Of the many thousands of pages that the great Robert Caro has written, some of my favorites are not about power or urban planning or the machinations of Congress, but a detailed and moving description of the typical housewife's duties in rural Texas in the early-to-mid 20th century, in a famous chapter of his Lyndon Johnson autobiography: "The Sad Irons." Before describing how Johnson's work on rural electrification created the future president's path to power, Caro devotes significant time to how difficult things were before that, particularly for women, whose jobs were as difficult—both in terms of time and physical labor—as anything in a factory:

Wielding an iron in those days meant tossing around six or seven-pound wedges of iron, often without handles, that had to be heated over a fire, where soot sometimes accumulated and, despite every effort, sent another garment back to the original washing tub. Also despite every effort, women burned their hands from time to time, which didn’t excuse them from hauling six and seven-pound loads of clothes around all day.

In many areas, this state of affairs continued into the 1930s (when 90 percent of rural households didn't have electricity) and the 1940s. Electrification and running water did away with the sad irons, turning difficult, hours-long household labor into household chores, and with them the need for someone—almost always a woman—to run the house as a full-time job. More women pursued higher education; more women went into the workforce; and one of the many implications was a massive gain in economic productivity.

It's no wonder, then, that Northwestern economist Robert Gordon (via Bloomberg Businessweek) includes both electrification and the entrance of American women into the workforce as two of the most important results of the turn-of-the-century industrial revolution and the extraordinary gains in GDP that resulted, using language similiar to Caro's (emphasis his):

Every drop of water for laundry, cooking, and indoor chamber pots had to be hauled in by the housewife, and wastewater hauled out. The average North Carolina housewife in 1885 had to walk 148 miles per year while carrying 35 tons of water. Coal or wood for open-hearth fires had to be carried in and ashes had to be collected and carried out. There was no more important event that liberated women than the invention of running water and indoor plumbing, which happened in urban America between 1890 and 1930.

It's pretty great. But there are only two sexes to go into the workforce. There aren't too many more minutes left to shave off of washing clothes (folding is still a barrier). Gordon argues that we've already locked in most of those gains as far as effect on economic growth (perhaps more women in positions of power and greater financial equity, would increase economic productivity, but nothing like going from the 1930s to now). What then? This:

By other measures:

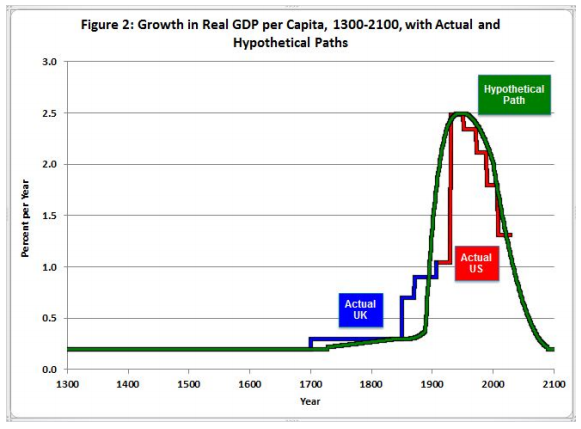

[D]oubling the standard of living took five centuries between 1300 and 1800. Doubling accelerated to one century between 1800 and 1900. Doubling peaked at a mere 28 years between 1929 and 1957 and 31 years between 1957 and 1988. But then doubling is predicted to slow back to a century again between 2007 and 2100. Of course the latter is a forecast, and the rest of this essay provides support for its plausibility.

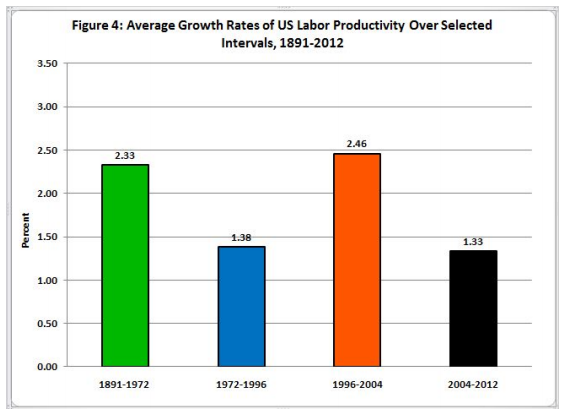

And the rate of growth has slowed. With stagnant incomes, shrinking government, labor tensions, rising oil prices, and synth-y dance music, a number of people have observed that it feels a lot like the 1970s. And they're right:

If you started thinking "but what about the New Economy of the Internet?" Gordon points you to that chart. It was a nice bump in productivity growth, but it, too, got locked in. It also got smoothed out more than you might think, in part because the microchip revolution that made the New Economy possible started before the rise of the Internet with the efficiency of robotics and supply-chain management, which New Economy companies have piggybacked on. Companies like Amazon have squeezed unimaginable efficiencies out of the chain, but it was happening before that; the Internet has accelerated that process, but it was happening before broader acceptance.

Gordon admits that his argument is in part a provocation. People have predicted the end of society-changing innovations before and something's come along; it's more a warning that we can't necessarily count on 20th century growth rates in the 21st. But he even spots us game-changing innovations and sees still more problems:

Although the central theme of this article is that innovation does not have the same potential to create growth in the future as in the past, nevertheless let us start by assuming that future innovation propels growth in per-capita real GDP at the same rate as in the two decades before 2007, about 1.8 percent per year. This strains credulity as a forecast for the future, in that the ICT-driven internet productivity revival of 1996-2000 is included in the performance outcome of the two decades 1987-2007. To start a forecast for 2007-27 at the same growth ratemakes the heroic assumption that another invention with the same productivity impact of the internet revolution is about to appear on the near-term horizon. Thus our starting point is quite optimistic.

[snip]

If inequality continues to rise as it did in the last two decades, income for the bottom 99 percent of the income distribution will grow about half a point slower than 1.4 percent, bringing us down to 0.9. Globalization could continue to hollow out middle-level jobs, bringing the rate down to 0.7. Higher energy taxes could bring the rate down to 0.5. And a combination of consumer debt repayments, income tax increases, and reduced transfer payments, could plausibly reach the 0.2 percent annual rate assumed by the hypothetical green line in Figure 2. These final subtractions would not necessarily reduce real GDP growth but would force real consumption of the bottom 99 percent of the income distribution to grow more slowly than real GDP as debt is repaid.

And it's not just inequality. Women leaving the house, going to college, and joining the workforce wasn't the only immense 20th-century labor change; in the wake of World War II, more people began to finish high school and attend college, with very good implications for productivity and innovation. A college degree is much more of an expectation than it was even 30 years ago. Continuing the pace of improvement in academic achievement gets harder as high school graduation rates have improved (which, I suspect, is one reason why people are freaking out about school reform these days—as the curve gets steeper, it's harder to push gains up the hill). And as Gordon notes, we're backsliding; more students may be prepared for college than in, say, the 1950s, but college has gotten more expensive (the California higher-education system is a good example of this).

The second headwind already taken into account in the 2007-27 forecast is the plateau in educational attainment in the U.S. reached more than 20 years ago, as highlighted in the path-breaking work of Claudia Golden and Lawrence Katz (2008). The U.S. is steadily slipping down the international league tables in the percentage of its population of a given age which has completed higher education. This combines several problems. One is the cost disease in higher education, that is, the rapid increase in the price of college tuition relative to the prices of other goods. This cost inflation in turn leads to mounting student debt, which is increasingly distorting career choices and deterring low-income people from going to college at all. Not everybody gets a scholarship.

In all, Gordon is outlining a bad but not worst-case scenario, with the implication that we have to consider the possibility that GDP growth in the short-to-medium term just won't be very high, and the implications of that are enormous. Medicare costs are indexed to GDP growth; Social Security costs are often expressed in their relationship to GDP growth. So much of what American government is at every level was invented during a period of what Gordon argues is unrealistic GDP growth, so if his forecast is realistic, we have to figure out how it can work in this new context while waiting for the next new thing.