Been reading up on the CME/CBOE request for a tax break. I don't have an answer for you—the tradeoffs are pretty obvious—though I'm a bit perplexed and a bit resentful that the computer jockeys will get a cut but not the good old fashioned open outcryers.

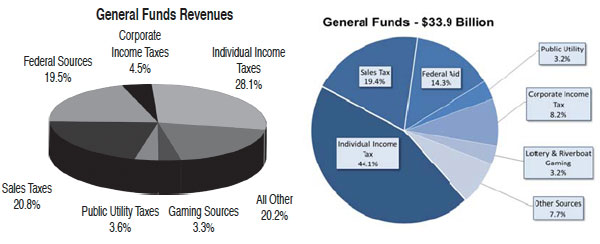

If you want, in brief, one reason why the corporate income tax got hiked, note the drop in corporate tax revenues from 2008-2010: $3.72 billion, $3.56 billion, $2.69 billion. Individual and replacement taxes also collapsed; total state collections dropped about $4.5 billion from 2008-2010 (PDF). With the hike, YTD corporate tax revenues (PDF) are up $40.8 million as of August, a 54.6 percent increase over fiscal year 2011. For what it's worth, here's the corporate piece of the pie compared to everything else, circa 2010 and 2012:

One overlooked hole in the state budget is the vanishing Illinois estate tax. YTD 2011: $53.4 million. YTD 2012: $3.3 million. The gap so far is about half what CME/CBOE seeks.

What happened? The State of Illinois didn't exactly have its own estate tax. It essentially piggybacked on the federal estate tax, which was phased out by the Bush administration and reinstated by the Obama administration, leaving a one-year gap. No federal estate tax means no Illinois estate tax revenues.

The best explanation I've read comes from Adam Doster at Progress Illinois, who reported extensively on the state estate tax: why it disappeared for a year and how coupling the taxes worked. In the State Journal-Register, Tim Landis has the latest on the estate tax. I'm not really doing the complexity of the issue justice, but revenue estimates range from $200 to $300 million a year. It's starting to come back at the rate of about $20 million a month, but that revenue stream completely dried up for a year.

Photograph: Ken_Mayer (CC by 2.0)