My former colleague Ben Joravsky found himself on the Brown Line the other day, and made an observation that I think many of you will find familiar:

The train takes me through the heart of Emanuel country — if Mayor Rahm has a fan base, this is it. Young professionals with iPods and other electronic gadgetry.

And here's my great discovery….

They're all miserable!

Never seen such a collection of glum-and-grim, don't-talk-to-me, don't-look-at-me, don't-even-smile-at-me people in my life.

[snip]

And, remember, these are the lucky ones — they have jobs! At least, I presume they have jobs. Why else would people make this ride if they didn't have to?

First, as someone with the sort of natural expression that, even in the best of times, causes strangers to actually inquire about my well-being, I have to maintain some skepticism. (No, really, it's a thing. As Bill Hicks put it in Relentless: "I just have one of those faces. People come up to me and say, 'What's wrong?' Nothing. 'Well, it takes more energy to frown than it does to smile.' Yeah, you know it takes more energy to point that out than it does to leave me alone?")

Second, I don't think the ennui of the young, educated middle class is a contemporary phenomenon, having tried and failed to finish Richard Yates's Revolutionary Road and other terminally bleak depictions of urban/suburban desperation:

And yet ''Revolutionary Road'' stands at the beginning of the new computer age, and chronicles its early fascination with empty communication, which has led us to self-absorption, narcissism, megalomania and unwanted e-mail. ''It's a completely new kind of job, and we're going to have to develop a completely new kind of talent to do it,'' brays the bulbous Bart Pollock to the feckless and fearful Frank after knocking back one more big gin. Frank Wheeler is that new man, the heir apparent, ''selling the electronic computer to the American businessman,'' and thus heralding ''a whole new concept in business control.''

Nor is the anomie of the reasonably well-compensated merely a white-collar phenomenon. One of the best parts of Jefferson Cowie's excellent history of the labor movement in the 1970s, Stayin' Alive, is his recounting of "Lordstown syndrome," which took its name from a strike over working conditions at an Ohio GM plant. But the working conditions at issue are not what you'd expect. You can sample Cowie's argument in an NYT op-ed (but I do recommend the book):

Most workers weren’t angry over wages, though, but rather the quality of their jobs. Pundits often called it “Lordstown syndrome,” after the General Motors plant in Ohio where a young, hip and interracial group of workers held a three-week strike in 1972. The workers weren’t concerned about better pay; instead, they wanted more control over what was then the fastest assembly line in the world.

Newsweek called the strike an “industrial Woodstock,” an upheaval in employment relations akin to the cultural upheavals of the 1960s. The “blue-collar blues” were so widespread that the Senate opened an investigation into worker “alienation.”

As for myself, I'm right in what Joravsky describes as Emanuel's wheelhouse: a straphanging, headphone-wearing young professional with electronic gadgetry and a card-carrying "glum-and-grim, don't-talk-to-me, don't-look-at-me, don't-even-smile-at-me" CTA denizen. A sociologist or historian might tell you different, but as an English major plenty versed in the bildungsroman genre, it's my belief that glum young twerps like myself are a staple of urban life in the West.

Nonetheless, I can think of a few practical economic reasons why the lucky ones, while not denying their (and my) luck, are not entirely satisfied with mere employment.

1. We're swimming in debt.

I was more fortunate than most; a combination of federal grants and subsidized loans means the college debt I have remaining is less than my age if you multiply it times one thousand. Then I married a law student, and I better appreciated a chart that's been making the rounds recently, about the 511-percent increase in student-loan debt from 1999 through 2011. What's remarkable about that statistic—besides its size, obviously—is how the growth in student-loan debt outpaced total household debt even during the inflation of the housing/credit bubble. This is why some people are worried that it's, you know, also a bubble.

Why has college gotten so expensive? In the Washington Monthly, Benjamin Ginsberg makes a compelling argument: "Administrators Ate My Tuition":

Between 1975 and 2005, total spending by American higher educational institutions, stated in constant dollars, tripled, to more than $325 billion per year. Over the same period, the faculty-to-student ratio has remained fairly constant, at approximately fifteen or sixteen students per instructor. One thing that has changed, dramatically, is the administrator-per-student ratio.

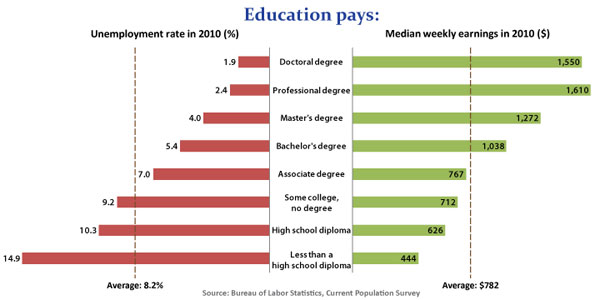

So if your college ROI is getting worse, it's time to skip it, right? Not so fast:

2. Sure, we're employed now….

Let us assume that some of those young professionals are not, like me, in the troubled world of media, which I acknowledge is my own fault. Instead, let's assume that they're among society's winners, employed in the field of high finance. In some ways—don't laugh—they're just as screwed.

One of the best, and to my mind most important, books about the current financial crisis is Liquidated: An Ethnography of Wall Street by Karen Ho. Dr. Ho took a leave of absence from her studies in anthropology to follow her bright young peers into investment banking as part of her research. Among the many things she found was that what's believed to be good for the goose is also considered good for the gander:

The shock of being a downsized anthropologist showed me directly that job insecurity lay at the heart of Wall Street's self-conception. Through constant layoffs, the attendant outplacement and headhunting industries, and compensation schemes (more on this in the next chapter), insecurity is built into the very structures of investment banking organizations, and used as a character-building, formative experience to recommend for other workers. [p. 222]

What's interesting about that: it's not just that layoffs and general job insecurity are considered to be a necessary evil of high finance, and the mergers and aquisitions work that often causes them. Job insecurity is considered, on Wall Street, to be good in and of itself. That insecurity is then passed down as a business strategy, and has become an increasingly familiar part of white-collar business life.

3. Not to look a gift horse in the mouth, but….

On one hand, getting a job during a recession is indeed lucky, because unemployment is high and business confidence is often low. On the other hand, it's also unlucky:

There are three central findings in this study. First, luck matters, because graduating in a recession leads to large initial earnings losses. These losses, which amount to about 9 percent of annual earnings in the initial stage, eventually recede, but slowly — halving within five years but not disappearing until about ten years after graduation. Second, initial random shocks affect the entire career.

4. Even for those of us who have a job, and probably aren't going to get fired, and actually get paid a lot, that job probably stinks more than it did a few years ago.

Now let us further assume that, during the economic crisis, these employed young straphangers have survived layoffs and still, somehow, aren't fazed by survivor's guilt, job insecurity, and reduced potential earnings. What's eating them now? There's a good chance they're doing their fallen colleagues' work.

[I]ncreasingly, US workers are also falling prey to what we'll call offloading: cutting jobs and dumping the work onto the remaining staff. Consider a recent Wall Street Journal story about "superjobs," a nifty euphemism for employees doing more than one job's worth of work—more than half of all workers surveyed said their jobs had expanded, usually without a raise or bonus.

In all the chatter about our "jobless recovery," how often does someone explain the simple feat by which this is actually accomplished? US productivity increased twice as fast in 2009 as it had in 2008, and twice as fast again in 2010: workforce down, output up….

Kevin Drum calls this the Great Speedup. Which brings us back around to Joravsky's post:

Point is — how can folks care about the assault against teachers if they're utterly miserable about their own existence?

In some ways, this is the central tension about the argument over a longer school day and the Chicago Teachers Union's demand for more compensation than has been offered. People in all walks of life are being pushed to do more work without comparable salary hikes. That's the nut of Mary Mitchell's argument against the Chicago Teachers Union:

The world has changed dramatically. There probably isn’t a worker in America that isn’t being asked to do more for the same salary or less.

[snip]

Now reporters have to worry about photographs, videos, blogs, Facebook and Twitter. That means a day that used to start at a certain time and end when the story was passed on to an editor can last well after the evening news signs off, as reporters attempt to keep up with what’s being posted in never-ending blogs, e-mails and tweets.

You adjust.

I cannot say for myself that I have drawn a hard line about being asked to do more for the same salary in the past. And from personal experience, it can be hard to differentiate between "working hard for the sake of my work ethic" and "clinging desperately to employment." Either way, high unemployment and what's termed "the great speedup" makes the CTU's stance less popular than it might be in other times.

5. Also we're just in a bad mood.

Times is rough and tough like leather, as a wise man once said:

The NBER study examining the attitudes of people ages 18 to 25 who began their adulthood in economic downturns from 1972 onward found that they all tend to believe that success in life depends more on luck than on effort, and they have less trust in public institutions…. As Paola Giuliano, a professor at UCLA's Anderson School of Management and one of the authors of the study, notes, "People who buy into the idea of luck over effort tend to work less hard, and that lowers productivity, which of course can lower economic growth." Indeed, this may go some way toward explaining the often mysterious growth edge that "can-do" Americans have long enjoyed over "yes, but" Europeans, who tend to mock such Type A behavior. Whether Americans will eventually follow them is an interesting question: the Conference Board recently released numbers showing that U.S. job satisfaction is at its lowest level in two decades.

And there, perhaps, is a glimmer of hope. Those depressed yuppie commuters are not a reason to despair, but the light at the end of the tunnel. If increased productivity helps maintain high unemployment, and cynicism reduces productivity, we should be confident in our lack of confidence, and do what we can to encourage it, though maybe "encourage" is the wrong word.

I envision a New Raw Deal, in which a Civilian Cynicism Corps funds sketch comedy troupes, shoegaze bands, and first novels about cubicle life. Workers of the world, unite glower quietly on the Brown Line! You have nothing to lose but your mood!

Photograph: -Tripp- (CC by 2.0)