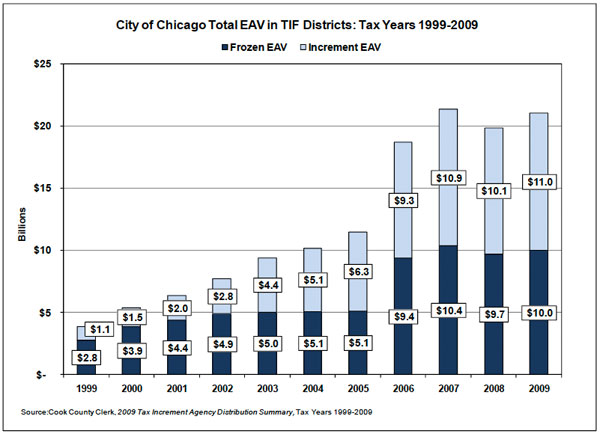

Another week, another attempt by tax increment finance obsessives to demonstrate the effect of TIF districts on city finances. This one's from the Civic Federation's September 9 report "The Cook County Property Tax Extension Process: a Primer on Levies, Tax Caps, and the Effect of Tax Increment Financing Districts." Despite the unsexy title, this is a good graph:

Basically the light blue bars represent "incremental" taxable assessed value. One of the things I like about this chart is how it shows that in TIF districts, the amount of incremental EAV—which, as you are probably aware, highly limits what the city can do with those revenues—began to outpace the "frozen" EAV in 2005, and with the exception of 2006, has continued to make up more than half of the total equalized assessed value. So in TIF districts, which cover about a third of the city, the amount of money available only to economic development (and some more loosely definied economic development like building schools) is greater than that available to the basic business of running a city. And those light blue bars also mean that the money is essentially locked within certain geographical boundaries, with exceptions for porting and declared surpluses.

The big jump in 2006 comes from the creation of the LaSalle/Central TIF district, as the report notes. Here's what Ben Joravsky wrote about that TIF in '06:

The proposed LaSalle Central tax increment financing district would cover the area running roughly from Randolph on the north to Van Buren on the south and from State on the east to Canal on the west, with LaSalle, Wells, and Franklin streets at its heart. According to Daley and planning department officials, the city needs the TIF–its 145th–to keep what's traditionally been the city's financial district from falling into blight. Planning commissioner Lori Healey says that the TIF would finance a range of development projects and help refurbish aging office buildings, which have been losing business to newer sites on Wacker.

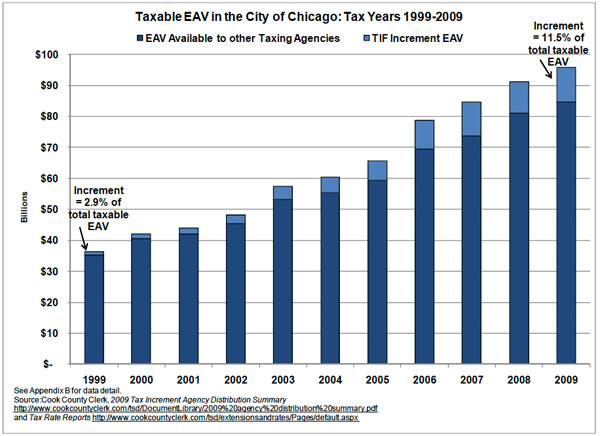

What does that mean in the broader picture? Well, those TIFs have been incrementin':

So while the city's total taxable EAV went up a bit more than half during the Naughts, the amount available to siphon off into the TIF coffers has basically quadrupled, making up more than ten percent of the city total. Joravsky has written convincingly about TIFs as a "slush fund," but of equal importance is the degree to which TIFs aren't slushy, in the sense that they greatly limit what the city can do with property tax revenues, to the extent that the program has built substantial surpluses even as the city itself remains in the red.

Slushy though TIF revenues may be, we haven't even been able to figure out where to pour it all, and the graphs offer considerable evidence that the speed at which TIF districts have been consuming property taxes in the past half-decade may be a significant factor.