During his budget address (PDF), Rahm Emanuel mentioned the following about pensions:

So, here is the hard truth: in less than four years, payments to meet our pension obligations will comprise 22 percent ofthe City's budget – one out of every five dollars. That's $1.2 billion of taxpayer money, and growing, each year after that.

[snip]

If we choose to keep those services and make no changes to our pension system, you and I would have to ask taxpayers to pay 150 percent more in property taxes. That is unacceptable to me. I think it is safe to assume it is unacceptable to you. And I know it is absolutely unacceptable to the homeowners of Chicago.

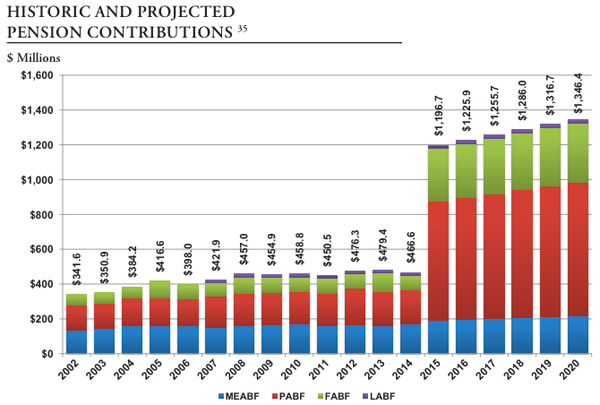

Why so much, and why "in less than four years"? The numbers come from the city's annual financial analysis (PDF). Here's what it looks like:

Alphabet soup translation: MEABF is civil servants and non-teacher CPS employees, LABF is labor services, FABF is firefighters and paramedics, PABF is cops. The footnote is vague but non-trivial: "All projections are based on actuarial assumptions regarding future conditions, which are subject to numerous political, economic, and other factors; while reported projections are the best estimates available at this time, these should be viewed as approximate." In other words, political warring TK.

The big jump comes from 2010 legislation enacted by the state, which earned the ire of then-mayor Daley:

Chicago Mayor Richard M. Daley accused his fellow Democrat, Illinois Governor Pat Quinn, of imposing “the largest property-tax increase in the history” of the city by signing a pension-overhaul bill into law.

[snip]

The legislation requires Chicago to fund its public-safety pensions at 90 percent of projected obligations within 25 years. That is “a higher ratio and shorter timeframe than every other municipality in the state and the state’s own employee pension system,” according to the statement from Daley’s office.

It's not a long time frame, but the collapse also happened very quickly, as Jason Grotto explained that year:

It hasn't always been this way. The pensions were run successfully for decades and, just 10 years ago, were relatively well-funded. The teachers pension was close to 100 percent funded in 2000. Municipal workers had funding levels above 90 percent. City laborers had enough assets to cover 133 percent of their liabilities. The city's police pension, traditionally underfunded, hovered around 70 percent.

By the end of this year, however, not one of the pensions' funding levels will be above 70 percent. The police and fire funds are already below 40, and the municipal fund is below 50.

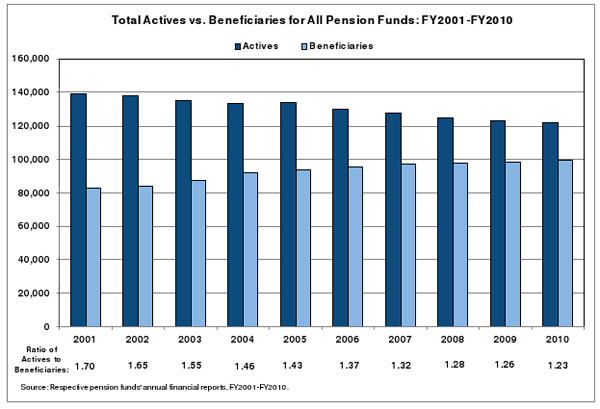

One cause: the ratio of active employees to pensioners (PDF):

SB3538, opposed in part by City Council (PDF), started the clock to get Chicago's municipal pensions up to speed in 2015, giving the city 25 years to reach 90 percent funding (which, admittedly, is a fairly high standard as far as "fully funded" pensions go). Emanuel called out the state legislature regarding pensions in his address—"what we really need is for our representatives in Springfield to step up, take their share of responsibility"—but was didn't say what that meant. With the big pension wall coming in 2015, there are a lot of fronts to fight, wheedle, and negotiate.