Two stories you may have missed last week:

* Lose home value? Don’t expect a lower property tax bill

* Chicago schools to cut 200 office jobs to save $16 million

Once more with vigor, a couple favorite graphs:

Our arcane tax property system makes an easy target, and that first Sun-Times article is a good example of why; it's an intersection of confusingly named moving parts that all add up, eventually, to property taxes:

“Just because your assessed value has dropped does not mean that your tax amount will drop accordingly,” Vaselopulos said.

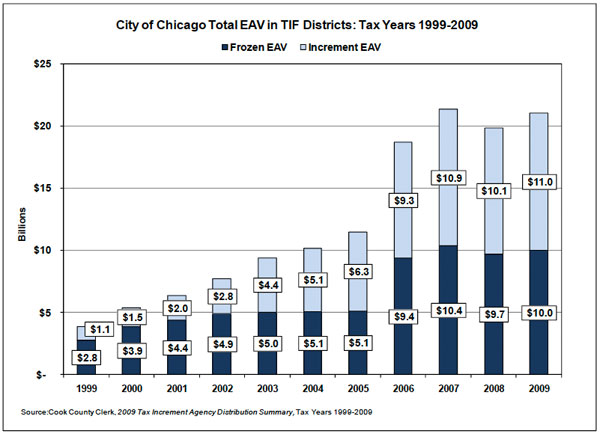

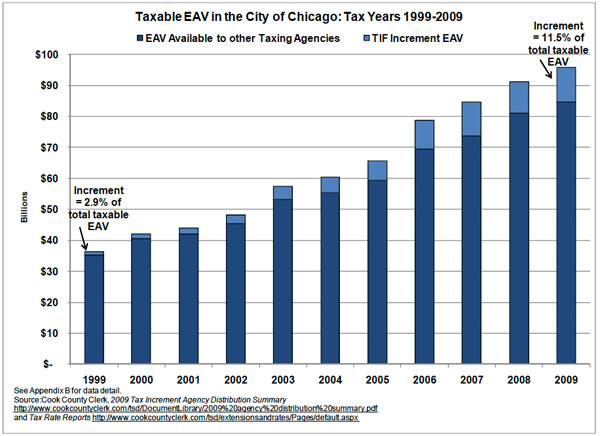

But I feel sorry for property taxes. Our reliance on them creates substantial structural inequities, and then we heighten that by locking down an increasingly large percentage of property tax revenues with our kudzu-like TIF districts. The complex, fungible nature of our property tax system gives it increased reliability as a revenue source, but it also frustrates residents and renders opaque the structural flaws in our budgetary system.