emphasis theirs):

There was no apparent shock to productivity nor a clear slowdown in innovation. The government has kept taxes low. The Federal Reserve has kept interest rates low and cut them even further. What happened?

[snip]

Something important was destroyed in the last few months. It is an asset crucial to production, even if it is not made of bricks and mortar. While this asset does not enter standard national account statistics or standard economic models, it is so crucial to development that its absence — according to Nobel laureate Kenneth Arrow — is the cause of much of the economic backwardness in the world. This asset is TRUST.

It's an odd question. Do I trust my major bank? To not lose my money, to have functioning ATMs and a robust online banking system, sure. To be a good corporate citizen? Well, that's a different question. But there's room for odd questions in economics and the social sciences, and something to be said for sampling broad-based, inchoate fear, since that's more like what the world runs on.

"Wave 12" of the quarterly index is out (h/t The Big Picture):

“First, only 23 percent of those surveyed say they trust the country’s financial systems, down from 25 percent in our last report in June 2011. Also, nearly 60 percent of respondents in our survey said they are angry or very angry about the current economic situation – the highest level of anger we’ve found since the earliest months of the financial crisis,” said Luigi Zingales, the Robert R. McCormack Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business and co-author of the Financial Trust Index, a quarterly look at trust in America’s financial systems.

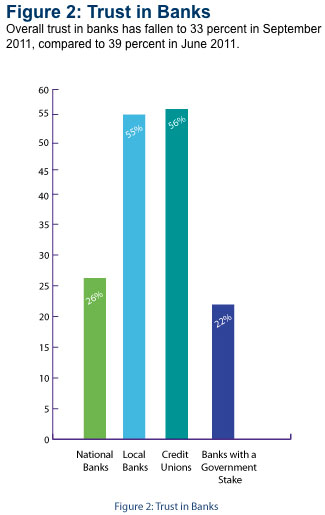

Most of the results won't be too surprising. For instance:

Zingales calls this "worrisome." I understand where he's coming from, but maybe it's also perfectly sensible. Via The Big Picture, some credit unions are seeing spikes in membership, including the Chicago Patrolmen's Federal Credit Union. Not a surprise given encroaching fees; Brad Plumer finds some neat data on the degree to which fees force people out of bank accounts. I'm considering dropping mine, as I'm shy of the threshold my bank's setting to ding people with $25/month fees.

I'm not mad; they don't want my money all that much, which is their business. And there's an interesting story behind that, as an excellent New York Times article explains. The economy is bad, so people are getting out of the market and into banks, which results in them having a lot of money. And because the economy is bad, they don't have many places to loan it, and furthermore are getting crap returns when they invest deposits. It's a circle of stagnation, and they don't want all these little deposits cluttering up their vaults. Message recieved!

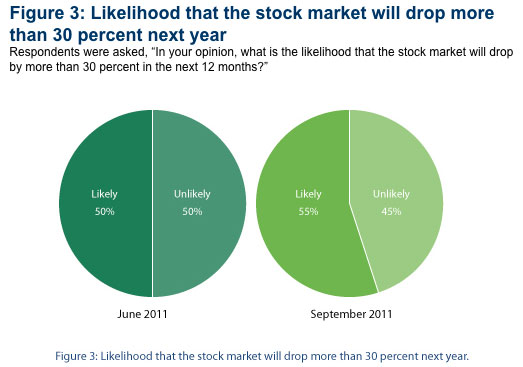

Speaking of the market, this is why people are getting out of it and into the banks that don't want their money:

I.e.: 30 Percent of the End Is Near, Repent Now.