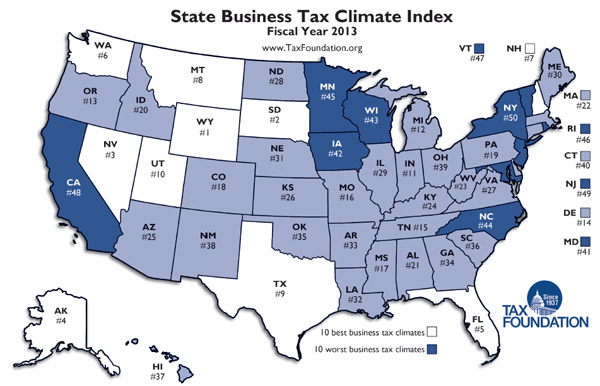

The Tax Foundation (via Muniland's Cate Long) has an interesting look at state tax climates for business. It may surprise you to learn that Illinois isn't considered a high tax state. (Sort of.)

One reason is that the Tax Foundation weights different taxes for its index. Income taxes are one-third of their rankings, and Illinois's income taxes—even after the recent hike—are comparatively low, just 13th in the country (a low rank means low taxes, and Illinois has a flat, non-progressive income tax, which the Tax Foundation considers this as good for the business climate). By other measures, the state has pretty high taxes: 47th in corporate income taxes (9.5 percent), 34th in sales taxes, 43rd in unemployment insurance, and 44th in property taxes.

But this isn't close to the whole picture. Illinois has a high nominal corporate tax rate, but:

Two-thirds of corporations filing Illinois returns owed no taxes in 2008, according to the most recent data available from the state Department of Revenue. Economic conditions caused some of that, but the state's tax rules also let some off the hook.

[snip]

And a significant restructuring took full effect in 2001 that effectively slashed the tax bills for multinational corporations, many of them manufacturers. The state restricted the tax to profit stemming from in-state sales and eliminated property value and payroll size from the formula.

The goal was to encourage growth in the state's manufacturing sector, though as it turned out employment levels plummeted. The change was expected to cost the state an estimated $63 million a year when it first was implemented. More recent estimates are unavailable because companies no longer report their Illinois payroll and assets.

[snip]

Partnerships and closely held firms do not pay the corporate income tax, except for a reduced personal property replacement tax of 1.5 percent of Illinois income. Their company profits flow to partners and shareholders and are taxed at lower individual rates, which the state hiked from 3 to 5 percent until 2014.

In 2008, only about half of these filers had a tax liability. Of those who paid taxes, the average bill was $2,339.

There are a lot of caveats to Illinois's 9.5 percent corporate income tax:

When all state and local taxes are considered, Illinois has the fifth-lowest effective tax rate in the country, at 4.6%, according to a 2011 study by Ernst & Young LLP. The study is based on data that don't reflect the recent income tax hike, but Ernst & Young says the impact of the increase on Illinois' effective tax rate would be relatively minor.

[snip]

"There are so many deductions and writeoffs, very few companies pay the nominal rate," says John Boyd, a site-selection consultant and principal at Boyd Co. in Princeton, N.J.

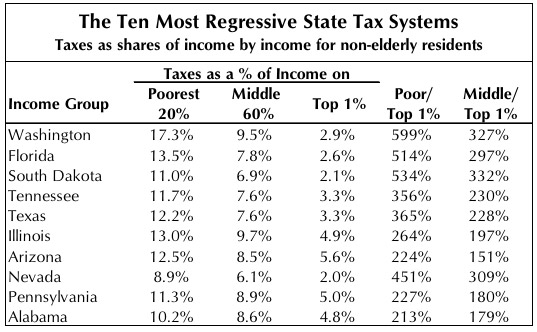

Then there's the matter of the flat tax, which falls heaviest on low-income taxpayers (PDF):

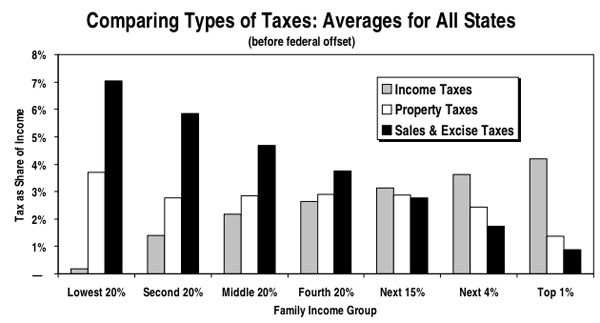

Which cuts against national trends:

By the broadest measures, it's a moderately high tax state, but there's a great deal in the details.